Industry Experts Weigh in on MiCA’s First Two Months of Enforcement

Since its enaction two months ago, the Markets in Crypto-Assets (MiCA) regulation has created a cohesive framework and clear standards for digital asset issuers across the European Union (EU). The model aims to balance innovation and consumer protection, creating greater pathways for crypto adoption.

BeInCrypto spoke with Monerium, Moonpay, OKX, and Yellow Network experts to further understand what this unprecedented regulation means for EU-based crypto users and the challenges that remain for firms looking to set up shop in the region.

The EU Sets a Global Precedent

On December 30, 2024, the European Union made history by becoming the first region in the world to enact a widespread crypto regulation.

Crypto companies wanting to operate in the EU can obtain a single MiCA license to offer services across all member states, avoiding the hassle of getting separate permits for each country.

“MiCA sets a global benchmark as the most extensive regulatory framework for crypto assets to date, positioning the EU as a leader in shaping the future of digital finance and providing a blueprint for other jurisdictions to follow,” Erald Ghoos, CEO OF OKX Europe, told BeInCrypto.

Several regional crypto firms have already applied for MiCA and received licenses. Less than two weeks ago, Crypto.com became the first global crypto platform to receive full approval under the EU’s regulatory framework.

At the beginning of January, MoonPay, BitStaete, ZBD, and Hidden Road secured the MiCA license from the Dutch Authority for the Financial Markets (AFM). Standard Chartered closely followed suit when it gained its license in Luxembourg. Meanwhile, Boerse Stuttgart Digital Custody became Germany’s first crypto asset service provider to receive a full license.

MiCA Unified Licensing Regime

The crypto market has expanded considerably since Bitcoin’s launch over 15 years ago. Despite this growth, a consistent and comprehensive regulatory structure is still lacking in many parts of the world. This absence of clear rules can expose investors to risks and create vulnerabilities in consumer protection and market integrity.

The EU’s MiCA framework is designed to address these challenges while simultaneously promoting responsible growth within the cryptocurrency industry.

“Clear rules create a more predictable environment where serious players can thrive. MiCA is essentially giving the green light for the next chapter of crypto in Europe,” explained Alexis Sirkia, Co-Founder of Yellow Network.

MiCA’s standardized licensing process across the EU simplifies regulatory requirements and makes it easier for companies to operate within the European Economic Area. This framework also provides official recognition for the cryptocurrency industry.

“One of the biggest advantages of MiCA is its role in legitimizing the crypto asset industry, for both consumers and other companies, given its requirements and regulatory standards. This should consequently help build confidence in MiCA-regulated firms,” Matt Sullivan, Deputy General Counsel and Head of Ireland at MoonPay, told BeInCrypto.

The legislation also specifically works toward safeguarding the interests of consumers by keeping associated risks at bay and enhancing trust.

“MiCA enhances consumer protection through robust transparency requirements, stringent compliance measures, and oversight of stablecoin issuers. It also strengthens anti-money laundering (AML) and Know Your Customer (KYC) protocols, creating a safer, more secure, and trustworthy environment for market participants. This comprehensive framework paves the way for broader adoption and sustainable growth of the crypto ecosystem across Europe,” added Ghoos.

Despite its long list of advantages, MiCA’s framework also raises some considerations, particularly for smaller players.

A Rigorous Process

Compared to frameworks developed by other jurisdictions, MiCA’s legislation is particularly thorough.

“MiCA is definitely one of the most detailed and stringent frameworks out there. While places like Singapore and Hong Kong focus on fostering innovation with lighter-touch regulations, MiCA is all about building trust and security. It’s a different approach and less about speed and more about laying down a solid foundation,” said Sirkia.

Securing a MiCA license involves a step-by-step procedure. Crypto firms must first assess their eligibility and prepare all relevant documentation. Once submitted, the application undergoes a compliance review by the applicable regulatory authority.

“It will become more difficult for the classic example of two individuals with a novel idea to simply launch their crypto service or token to the public,” Sullivan said.

It might also create certain barriers to entry.

Obstacles for Smaller Players

This process can be particularly burdensome for small players or newer crypto firms seeking services in the European Union.

“While MiCA brings much-needed regulation, it also introduces higher compliance costs and operational burdens, particularly for smaller crypto businesses. Companies will have to navigate complex reporting requirements, stringent capital reserves for stablecoin issuers, and strict disclosure obligations,” Ghoos explained.

The framework also requires companies to have a base of operations in the EU.

“For smaller players, the requirements, such as maintaining a physical presence in the EU and holding significant capital reserves, can feel like a high hurdle. It risks shutting out startups that could bring fresh ideas to the table,” said Sirkia.

Some critics have said that this sort of regulation favors established crypto firms, creating barriers to entry for newer players. Larger companies with sufficient resources to overcome these obstacles do so anyway, given the significant opportunities of operating across such a large region.

“Those who manage to navigate the regulations will find themselves in a more secure and stable environment, with access to a massive market of 450 million people. It’s a challenge, yes, but it could also be a badge of legitimacy,” Sirkia said.

Beyond this, the MiCA regulation has also presented concerns regarding user privacy.

KYC Requirements Generate Privacy Concerns

MiCA implements AML and KYC protocols to create a safer, more secure, and trustworthy environment for market participants. However, it also raises some security concerns for users.

“On the user side, there’s concern about privacy. The stricter KYC rules, while aimed at security, could make some people uneasy about how their data is handled,” Sirkia said.

The extensive data collection and storage required by Know Your Customer (KYC) regulations conflict with individual privacy rights, raising concerns about data security, potential misuse, and unauthorized access.

“MiCA’s KYC rules are designed to prevent fraud and boost security, but they do raise eyebrows when it comes to privacy. Collecting and storing so much personal data creates risks. What happens if that data is hacked or misused? Users who value their privacy might turn to less regulated platforms, which is exactly what MiCA is trying to avoid. It’s a fine line to walk, and how the EU handles these concerns will be critical in building user trust,” Sirkia added.

Looking past these concerns, the most debated aspect of MiCA has been its regulation of stablecoins.

Stablecoin Issuers Face Significant Hurdles

Stablecoins are cryptocurrencies designed to maintain a stable value, typically by being pegged to another asset like gold or fiat currency. This makes them popular with investors seeking to engage with digital assets while mitigating price volatility.

The stringent nature of MiCA’s stablecoin regulations has been a key point of contention.

“MiCA will require all stablecoin issuers to maintain more than 1:1 backing with liquid reserves and obtain proper authorization as electronic money institutions. This will particularly impact unauthorized stablecoin issuers who have been operating in Europe without the appropriate e-money licenses, as they’ll need to either comply with these stricter requirements or cease operations in the EU,” Jón Helgi Egilsson, Co-Founder of Monerium and former Chairman of the Central Bank of Iceland, told BeInCrypto.

To that point, Sirkia added:

“Stablecoins are going to feel the MiCA effect in a big way. Issuers will need to step up their game with more transparency and stronger reserves. For USDC, which already operates under a pretty robust framework, the transition might be smoother. But for others, like USDT, it could mean more scrutiny and possibly some big adjustments.”

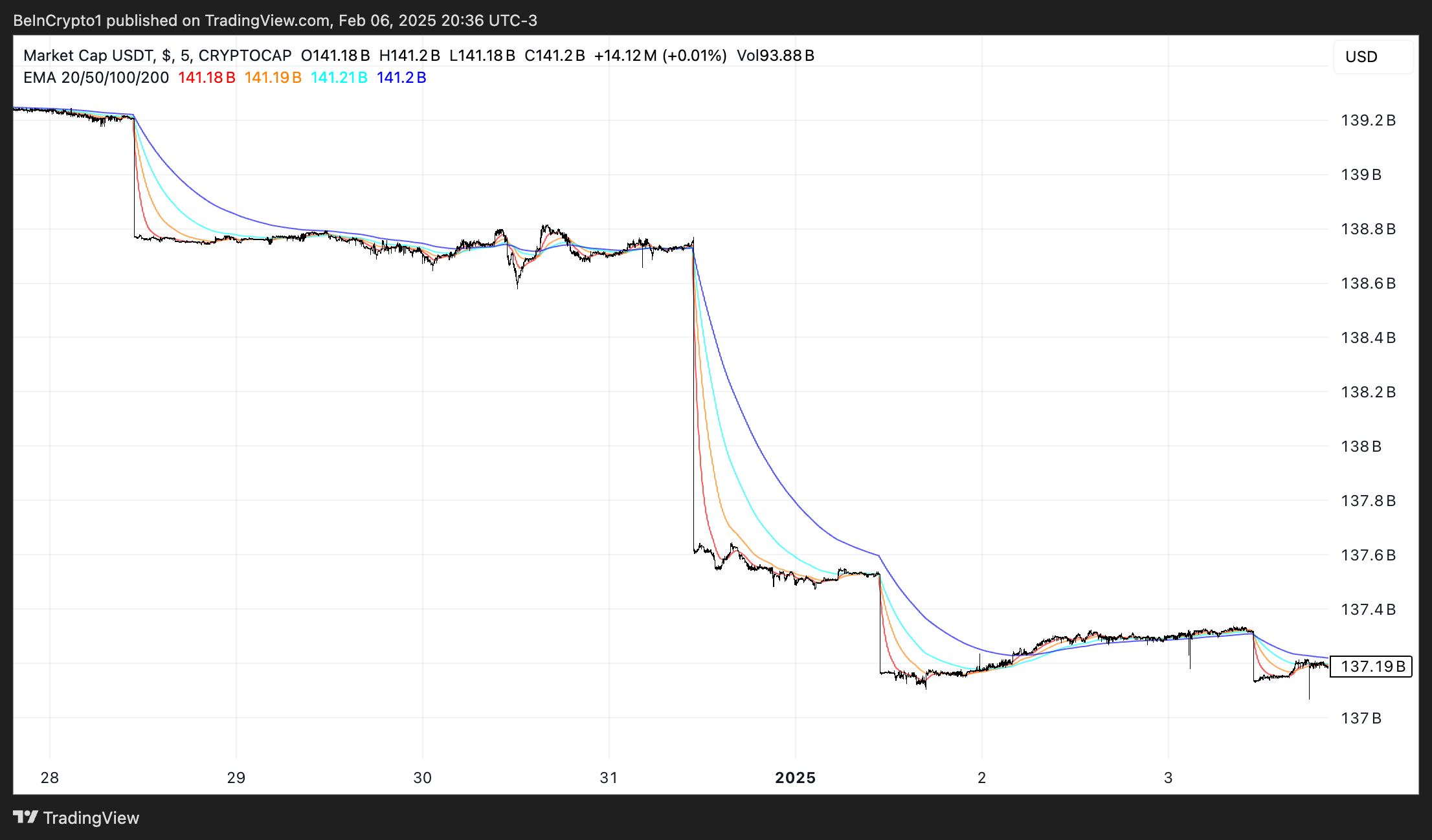

As soon as MiCA took effect, Tether’s USDT experienced a $2 billion drop in market capitalization– the biggest since the FTX collapse. Even before MiCA’s enactment, centralized exchanges like Coinbase began restricting USDT, while EU exchanges were directly ordered to delist the stablecoin en masse.

USDT experienced a $2 billion drop in market cap during the week that MiCA went into effect. Source: TradingView.

USDT experienced a $2 billion drop in market cap during the week that MiCA went into effect. Source: TradingView.

While USDT hasn’t yet met MiCA’s stablecoin regulation, its criteria have sparked debate. Some critics argue that they give traditional financial institutions a considerable advantage.

Controversy Over the Use of Traditional Banks as Intermediaries

Three days before MiCA’s launch, Tether CEO Paolo took to social media to call out the framework’s requirements for stablecoin issuers.

“MiCA is nothing but a massive gift to the traditional banking system. Forcing stablecoin issuers to hold >30% of their liquidity in banks only ensures more profits for the legacy players. Its regulation designed to benefit the old system, not innovation,” read Diomede’s X post.

Egilsson explained that this policy significantly influences banks over their competitors’ operations and licensing.

“In extreme cases stablecoin issuers will have to safeguard up to 60% of funds with up to 12 commercial banks. Placing banks as intermediaries is like handing them the keys as gatekeepers to monitor their competitors and determine if their competitors will get a license to operate since a business relationship with multiple banks is now a requirement by EU law under MiCA,” he said.

Using traditional banks as intermediaries between stablecoin providers and consumers directly also opposes the idea of decentralization, according to Egilsson.

“It is simply absurd and a misuse of public EU legislation power in order to try to preserve the status quo for EU banks. To demand banks to be intermediaries doesn’t align with either the ethos of web3 or is it a fair playing field that would facilitate innovation,” he told BeInCrypto.

Egilsson also pointed out that USDT continues to operate within the European Union despite MiCA being in effect.

“Before MiCA, stablecoins fell under EU law as e-money, but EU legislators did not enforce it. The promise made by EU legislators was that enforcement will now follow. Yet, the legislation has taken effect, but unauthorized stablecoins continue to be offered. Regulation is one thing, enforcement is another. If enforcement remains as lax as it was before MiCA, one might ask: why bother regulating at all?” he said.

Regardless, Tether’s lack of full MiCA compliance creates risks, such as potential penalties, fines, or even an EU-based ban on USDT.

MiCA and the Future of Crypto Regulation

Despite certain pain points, most industry experts believe MiCA is a groundbreaking piece of legislation that could inspire similar regulations in other jurisdictions.

Given that the framework has only been in effect for a little over two months, the likelihood that it will be revised in the future is high– especially considering that the crypto industry is under a constant state of transformation.

“All regulations evolve, and MiCA will likely be no different. This evolution could be driven by increased crypto adoption, but it could also be driven by other factors such as technological progress. To use payment regulation as an example of natural regulatory progression, the EU is currently preparing the third Payment Services Directive (PSD3), a natural evolution of the earlier payment directives, PSD and PSD2,” Sullivan noted.

As Web3 evolves and new technologies emerge, MiCA must be updated to address them.

“The crypto space moves fast, and the framework will need to keep up. As adoption grows and new technologies like DeFi and NFTs become more mainstream, we’ll likely see updates to address these areas. The EU has set the bar high with MiCA, but staying relevant in a constantly evolving industry will require ongoing dialogue with the crypto community and flexibility in the regulatory approach,” said Sirkia.

If other countries adopt similar regulations, the EU may revise MiCA to remain competitive.

“As other jurisdictions develop their own crypto laws, the EU may refine MiCA to remain competitive and aligned with global standards, ensuring that Europe continues to be a leader in crypto regulation,” Ghoos explained.

In the future, a collaboration between industry players and regulators will be crucial in ensuring that these frameworks continue to protect consumers while developing an environment that fosters innovation.