XRP ETFs get a 65% chance of approval as the race for crypto ETFs in 2025 continues

- XRP, Litecoin and Dogecoin are on the list of probable ETF approvals.

- Litecoin and Solana are the only ETF filings acknowledged by the SEC so far.

- XRP needs to hold the $2.33 and $1.96 support levels as it targets a broadening wedge's upper boundary line.

Ripple's XRP saw a 3% gain on Monday as Bloomberg analysts Eric Balchunas and James Seyffart released a list of the most likely crypto ETF filings to receive a green light from the Securities & Exchange Commission (SEC). The list includes XRP, Litecoin (LTC), Dogecoin (DOGE) and Solana (SOL).

Analysts make educated guess on XRP ETF approval odds

Bloomberg analysts Eric Balchunas and James Seyffart shared that upcoming crypto ETF filings for Litecoin, Dogecoin, Solana, and XRP have strong chances of receiving regulatory approval.

In an X post on Monday, the ETF analysts highlighted that these four cryptocurrencies have varying approval levels, with XRP ETFs holding a 65% chance of approval.

NEW: @EricBalchunas and I took a look at the filings for spot crypto ETFs. We're putting out relatively high odds of approval across the board. Mainly focused on Litecoin, Solana, XRP, and Dogecoin for now.

— James Seyffart (@JSeyff) February 10, 2025

Here's the table with the odds and some other details: pic.twitter.com/xaXaNXLb0M

Several asset managers, including Canary, Grayscale, 21Shares, Bitwise, have already filed applications for XRP spot ETFs, signaling strong institutional interest. However, the filings are yet to be acknowledged by the SEC.

The SEC vs. Ripple case was a major hurdle to XRP ETF applications. However, following Judge Analisa Torres's final ruling in August that XRP sales to retail do not constitute a security, asset managers began submitting their applications for an XRP fund. The ruling in August saw Judge Torres impose a $125 million penalty on Ripple for illegal XRP sales to institutions instead of the $2 billion sought by the SEC.

XRP ETFs could pull off an impressive performance if approved, considering the positive flows seen in global XRP investment products, which raked in $21 million in net inflows last week, per CoinShares data.

Additionally, Balchunas and Seyffart highlighted that Litecoin and Dogecoin ETFs are most likely to be approved by regulators.

This may be due to the similarities they possess to Bitcoin, being somewhat offspring of the Bitcoin blockchain.

Specifically, the analysts reported that Litecoin ETF filings by firms such as Canary Capital and Grayscale have a 90% chance of approval.

The post stated that Dogecoin follows behind with a 75% chance of approval. A favorable regulatory environment under Donald Trump may also be a potential reason for the belief shown toward the assets.

Since taking office in January, President Trump's administration has signaled strong support for the crypto industry, suggesting that previous regulatory hurdles could soon be removed.

Likewise, Solana and XRP ETFs also got approval odds of 70% and 65%, respectively.

Notably, only the Litecoin and Solana ETF filings have been acknowledged by the SEC and await a final verdict of approval.

Balchunas clarified that Litecoin ETFs have always had a high chance of approval since Canary Capital first filed for one in October.

He also stated that other tokens had lower than a 5% chance of approval before the US presidential election.

The crypto community continues to anticipate a positive outcome from the regulator for these ETF filings.

XRP needs to hold $2.33 and $1.96 support levels to prevent a massive decline

XRP saw $3.08 million in futures liquidations in the past 24 hours, per Coinglass data. The total amount of liquidated long and short positions accounted for $1.19 million and $1.90 million, respectively.

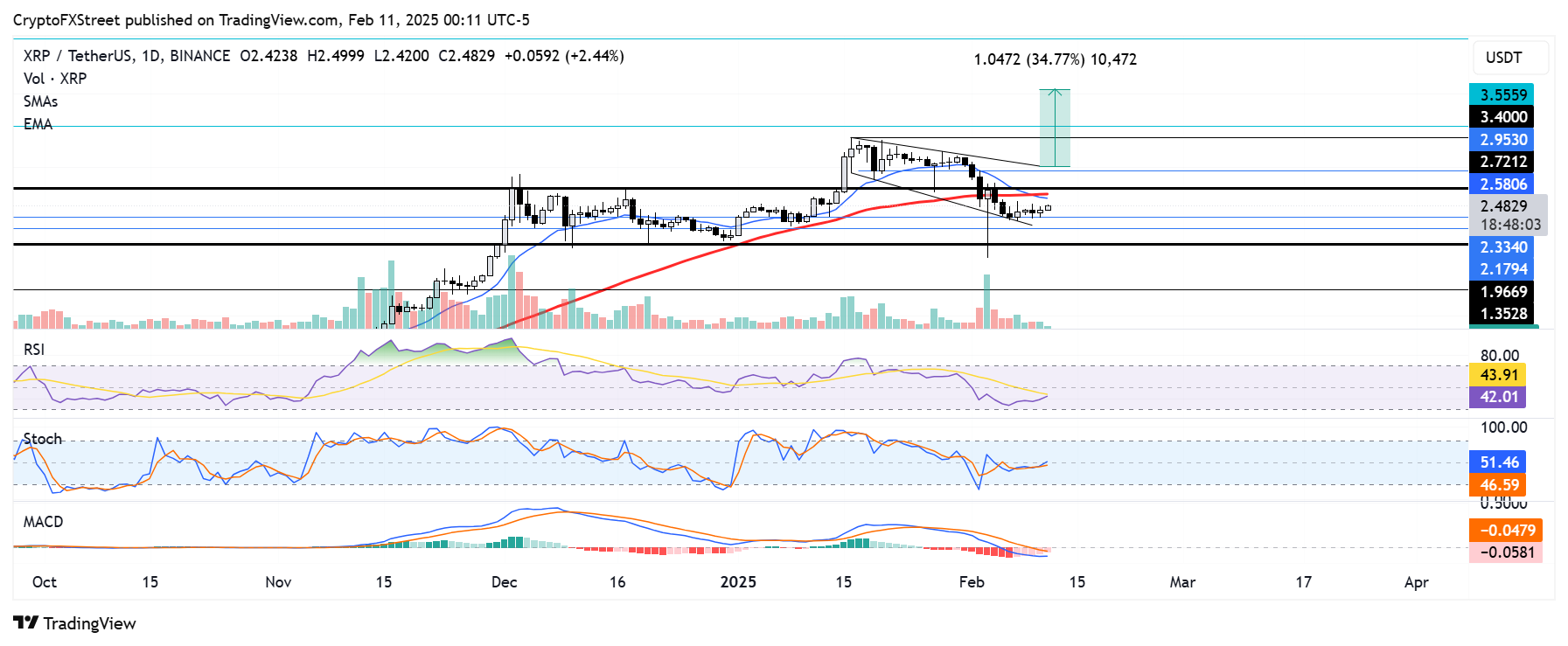

In the past three days, XRP held the lower boundary support of a descending broadening wedge near the $2.33 key level. With prices slightly tilted toward the upside, XRP could rally to test the wedge's upper boundary.

XRP/USDT daily chart

However, it faces resistance near the upper boundary of a key rectangular channel at $2.72. This resistance is strengthened by the 14-day Exponential Moving Average (EMA) and 50-day Simple Moving Average (SMA).

On the downside, if XRP declines below the $2.33 support level outside the falling wedge, it could decline to find support at a rectangular channel's lower boundary at $1.96. A further breach of this level will spark heavy bearish pressure on the remittance-based token.

The Relative Strength Index (RSI), Stochastic Oscillator Stoch and Moving Average Convergence Divergence (MACD) histograms are below their neutral levels but are trending upward. Crossing above their respective neutral levels could flip the XRP market from a bearish trend to a bullish structure.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.