Australian Dollar remains subdued following Westpac Consumer Confidence Index data

The Australian Dollar depreciated as the US and China reached a preliminary agreement to significantly reduce tariffs after Geneva talks.

Australia’s Westpac Consumer Confidence Index rose 2.2% MoM, recovering from a 6.0% drop in the previous month.

US Trade Representative Jamieson Greer said that if things don’t work out, China tariffs can go back up.

The Australian Dollar (AUD) is extending its decline against the US Dollar (USD) for a second consecutive session on Tuesday. The AUD/USD pair remains under pressure despite a rebound in Australia’s Westpac Consumer Confidence Index, which rose 2.2% month-on-month to 92.1 in May, recovering from a 6.0% drop in the previous month and marking its third increase this year.

The AUD/USD pair weakened further as the US Dollar strengthened following news that the United States and China reached a preliminary agreement to significantly reduce tariffs after productive trade talks over the weekend in Switzerland. Under the deal, US tariffs on Chinese goods will be reduced from 145% to 30%, while China will lower its tariffs on US imports from 125% to 10%—a move broadly viewed as a major step toward de-escalating trade tensions.

Australia, which has deep trade ties with China, is particularly sensitive to shifts in US-China relations. The easing of global trade tensions has also led investors to scale back expectations for aggressive domestic interest rate cuts. Markets now expect the Reserve Bank of Australia (RBA) to lower the cash rate to around 3.1% by the end of the year, up from earlier forecasts of 2.85%. However, the RBA is still widely anticipated to implement a 25 basis point rate cut at its upcoming policy meeting.

Australian Dollar depreciates as US Dollar advances following two-day US-China discussion

The US Dollar Index (DXY), which measures the US Dollar against a basket of six major currencies, is trading lower around 101.60 at the time of writing. Traders will keep an eye on the US April Consumer Price Index (CPI) report, which is due later on Tuesday.

After two days of negotiations aimed at easing trade tensions, both the US and China reported “substantial progress.” China’s Vice Premier He Lifeng described the talks as “an important first step” toward stabilizing bilateral relations.

Meanwhile, US Treasury Secretary Bessent and Trade Representative Greer called the discussions a constructive move toward narrowing the $400 billion trade imbalance. However, Greer warned later that if the agreement falls through, tariffs on Chinese goods could be reinstated.

Last week, the Federal Reserve (Fed) left interest rates unchanged at 4.25%–4.50%, but its accompanying statement highlighted rising concerns about inflation and unemployment, adding a layer of uncertainty to the market outlook.

Fed Chair Jerome Powell, in a post-meeting press conference, warned that ongoing trade tariffs could hinder the central bank’s efforts to manage inflation and employment in 2025. He also suggested that persistent policy instability may prompt the Fed to take a more cautious, wait-and-see approach to future rate moves.

China's Consumer Price Index (CPI) declined for the third consecutive month in April, falling 0.1% year-on-year, matching both the market forecast and the drop recorded in March, according to data released Saturday by the National Bureau of Statistics. Meanwhile, the Producer Price Index (PPI) contracted 2.7% YoY in April, steeper than the 2.5% drop in March and below the market expectation of a 2.6% decline.

On the trade front, China posted a trade surplus of $96.18 billion in April, exceeding the forecast of $89 billion but down from March’s $102.63 billion. Exports rose 8.1% YoY, outperforming the expected 1.9% but slowing from the 12.4% gain seen previously. Imports dipped 0.2% YoY, a milder decline than both the forecasted -5.9% and March’s -4.3%. China’s trade surplus with the US narrowed to $20.46 billion from $27.6 billion in March.

Australia’s Ai Group Industry Index showed improvement in April, although it marked the 33rd straight month of contraction—particularly driven by weakness in export-reliant manufacturing. These signs of persistent softness have strengthened market expectations that the Reserve Bank of Australia (RBA) may cut its cash rate by 25 basis points to 3.85% later this month.

Australian Dollar may target 0.6350 support near nine-day EMA

The AUD/USD pair is hovering near 0.6370 on Tuesday. Technical analysis of the daily chart indicates a bearish outlook, with the pair trading below the nine-day Exponential Moving Average (EMA). Furthermore, the 14-day Relative Strength Index (RSI) has dipped below the 50 mark, reinforcing the bearish sentiment.

The AUD/USD pair is likely to test initial support at the 50-day EMA around 0.6344. A decisive break below this level could strengthen the bearish bias and open the door for a decline toward 0.5914 — a level not seen since March 2020.

On the upside, the AUD/USD pair could retest the nine-day EMA at 0.6402 and potentially revisit the six-month high of 0.6515, recorded on December 2, 2024. A sustained break above this level may pave the way for a move toward the seven-month high of 0.6687 from November 2024.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

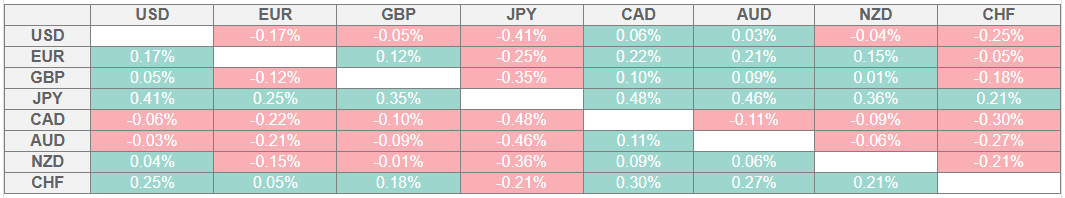

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.