Toncoin Death Cross Imminent: TON Price Heading to Monthly Lows

Toncoin (TON) price has faced significant downward pressure recently, with the broader market’s bearishness spilling over onto the altcoin.

Over the past few days, TON has registered a notable decline, and the outlook appears bleak as the cryptocurrency is on the verge of a Death Cross.

Toncoin May Start a Downtrend

Toncoin is nearing a Death Cross, a bearish signal that occurs when the 50-day Exponential Moving Average (EMA) crosses below the 200-day EMA. This pattern is often seen as a strong indication of a prolonged downtrend. When a Death Cross forms, it suggests that recent price momentum has been negative, and the market could experience more downside pressure.

The intensifying bearish sentiment is already evident in Toncoin’s price action. With both the 50-day and 200-day EMAs aligning to form this pattern, the potential for a significant price drop is growing.

Read more: What Are Telegram Bot Coins?

Toncoin Death Cross. Source: TradingView

Toncoin Death Cross. Source: TradingView

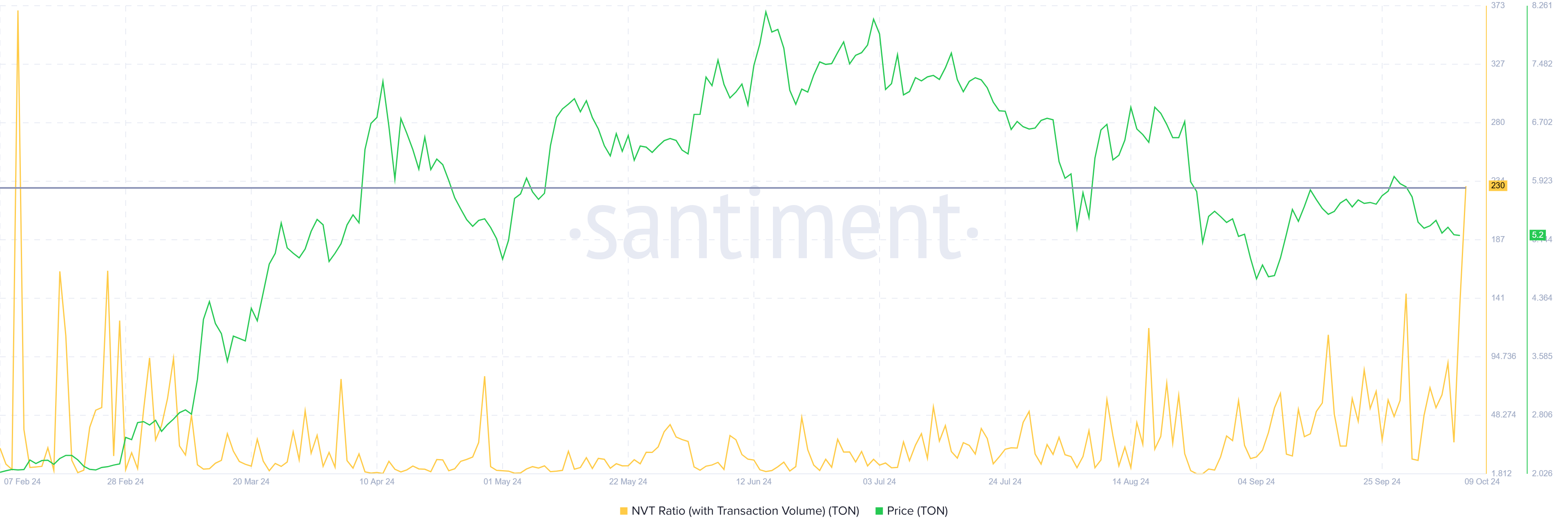

From a macro perspective, the Network Value to Transactions (NVT) Ratio is providing additional bearish signals for Toncoin. The NVT Ratio measures the relationship between the network’s market capitalization and the total transaction volume. Currently, the NVT Ratio for TON is at a seven-month high, suggesting that the network value is inflated compared to its transaction activity.

Historically, a high NVT Ratio indicates that a cryptocurrency is overvalued and could be heading for a correction. With Toncoin’s NVT Ratio at elevated levels, the market is signaling that the altcoin may be due for a price drop, especially with the bearish technical indicators aligning.

Toncoin NVT Ratio. Source: Santiment

Toncoin NVT Ratio. Source: Santiment

TON Price Prediction: Monthly Lows Ahead

Toncoin has already experienced a 13% decline after failing to breach the $5.96 resistance level. The looming Death Cross further suggests that a continued downtrend is likely.

Thus, TON could see a decline below the $4.86 support level. Furthermore, a drop to $4.61, marking an 11% drawdown and a monthly low, could be on the horizon.

Read more: What Are Telegram Mini Apps? A Guide for Crypto Beginners

Toncoin Price Analysis. Source: TradingView

Toncoin Price Analysis. Source: TradingView

The bearish trend will likely continue if TON fails to hold above $4.86. However, if the altcoin manages to prevent this drop and the broader market turns bullish, there is a chance for recovery. Toncoin could bounce back and flip the $5.37 resistance into support, potentially invalidating the bearish outlook and recovering the recent 13% loss.