Forex Today: Trade war risks keep US Dollar afloat, Bitcoin renews ATH

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

- WTI declines below $63.00 as US-Iran talks loom

Here is what you need to know on Monday, July 14:

It’s a risk-averse start to an action-packed week ahead as the US Dollar (USD) remains supported by sustained safe-haven demand, induced by incoming developments on the trade front.

After sending tariff letters to 20-odd countries last week, US President Donald Trump threatened a 30% tariff on imports from the European Union (EU) and Mexico on Saturday, to take effect on August 1.

On Sunday, European Commission President Ursula von der Leyen noted that the EU will extend its suspension of trade countermeasures against new US tariffs until August 1, as it continues its trade negotiations with the US.

However, early Monday, Italian Foreign Minister Antonio Tajani said that if no deal is struck with the US, the EU has already prepared a list of retaliatory tariffs amounting to EUR21 billion against the US to start with.

These headlines underscore the risks of a widening global trade war. Investors also remain on edge amid increased concerns about the US Federal Reserve’s independence ahead of Tuesday’s all-important US Consumer Price Index (CPI) data release.

President Trump continued to bash Fed Chair Jerome Powell by saying on Sunday that “it would be a great thing if Powell stepped down.”

White House economic adviser Kevin Hassett over the weekend warned Trump might have grounds to fire Powell because of renovation cost overruns at the Fed's Washington headquarters.

The US extends its previous week’s recovery momentum against its six major rivals as the US Dollar Index stays well bid above 98.00, it’s highest since June 25. Meanwhile, the US equity futures are about 0.60% so far.

US Dollar PRICE Today

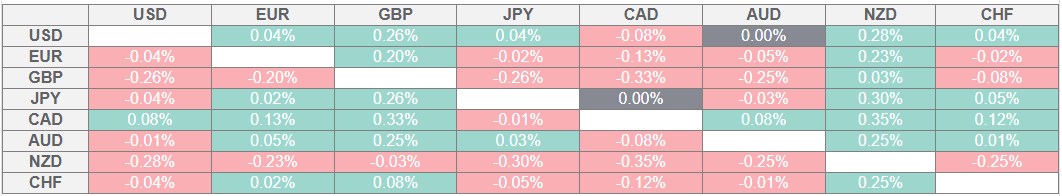

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the New Zealand Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

EUR/USD mires in two-week lows near 1.1650 in the European morning on Monday, weighed down by US-EU trade tensions.

GBP/USD holds lower ground near 1.3450, extending its correction from multi-year highs as the risk-sensitive Pound Sterling loses further ground against the Greenback.

Despite the broad US Dollar uptick, USD/JPY remains on the back foot below 147.50, mainly on expectations that the Bank of Japan (BoJ) could raise its inflation forecasts at the July policy meeting.

Antipodeans are also underperforming amid trade war-led risk aversion, with the New Zealand Dollar (NZD) the main laggard. AUD/USD is losing 0.30% on the day at 0.6560 while the NZD/USD pair sheds 0.50% so far.

USD/CAD is little changed near 1.3700, with the USD advance offset by the rally in Oil prices. WTI holds Friday’s 2.6% upswing near $67.50 amid increased geopolitical risks.

US President Trump said on Sunday that he will send Patriot air defence missiles to Ukraine. He is due to make a "major statement" on Russia on Monday, per Reuters.

Gold treads water above $3,350 after testing the key 23.6% Fibonacci Retracement level of the April record rally at $3,377.

Bitcoin flirts with a new all-time high near $1,25,000 amid heavily overbought conditions on the daily chart.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.