Bitcoin Hits New Highs — But Why Is Retail Interest Lagging Behind Previous Bull Markets?

TradingKey – On Monday, July 14, Bitcoin (BTC) continued its multi-year rally, climbing toward the $120,000 mark and setting yet another all-time high. At press time, BTC is trading at $119,113.

Bitcoin Price Chart – Source: TradingView

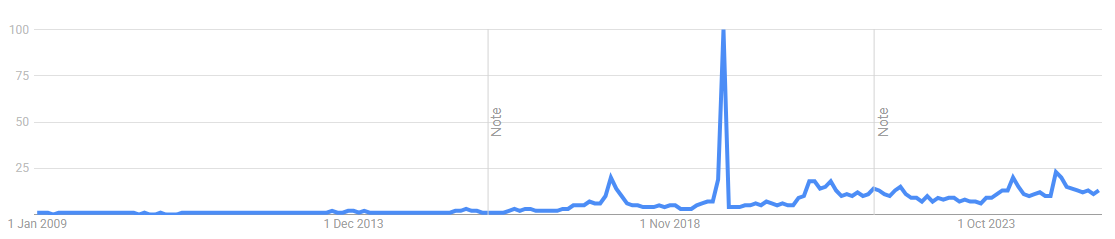

Since bottoming out at $16,000 in 2023, Bitcoin has surged nearly 650%, yet retail enthusiasm appears muted. According to Google Trends, search interest for “Bitcoin” currently scores 13, far below the peaks of 100 in 2017 and 18 in 2021.

Google Search Interest for Bitcoin – Source: Google Trends

Why the Lukewarm Retail Buzz?

Analysts suggest that Bitcoin’s sky-high price tag may be intimidating for everyday investors. Despite bullish sentiment, many retail participants — especially small-scale traders — feel priced out, dampening overall engagement.

Meanwhile, institutional players are quietly accumulating:

As of July 13, wallets holding 100–1,000 BTC control 4.76 million coins, up from 3.9 million a year ago.

This signals growing influence from funds, family offices, and high-net-worth individuals.

According to Blockware Intelligence, over 36 publicly listed companies are expected to add Bitcoin to their balance sheets by year-end 2025, a 25% increase from the current count of 141. Strategy, led by Michael Saylor, tops the list with 590,000+ BTC, and Saylor has hinted at further accumulation.

Institutional Inflows Drive the Rally

Matt Hougan, CIO of Bitwise, attributes Bitcoin’s strength to persistent institutional inflows, noting that:

Bitcoin’s daily supply is just 450 coins,

Yet institutional demand continues to rise, creating a supply squeeze.

Hougan also emphasized that legislative progress, corporate adoption, and macro uncertainty will fuel Bitcoin’s growth for years to come. His forecast: $200,000 by the end of 2025.

Conclusion: A New Kind of Bull Market

Unlike previous retail-driven cycles, this bull run is institutionally led. While public excitement may be lower, the price action remains strong. Bitcoin’s rally is being powered by deep-pocketed investors, not viral hype — and that may make it more sustainable.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.