SEC Acknowledges Canary Capital’s Litecoin ETF Application

In a crucial signal of approval, the SEC formally acknowledged Canary Capital’s 19b-4 filing for a Litecoin ETF. This is the first altcoin ETF after Ethereum to receive this nod, and it locks the Commission into a deadline to approve or reject it.

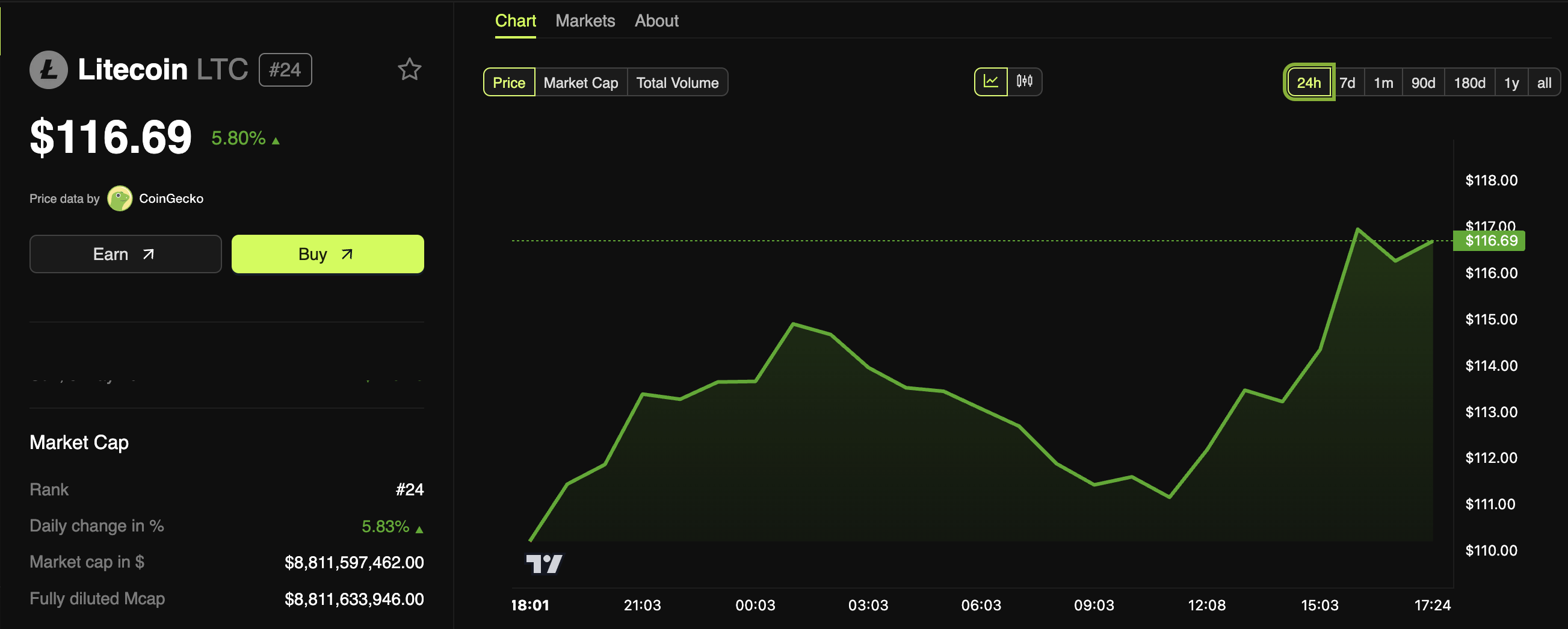

These ETF rumors have already caused another spike in LTC’s price. This gesture from the SEC is a very positive signal, but the Commission has yet to address most of the other altcoin ETF applications.

Canary Capital: The First Litecoin ETF?

A Litecoin ETF has sometimes been considered a “dark horse candidate” for altcoin ETFs, but it has its adherents. ETF analysts Eric Balchunas and James Seyffart claimed it was more likely to win approval than Solana or XRP, and this prediction is bearing fruit.

Today, the SEC acknowledged Canary Capital’s 19b-4 filing for an LTC ETF.

“It’s the altcoin 19b-4 to be acknowledged; the rest were told to withdraw by Gensler’s SEC. Throw in the comments from SEC on the S-1 and this filing is by far the furthest along checking all the boxes. The question now is will this SEC wait the full 240 days or approve more rapidly,” Balchunas said via social media.

This particular milestone is especially noteworthy in the SEC’s ETF approval process. As Balchunas explained regarding previous failed Solana ETF attempts, this 19b-4 acknowledgment locks in a strict deadline.

Regardless of the intervening process, this Litecoin ETF will either receive approval or rejection in the next 240 days.

Naturally, these ETF rumors have had an impact on Litecoin’s price. After the Nasdaq first filed this form 19b-4, the value of LTC spiked by 12%.

Grayscale, a fellow ETF issuer, filed its own application last week, and this also helped the asset along. Today, the SEC’s 19b-4 acknowledgment maintains this trend with new forward momentum.

Litecoin (LTC) Price Performance. Source: BeInCrypto

Litecoin (LTC) Price Performance. Source: BeInCrypto

Still, this simple gesture does not guarantee the success of Canary Capital’s Litecoin ETF. Since Gary Gensler resigned, a flurry of altcoin ETF applications has reached the SEC, including many with dismal chances of success.

The SEC’s actions here will serve as an important data point. Even if the SEC starts approving altcoin ETFs, it might not accept all of them.