Toncoin (TON) Price Rise Above $7 Could Unlock Over $1Billion in Profits

Toncoin (TON) price could be on the verge of a major breakout. As the coin inches closer to this critical threshold, investors who have been holding at a loss might have cause to celebrate with gains.

This analysis examines the driving forces behind Toncoin’s upward momentum and the potential profit opportunities that a sustained rally could bring for traders and long-term holders alike.

Toncoin Has Huge Funds on the Line

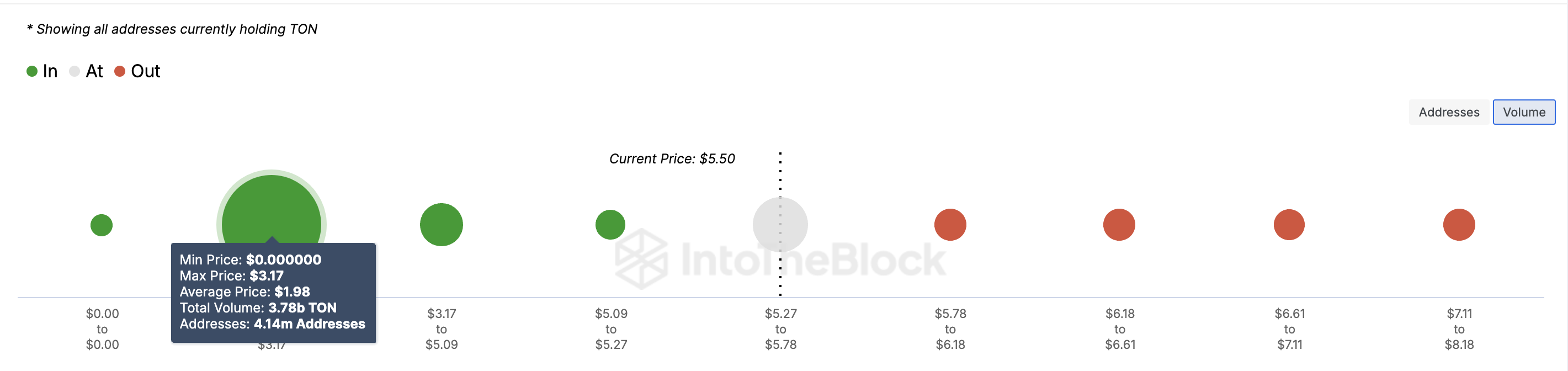

Toncoin (TON), currently ranked as the 9th most valuable cryptocurrency, is trading at $5.54, marking a 33% drop from its all-time high. However, data from IntoTheBlock suggests Toncoin could soon close this gap. The platform’s Global In/Out of Money (GIOM) shows that 3.78 billion tokens purchased at a weighted price of $1.98 are in profit.

The GIOM helps identify support and resistance by showing the volume of tokens at profit, loss, or breakeven points. Larger clusters at specific price levels indicate stronger support or resistance. Notably, over 30 million addresses hold 222 million TON tokens at a loss, purchased between $5.78 and $8.18.

Since this volume is not as much as those accumulated at $1.98, Toncoin’s price could get substantial support. If validated, this support could drive the Toncoin’s price above $7.45, consequently leading to $1.22 billion in profits.

Read more: 6 Best Exchanges To Buy and Sell Hamster Kombat (HMSTR) in 2024

Toncoin Global/InOut of Money. Source: IntoTheBlock

Toncoin Global/InOut of Money. Source: IntoTheBlock

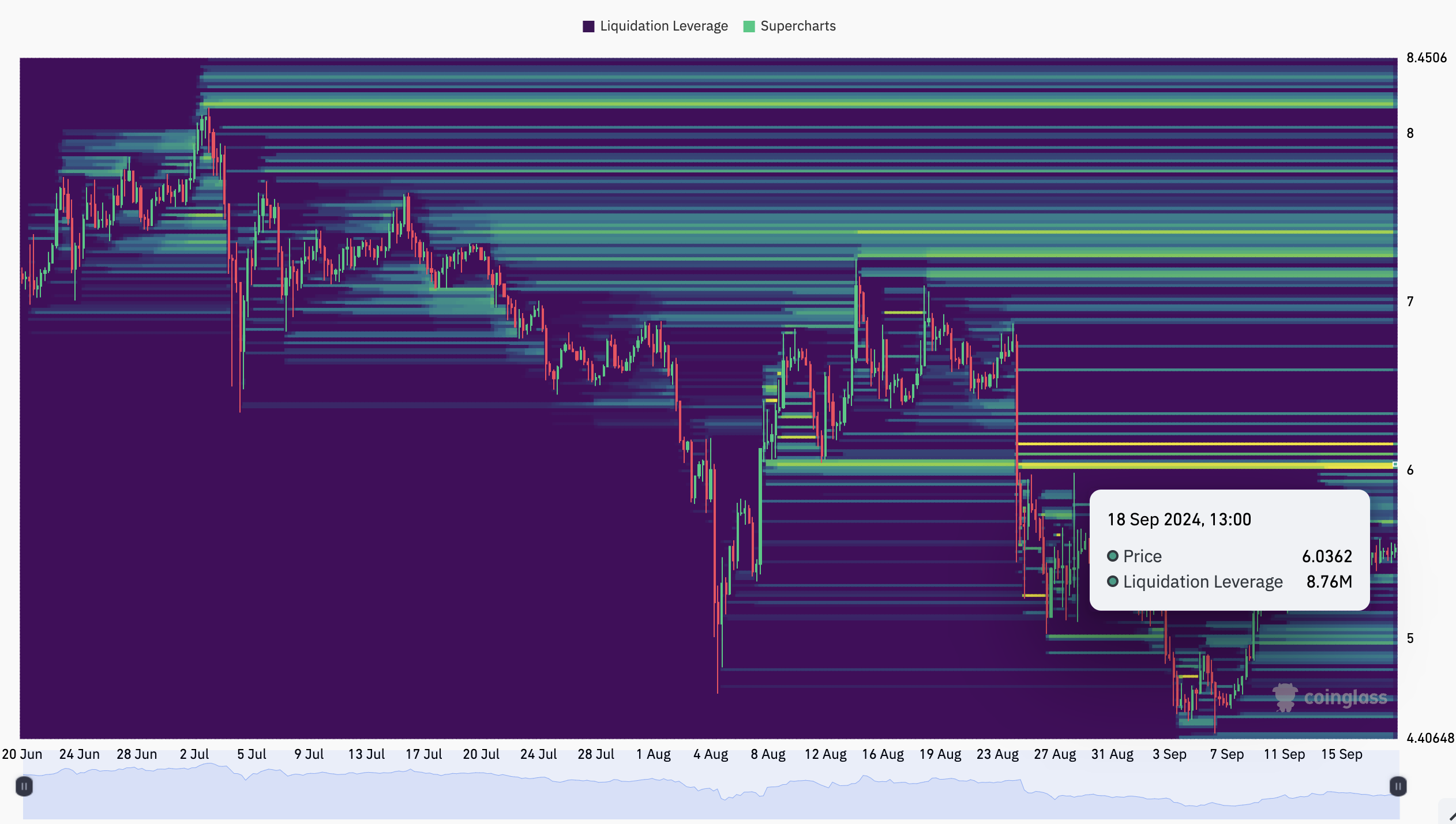

Toncoin’s three-month liquidation heatmap also indicates a potential price increase. For those unfamiliar, the heatmap highlights price levels where large-scale liquidations might occur. High liquidity concentrations, which appear as color shifts from purple to yellow, suggest a possible price move toward those levels.

In Toncoin’s case, the heatmap points to a possible jump to $6 first. If validated by increased buying pressure, the price could then rally toward $7.45, resulting in the $1 billion in profits previously mentioned.

Toncoin Liquidation Heatmap. Source: Coinglass

Toncoin Liquidation Heatmap. Source: Coinglass

TON Price Prediction: $7 Return Close

From a technical point of view, Toncoin’s price has been fluctuating between $5.45 and $5.55 today. Trading at $5.54, BeInCrypto observes consistent green histogram bars with the Bull Bear Power (BBP).

This technical oscillator estimated the strength of buyers (bulls) compared to sellers (bears). When the BBP is positive, bulls are in control. However, a negative reading of the indicator gives bears the upper hand.

As seen below, bulls appear to be dominant. This is also happening at a time when the Chaikin Money Flow (CMF) is increasing. Considering the current outlook, Toncoin’s price could be set to run toward $6.48 or as high as $7.27.

Read more: 6 Best Toncoin (TON) Wallets in 2024

Toncoin Daily Analysis. Source: TradingView

Toncoin Daily Analysis. Source: TradingView

However, a decline in sellers’ strength might tug the price back. In that situation, TON might drop to $4.95.