Pendle Expands BTCFi Presence with New Bitcoin Yield Pools Ahead of V3 Upgrade

Pendle, a decentralized finance (DeFi) yield trading protocol, has made a significant leap by expanding into Bitcoin (BTC) yield options.

This new development enables Bitcoin holders to explore unique yield strategies, broadening their options within the DeFi ecosystem.

BTC Staking Meets Flexibility: Pendle’s Multi-Phase Yield Strategy

The introduction of BTC pools is the first chapter in Pendle’s multi-phase plan, which they call the Bitcoin Arc. This plan aims to increase BTC yield opportunities through collaborations with three DeFi powerhouses—Corn, Lombard Finance, and Babylon Labs.

The partnership allows users to deposit Lombard’s liquid-staked BTC (LBTC) on Corn, a Layer 2 (L2) Ethereum protocol, and participate across the ecosystems of Lombard, Corn, and Babylon. Through this initiative, participants can receive benefits from Corn Kernel multipliers, Lombard Points, and Babylon Points, creating a comprehensive and interconnected yield ecosystem.

Read more: Top 8 High-Yield Liquid Staking Platforms To Watch in 2024

Pendle will offer Bitcoin holders two primary yield strategies through its BTC pools. The PT-LBTC option, which offers a fixed yield on BTC, allows users to lock in stable, predictable returns. This strategy is ideal for those seeking to avoid the risks of yield volatility and instead opt for consistent, guaranteed returns.

Meanwhile, the YT-LBTC option offers leveraged exposure to Bitcoin yields. Users can benefit from multipliers—up to 3x through Corn Kernel and Lombard Points—with additional Babylon Points enhancing yield potential. This approach caters to those looking to maximize returns by taking calculated risks to pursue higher yields.

Preparing for Bitcoin’s Growing Role in Decentralized Finance

Pendle’s latest initiative aligns with the growing momentum of Bitcoin in DeFi (BTCFi). As Bitcoin’s presence in DeFi expands, Pendle’s BTC yield pools position the platform to capitalize on this trend.

Daniel Anthony, Pendle’s Head of Growth, explained that incorporating Bitcoin yield options aligns with a broader strategy to adapt to key developments in the DeFi sector. He pointed out that the rise of BTC staking was anticipated earlier this year as venture capital began to flow into the space. Pendle was prepared for this shift, ensuring its platform could accommodate Bitcoin assets.

“RWA was hyped because people said we can tap into this trillion-dollar liquidity in TradFi and bring that whole thing to DeFi. But I think what people have been missing is that the next closest neighbor to us that we haven’t really tapped into the DeFi is BTC. I think Bitcoin has a very deep liquidity in crypto. I mean, look at centralized exchanges. The amount of liquidity that they have and Bitcoin is extremely deep. And that hasn’t been tapped into DeFi at all,” Anthony elaborated to BeInCrypto in a recent exclusive interview.

Looking ahead, Anthony foresees Bitcoin’s expanding role in DeFi, predicting continuous evolution for BTCFi alongside infrastructure advancements. He emphasized that Pendle’s strategic focus on Bitcoin positions it to stay relevant as the industry moves forward, particularly as demand for liquidity and yield opportunities in BTC increases.

Beyond aligning with current market trends, Pendle’s expansion into Bitcoin yield options also prepares for the protocol’s upcoming V3 upgrade. The V3 iteration will focus on improving liquidity and scalability, addressing current limitations in handling larger transactions.

Furthermore, Anthony highlighted that V3 will enable the protocol to accommodate larger investments. This capability will make it more attractive to institutional investors and large-scale DeFi participants.

“For example, currently, we are unable to tap into transactions that are 6, 7 figures, and above just because of liquidity constraints of Pendle V2. So, to cater to this, we are building Pendle V3. […] I think it mostly serves as an upgrade to what Pendle V2 cannot do and serves as a very big complement to what Pendle V2 is today. Hopefully, we can get it out by early next year,” he elaborated.

Read more: 9 Cryptocurrencies Offering the Highest Staking Yields (APY) in 2024

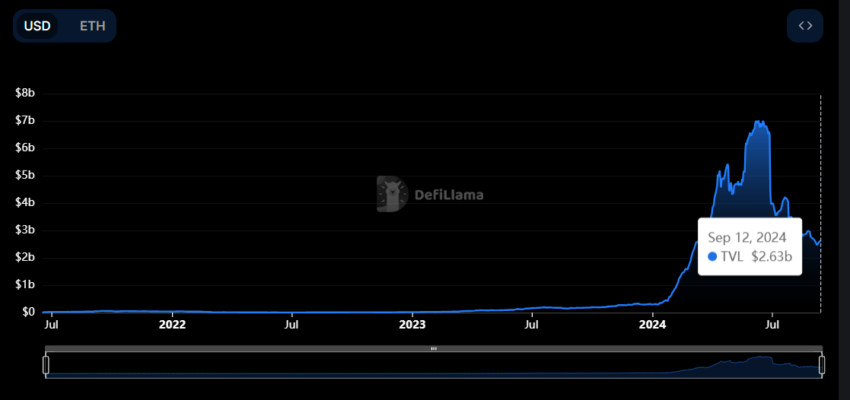

Pendle’s TVL. Source: DefiLlama

Pendle’s TVL. Source: DefiLlama

Currently, Pendle ranks as the largest yield protocol by total value locked (TVL). DefiLlama data shows that it has a TVL of $2.63 billion at the time of writing.