This $40 Billion News Could Be Game-Changing for Nvidia Stock in 2026

Key Points

In December, President Donald Trump decided to permit Nvidia to sell its advanced H200 chips to some Chinese customers.

A Reuters report suggests that there is high demand for Nvidia's chips in China.

The company's top line could jump substantially this year if it can fulfill the strong demand emerging from China.

- 10 stocks we like better than Nvidia ›

Shares of artificial intelligence (AI) chip pioneer Nvidia (NASDAQ: NVDA) delivered a solid performance in 2025, rising by nearly 39%. However, several concerns weighed on the stock throughout the year, including intensifying concerns about a potential AI bubble and the risk posed by the circular financing deals prevalent in the sector.

These factors explain why Nvidia underperformed the PHLX Semiconductor Sector index's 42% gain last year. Additionally, restrictions imposed by President Donald Trump on the company's ability to sell its chips into the Chinese market in April led to the company losing a significant amount of business. However, Trump's recent decision to allow Nvidia to sell its advanced chips to "approved customers" in the Chinese market could set the stage for the stock to beat the market in 2026.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Nvidia.

Nvidia is reportedly witnessing terrific demand from China

In December, President Donald Trump announced on his social media platform, Truth Social, that Nvidia would be able to sell its advanced H200 processors to select customers in China. However, it will have to pay 25% of its revenue from those sales to the U.S. government. This is good news for a company that seemed on track to clock $30 billion in revenue from the Chinese market in the current fiscal year before Trump's previous restrictions kicked in.

A recent report from Reuters revealed that Nvidia could start shipping its H200 data center processors, which are around 6 times more powerful than the downsized H20 chip it was previously selling there, in mid-February. And now, another exclusive Reuters report indicates just how strong the demand for the H200 processors is in China.

The latest article reports that Chinese tech companies have placed orders for more than 2 million H200 chips, which are based on the previous-generation Hopper architecture. Given that Nvidia has only about a third of that amount in stock, it has reportedly asked its foundry partner, Taiwan Semiconductor Manufacturing, to boost production so it can fulfill the demand from Chinese customers.

Reuters' source added that TSMC will reportedly start producing the additional China-bound chips in the second quarter. Also, Nvidia is reportedly going to price the H200 chips at $27,000 each for the Chinese market. After deducting the 25% that Nvidia will need to pay to Washington, it would receive just over $20,000 from the sale of each H200 chip to Chinese customers.

Assuming that the company indeed sells 2 million H200 processors to China, it could generate $40 billion in revenue from that market in 2026. That could pave the way for more upside in Nvidia stock in the new year.

The Chinese business could help Nvidia crush expectations in 2026

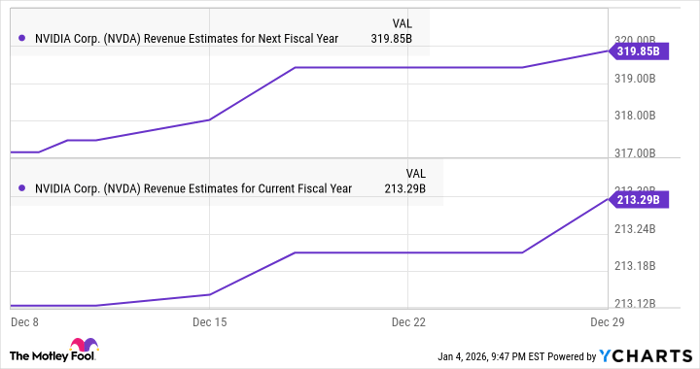

Wall Street's consensus revenue estimate for Nvidia's fiscal 2027 (which begins near the end of this month) stands at $320 billion, 50% more than the current fiscal year's expected revenue.

NVDA Revenue Estimates for Next Fiscal Year data by YCharts.

However, the chart above indicates that analysts haven't yet factored in the revenue that the company could generate from China. Trump's announcement and Reuters' reports have all arrived in the past month, and the revenue estimate line for the next fiscal year hasn't moved substantially in the wake of those developments.

So, if Nvidia indeed generates $40 billion in revenue from China in its fiscal 2027, its top line could hit $360 billion, which would be a jump of 69%. Nvidia today trades at a forward price-to-sales ratio of 21. It could continue to trade at that premium a year from now, as it is likely to deliver a stronger top-line jump than analysts' expectations.

Based on those numbers, Nvidia's market cap could hit $7.5 trillion next year, which would amount to upside of 63% from its current level. All of this indicates that it is likely to remain a top AI stock in the new year.

Should you buy stock in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $488,653!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,148,034!*

Now, it’s worth noting Stock Advisor’s total average return is 971% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 7, 2026.

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.