Polymarket Defends Neutrality as Donald Trump’s Odds Spark Allegations of Bias

Polymarket CEO Shayne Coplan has addressed recent allegations that the platform’s US election prediction markets are being manipulated.

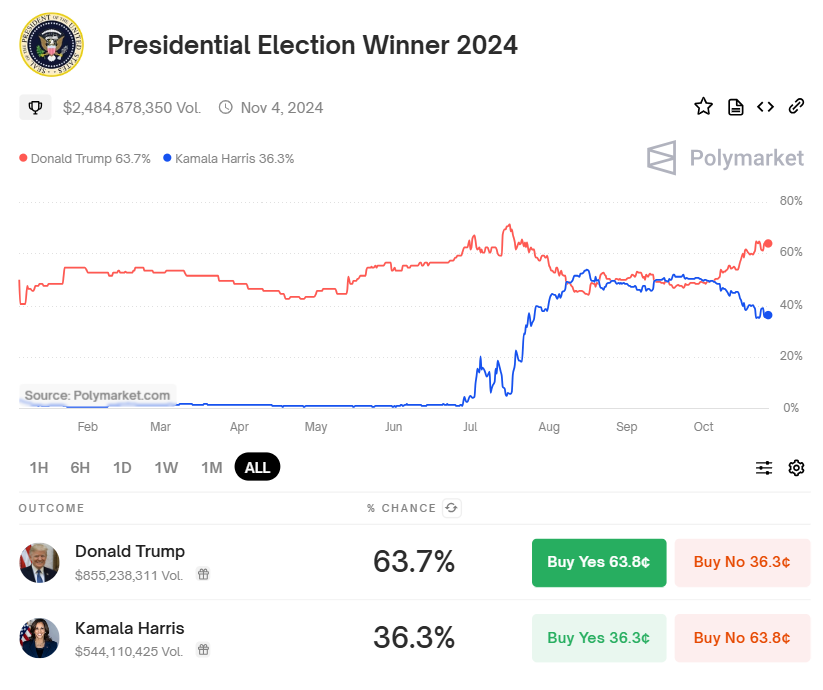

This clarification followed a report from The New York Times, which highlighted how Polymarket’s odds currently favor Donald Trump — a stark contrast to traditional polling data.

Polymarket Emphasizes Peer-to-Peer Transparency Amid Political Betting Surge

In an October 25 statement, Coplan emphasized Polymarket’s neutral stance. He explained that claims of bias often reflect market reactions rather than any actual favoritism within the platform.

“We get told we’re Dem operatives and MAGA, depending on the day. Unfortunately the story is much less juicy, we’re just market nerds who think prediction markets provide the public with a much needed alternative data source,” Coplan stated.

Coplan reiterated that Polymarket was not created with political motives. He emphasized that the platform’s purpose is to help people understand real-world events through open markets. He added that its popularity stems from its accurate prediction that Biden would exit the race — a call that set Polymarket apart.

Read more: Top 9 Web3 Projects That Are Revolutionizing the Industry

He also countered claims about investor Peter Thiel’s influence over Polymarket. Coplan clarified that Founders Fund, a venture capital firm associated with Thiel, is only one of Polymarket’s more than 50 investors and holds a minority stake with no direct control.

“Founders Fund, one of the most active VC funds (Airbnb, Stripe, etc.), and one of our 50+ investors, has a minority stake in the company with no board seat/control – and the partner who did the Polymarket deal isn’t even Thiel. His politics have no bearing on how Polymarket works, operates, or what the prices are – end of story,” Coplan stated.

Coplan highlighted Polymarket’s peer-to-peer structure as an edge over its traditional rivals. According to him, the platform’s transparent approach allows users to audit data directly, contrasting this openness with traditional financial institutions.

“The beauty of Polymarket is it’s all peer-to-peer and transparent. Even more transparent than traditional finance, where all the data is obfuscated and only visible to the operator,” He added.

With increased attention on the upcoming US election, Polymarket has become a prominent platform for political betting. The platform’s 2024 election market volume has reached $2.4 billion, reflecting heightened user interest, and it has attracted integration from major platforms like Bloomberg.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

US Presidential Election Winner. Source: Polymarket

US Presidential Election Winner. Source: Polymarket

However, scrutiny has also intensified, especially as political betting has surged, with certain accounts placing substantial bets favoring Trump. According to BeInCrypto, Polymarket’s leaderboard shows that a user, “Fredi9999,” has bet over $18 million on Republican outcomes.

As of press time, Polymarket data showed Trump with a 63.7% probability of victory, while Kamala Harris held a 36.3% chance.