Bitcoin Short-Term Holder Supply Decreasing At Fastest Pace Since 2012: What’s Going On?

On-chain data shows the Bitcoin supply held by the short-term holders has recently been going down at its fastest monthly rate since 2012.

Bitcoin Short-Term Holder Supply Plunges As Investors HODL

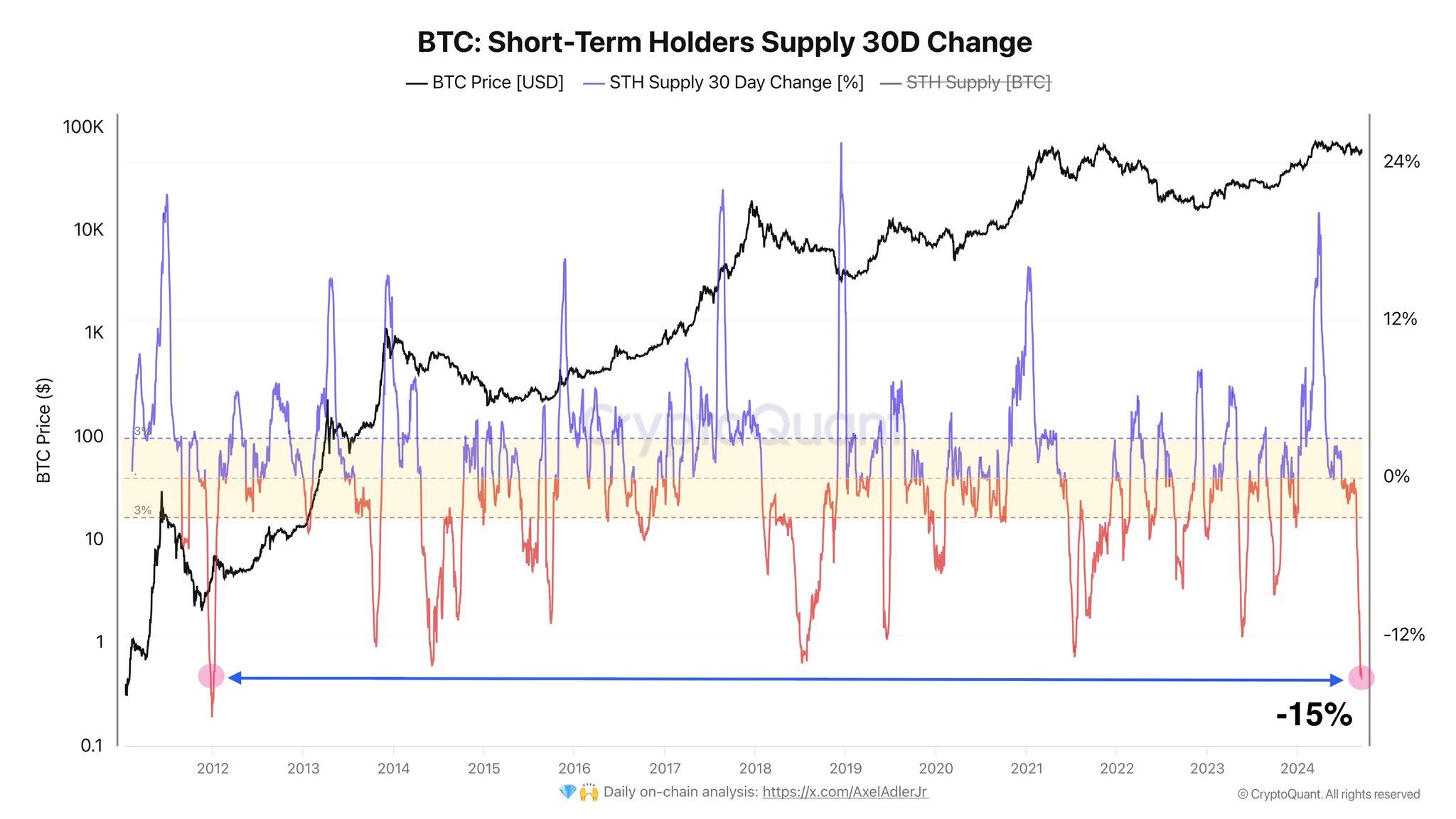

As explained by CryptoQuant author Axel Adler Jr in a new post on X, the 30-day change in the short-term holder supply has plunged deep into the negative territory recently.

The “short-term holders” (STHs) are the Bitcoin investors who bought their coins within the past 155 days. This cohort is one of the two main segments of the BTC market divided based on holding time, with the other group being known as the “long-term holders” (LTHs).

Statistically, the longer an investor holds onto their coins, the less likely they become to sell them at any point. Thus, the STHs may be considered to represent the fickle-minded side of the sector, while the LTHs are the stubborn ones.

One way to keep track of the behavior of these groups is through the total amount of Bitcoin supply they are carrying in their wallets right now. Below is the chart shared by the analyst, which shows the 30-day change in the supply specifically held by the STHs.

As displayed in the above graph, the 30-day change of the Bitcoin STH Supply had observed a sharp positive spike earlier in the year when the rally towards the new all-time high (ATH) had occurred.

This suggests that a huge supply transfer had occurred from the LTHs to the STHs. The graph shows that this isn’t unusual for a bull rally, as the LTHs have historically tended to take some of their HODLing profits when the asset has reached new heights.

The selling these diamond hands participate in during such periods is absorbed by the new demand coming into the market after getting caught in the hype of the rally.

Since Bitcoin has fallen to its consolidation, the LTHs appear to have calmed their selling. Not just that, the trend appears to have completely flipped most recently, as the 30-day change of the STH supply has plunged into the negative region.

Over the past month, the STH supply has decreased by around 15%, the lowest 30-day change recorded since way back in 2012, when the cryptocurrency was still in its infancy.

Naturally, this means that the LTH supply has gone up instead. Something to keep in mind, though, is that this trend doesn’t denote that the LTHs are “buying” these tokens from the hands of the STHs.

Rather, what’s happening is that the STHs are “maturing” into the cohort, after holding past the 155-day cutoff. Thus, it appears that even the STHs have been content being patient through this period of consolidation. This rise in HODLing sentiment can naturally be a positive sign for Bitcoin.

BTC Price

At the time of writing, Bitcoin is floating around $59,500, up around 5% over the last seven days.