Monero Price Forecast: XMR bulls target double-digit gains amid market volatility

- Monero price stabilizes after retesting and bouncing from its ascending trendline, eyeing a recovery ahead.

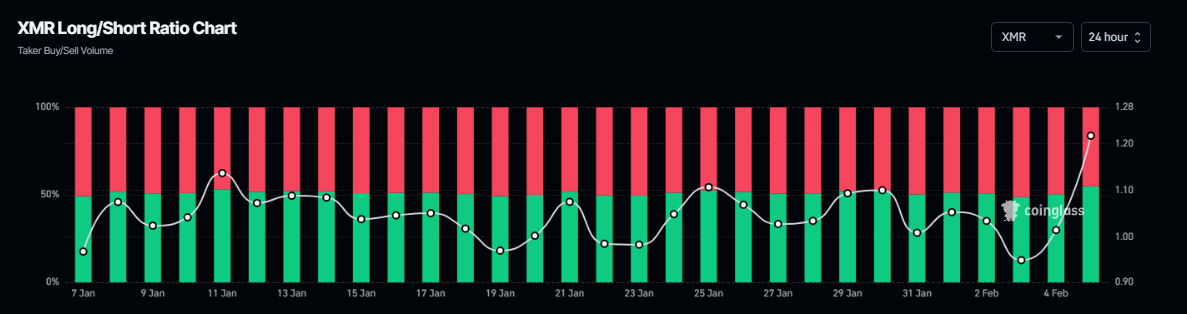

- Coinglass data shows that the XMR long-to-short ratio reaches the highest level in over a month, indicating more traders are betting Monero’s price to rise.

- A daily candlestick close below $195.72 would invalidate the bullish thesis.

Despite the recent market correction this week, Monero’s (XMR) price stabilizes above $220 at the time of writing on Wednesday after retesting its ascending trendline and finding support around $195 on Monday. Coinglass data shows that the XMR long-to-short ratio reaches the highest level in over a month, indicating more traders are betting Monero’s price will rally.

Monero price looks promising

Monero’s price bounced after retesting its 200-day Exponential Moving Average (EMA) on Monday, closing above its ascending trendline (drawn from connecting multiple highs since mid-November). However, it declined 2.2% the next day. At the time of writing on Wednesday, it hovers around $223.51.

If XMR continues its upward trend, it could extend the rally by 18% from its current trading levels to retest its April 26, 2022, high of $262.50.

The Relative Strength Index (RSI) on the daily chart reads 54 and points upwards, indicating increasing bullish momentum.

XMR/USDT daily chart

Another bullish sign is Coinglass’s XMR long-to-short ratio, which reads 1.21, the highest level in over a month. This ratio above one reflects bullish sentiment in the markets as more traders are betting for the asset price to rise.

XMR long-to-short ratio chart. Source: Coinglass

However, if XMR declines, breaks below the ascending trendline and closes below the 200-day EMA at $195.72, the bullish thesis would be invalidated. This scenario would lead to an additional decline to test its next daily support level at $181.43.