Monero Price Forecast: XMR bulls remain strong, eyes double-digit gains

- Monero price trades in the green, around $204.92 on Tuesday after holding its ascending trendline support the previous day.

- The technical outlook suggests a reversal ahead as XMR’s MACD indicator shows a bullish signal.

- A daily candlestick close below $180.79 would invalidate the bullish thesis.

Monero (XMR) price trades in green around $204.92 on Tuesday after finding support around its ascending trendline the previous day. The technical outlook suggests a rally ahead as XMR’s Moving Average Convergence Divergence (MACD) indicator shows a bullish divergence, hinting at double-digit gains.

Monero bulls remain strong

Monero price retested and found support around the ascending trendline (drawn by connecting multiple swing low levels from mid-November with a trendline) on Monday and bounced off 1.08%. At the time of writing on Tuesday, it continues to trade higher, around $206.77.

If XMR continues its upward momentum, it could extend the rally by 12% from its current levels to retest its December 16 high of $232.

The Relative Strength Index (RSI) on the daily chart reads 58, above its neutral level of 50, and points upwards, indicating bullish momentum. Additionally, the Moving Average Convergence Divergence (MACD) indicator shows a bullish crossover on Monday, suggesting an upward trend.

XMR/USDT daily chart

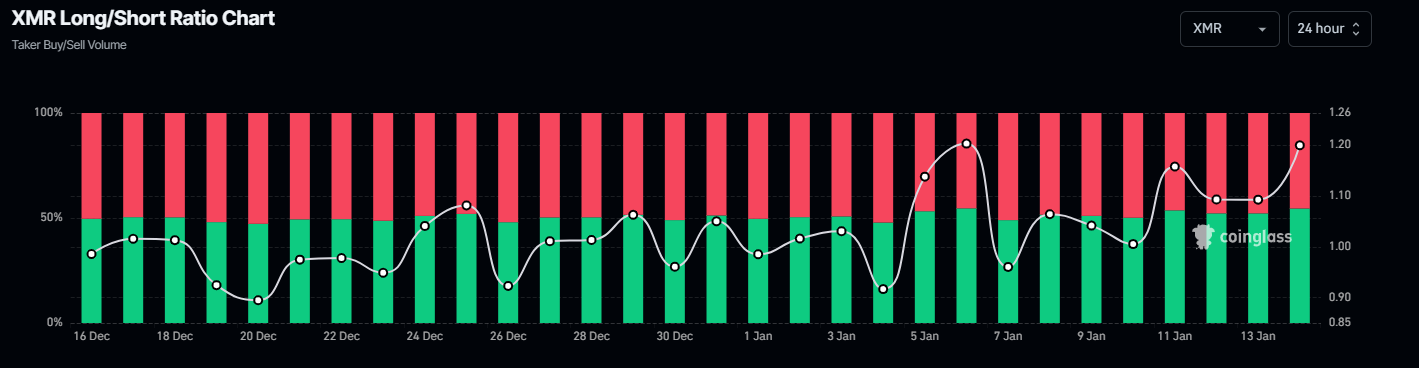

Another bullish sign is Coinglass’s XMR long-to-short ratio, which reads 1.20, the highest level in over a month. This ratio above one reflects bullish sentiment in the markets as more traders are betting for the Monero price to rise.

XMR long-to-short ratio chart. Source: Coinglass

However, if XMR breaks below the ascending trendline and closes below $180.79, it could extend the decline to test its December 20 low of $167.