Chainlink’s (LINK) Recovery Hinges on Overcoming Key $19 Resistance Level

Chainlink (LINK) has struggled to maintain momentum after a failed attempt to breach the $26 resistance level towards the end of January. This setback triggered a decline, causing LINK to fall below the $20 mark.

For a meaningful recovery, Chainlink now relies on the actions of its investors to make the right moves.

Chainlink Investors Have An Opportunity

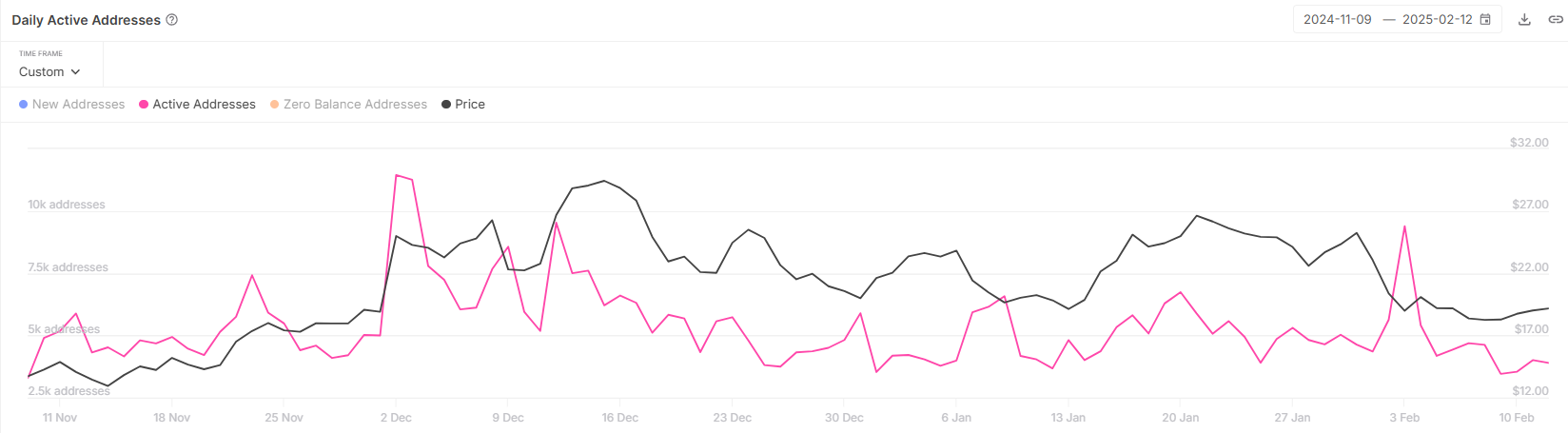

Currently, Chainlink’s active addresses have dropped to a two-month low of 3,400, a figure not seen since November 2024. This decline in active users indicates a waning interest from investors, as fewer participants are conducting transactions on the network. This suggests that the sentiment among LINK holders is largely skeptical.

The reduction in active addresses signals that many investors are adopting a wait-and-see approach, likely due to the recent price struggles. This lack of engagement and hesitance could further weigh on Chainlink’s price, as diminished transaction activity tends to correlate with limited upward momentum in the market.

Chainlink Active Addresses. Source: IntoTheBlock

Chainlink Active Addresses. Source: IntoTheBlock

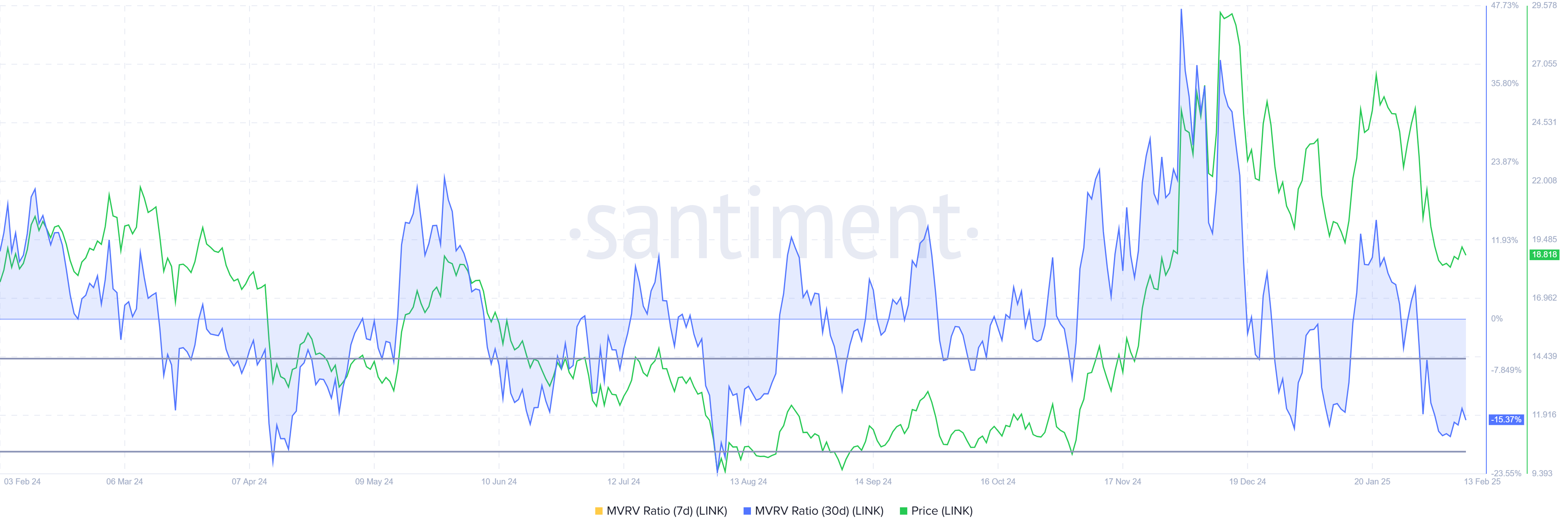

Chainlink’s broader momentum is also under pressure, as reflected by the Market Value to Realized Value (MVRV) ratio, which is currently at -15%. This means that those who bought LINK in the last month are facing losses of 15% on average. The MVRV ratio is now in the opportunity zone, between -8% and -19%, signaling potential for a reversal.

Historically, when the MVRV ratio dips into this range, it suggests that investors are halting sales and instead choosing to accumulate at lower prices. If this pattern continues, it could mark a turning point for Chainlink’s price, as long-term holders may step in to provide support and drive price recovery.

Chainlink MVRV Ratio. Source: Santiment

Chainlink MVRV Ratio. Source: Santiment

LINK Price Prediction: Bouncing Back

Chainlink’s price has fallen by 25% since the beginning of the month, currently trading at $18.84. The altcoin has been struggling to break above the resistance at $19.23 for the past week, which indicates a crucial level that must be breached for a potential recovery.

If investors begin to accumulate LINK at these lower prices, there is a strong possibility that the $19.23 resistance will be flipped into support. This could push Chainlink toward the next barrier at $22.03, providing the momentum needed for further price gains.

Chainlink Price Analysis. Source: TradingView

Chainlink Price Analysis. Source: TradingView

However, if the breach of $19.23 fails, Chainlink could fall through its downtrend support line, hitting $17.31. A drop below this level would invalidate the current bullish outlook, signaling a continued bearish trend for LINK and possibly triggering further declines.