Five bullish Shiba Inu (SHIB) Price Predictions for April 2025

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

Shiba Inu price consolidated at $0.000012, on Tuesday, down 9% from the peak of $0.000013 recorded on April 15.

Notably, Shiba Inu core team contributor, LucieSHIB, reposted a bullish prediction citing 550% upside potential ahead of Shibarium L3 update.

Longer-term forecasts of 14x–550% returns gain traction among retail traders but market sentiment remains neutral.

SHIB price targets diverge as investors weigh Shibarium L3 upgrades, burn-rate surges, and altcoin market sentiment. Forecasts range from a conservative $0.000012 to a parabolic $0.00030.

Shiba Inu sees muted gains in April despite analyst’s optimistic price forecast

Shiba Inu (SHIB) enters the second half of April 2025 locked in a tug-of-war between bullish price speculation and broader market indecision. At press time the SHIB token is trading at $0.000012 on Tuesday, down roughly 9% from its local high of $0.000013 reached on April 1.

Despite a flurry of optimism across social media—fueled by Shibarium Layer-3 upgrade anticipation and burn-rate metrics—market sentiment is split.

While optimistic analysts cite price targets ranging from $0.000015 to as high as $0.00030, institutional flows remain muted under bearish pressure from the US trade war which has escalated since the start of the month.

Below are the five of the most widely circulated price predictions for SHIB in April 2025.

1. LucieSHIB Sees 550% Rally on Shibarium L3 Integration

Shiba Inu’s ecosystem contributor @LucieSHIB ignited bullish sentiment earlier this month with a projection citing 550% upside potential for SHIB as Shibarium L3 approaches deployment.

According to team statements, Shibarium 3 upgrade will enable deep Ethereum Layer-2 compatibility, potentially transforming SHIB into a more scalable and utility-driven token.

“The key driver here is scaling and throughput,” one ecosystem developer said on Discord. “If Shibarium L3 delivers as promised, SHIB becomes a different kind of asset.”

The forecast signals in the article shared by LucieSHIB hints towards a rise toward $0.000077, just below the 2021 all-time high of $0.00008845. Validating the forecast, analysis pointed to a falling wedge breakout pattern on the monthly chart and oversold RSI levels, suggesting bullish sentiment intensifies.

2. TheSHIBMagazine’s “14x Incoming” projection lacks volume support

In a viral April 4 post, TheShibMagazine, a Shiba Inu focused online publication speculated a potential 14x breakout, targeting $0.000167—a level not seen even at the peak of 2021.

Shiba Inu price prediction | Source: SHIBMagazine

The projection, while headline-grabbing, came with a caveat: derivatives data points to longs in distress, and spot volumes remain subdued.“If the rally’s going to be sustainable, we need more than hype—we need capital rotation,” said one options trader on X.

While the SHIB price has convincingly broken above $0.000012 level on Monday, without a corresponding rise in open interest and funding rates, the forecast remains a tall order.

3. Burn rate forecasts hint at potential Shiba Inu price rally towards $0.000015

A more conservative outlook comes from trader @just_stuff_tm, who projects SHIB hitting $0.000015 by early May, contingent upon holding support at $0.000011. This scenario leans on fundamentals—particularly the 1,500% spike in SHIB burn rate and 4,100% growth in Shibarium active users.

“Despite whale dumps, I’m betting on a bounce back,” the trader stated, noting strong decentralized exchange (DEX) volume on Shibarium.

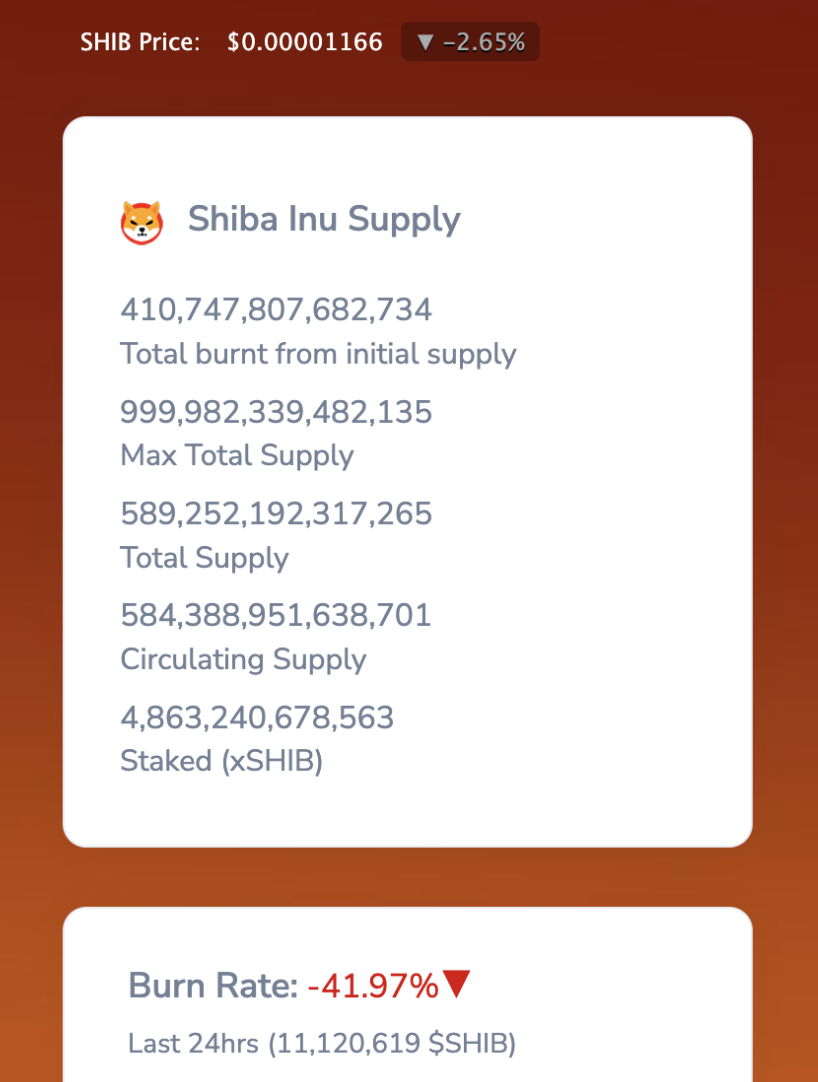

Shiba Inu Burn rate and token supply data as of April 16 | Source: SHIBBURN

As of Monday, Shiba Inu (SHIB) has a total supply of 584.39 trillion tokens, with 410.75 trillion already burned from its original 999.98 trillion supply—leaving a circulating supply of just 4.86 trillion SHIB.

This projection has gained traction among retail traders looking to rotate capital into meme tokens amid broader risk-on altcoin flows. The setup hinges on continued token burns and resistance stability at the $0.000012 level.

However, the official Shiba Inu burn rate on-chain data shows that only 11.1 million SHIB were burned in the past 24 hours, reflecting a 41.97% drop in daily burn rate.

4. $0.02886 Prediction Branded “Fantasy” by Analysts

A controversial April 9 forecast by India-based analyst IMSavya suggested SHIB could reach $0.02886—a 169,000% increase from current levels. The post quickly went viral but drew sharp criticism from seasoned market participants.

India-based analyst IMSavya predicts SHIB price could reach $0.02886

Such a price would require Shiba Inu’s market cap to surge beyond $13 trillion, overtaking the combined capitalization of Bitcoin and Ethereum—an implausible scenario without unprecedented token supply reduction or structural change.

5. Shiba Inu price likely to retake $0.0000015

While extreme predictions dominate social media discourse, the most credible forecasts place SHIB’s April 2025 trajectory between $0.000012 and $0.000018, largely depending on the inter-play between Shibarium L3 adoption and burn dynamics.

Heading into the second half of April, Shiba Inu’s price action hinges on three macro- and project-specific variables:

Continued high burn rates and reduced whale selling

Successful launch and adoption of Shibarium L3

Risk-on rotation across altcoins as Bitcoin dominance softens

If SHIB maintains support at $0.000011 and on-chain volume recovers, a move toward $0.000015–$0.000018 appears feasible. However, a lack of follow-through or broader market weakness could see SHIB retreat toward $0.00000950 support.

Shiba Inu (SHIB) continues to trade in a narrow consolidation zone near $0.00001167, reflecting indecision as bulls and bears await a catalyst. Technically, the Bollinger Bands are contracting, indicating suppressed volatility and an imminent breakout.

SHIB price currently hovers around the median band ($0.00001207), with resistance forming near the upper band at $0.00001319. Meanwhile, the Parabolic SAR dots remain above the candles, signaling short-term bearish control.

However, the Relative Strength Index (not shown here) is likely nearing neutral after weeks of downtrend exhaustion. On-chain volume delta remains negative, but selling pressure appears to be waning.

Based on the current technical setup, Shiba Inu’s next price leg-up hinges on a decisive close above the $0.000015 level. Conversely, failure to reclaim $0.000012 may extend the current stagnation and expose SHIB to a drop toward the $0.00000950 support level.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.