Algorand (ALGO) Large Transactions Decline as Price Stalls

ALGO, the native token of the pure-proof-of-stake (PoS) blockchain Algorand (ALGO), has witnessed a decline in whale activity in the past few weeks. Large transactions involving the altcoin have dropped due to the steady drop in value over the past few months.

Since the altcoin peaked at a year-to-date high of $0.31 on March 13, its value has plummeted by 58%.

Algorand Whales Look Elsewhere For Gains

Over the past 30 days, ALGO’s price has dropped by almost 10%. This has led to a reduction in the daily count of large transactions involving the altcoin.

According to IntoTheBlock’s data, the daily count of whale transactions worth between $100,000 and $1 million has declined by 89% during that period. Likewise, within the period under review, the number of larger transactions valued between $1 million and $10 million has reduced by 100%.

Algorand Transaction Volume. Source: IntoTheBlock

Algorand Transaction Volume. Source: IntoTheBlock

A decline in an asset’s large transaction count is a bearish signal. The reduction in high-volume buying activity signals a drop in demand and an increase in available supply, which puts downward pressure on an asset’s price.

Also, when retail investors notice institutional investors or whales decreasing their trading activity, their confidence is reduced, leading to more selling activity and sustained price declines.

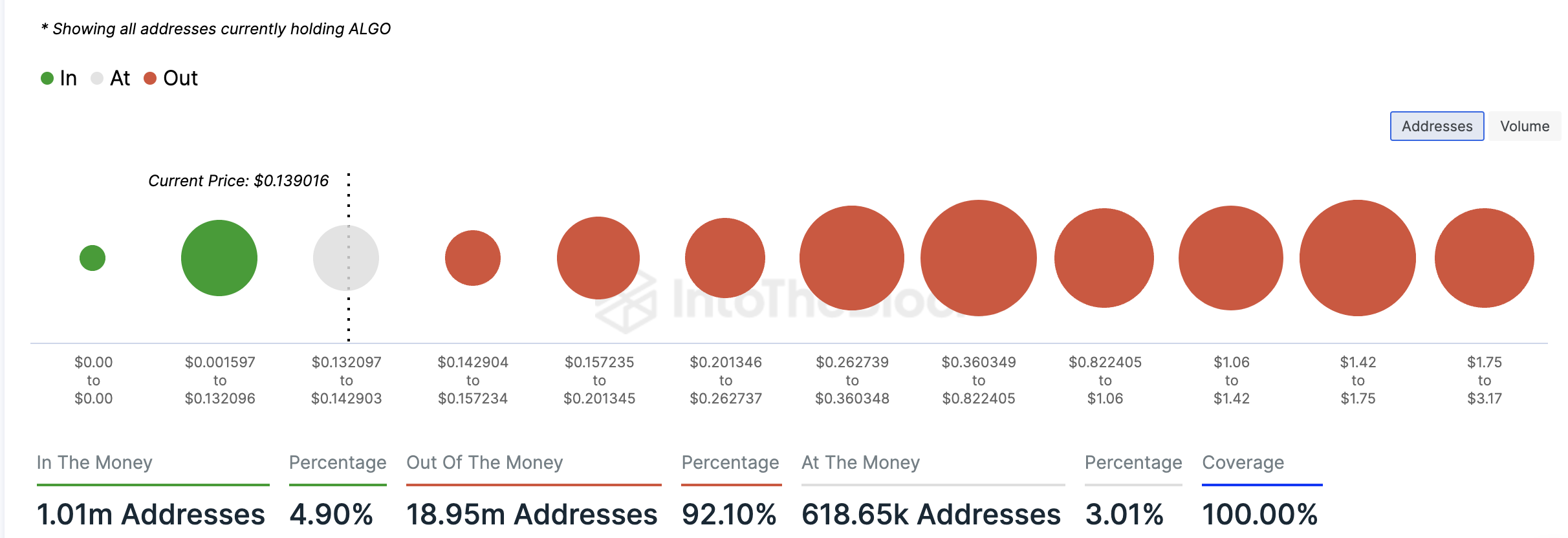

However, ALGO whales cannot be blamed for trading less over the past month. Due to ALGO’s unabated price decline since March, more than 18 million addresses, which comprise 92% of its holders, are currently “under the money.”

An address is considered out of the money if it holds an asset at a loss. This happens when the current market price of the asset is lower than the average cost at which the address purchased the tokens it currently holds.

Read more: What Is Algorand (ALGO)?

Algorand Global In/Out of the Money. Source: IntoTheBlock

Algorand Global In/Out of the Money. Source: IntoTheBlock

Conversely, 1.01million addresses, representing just 5% of all ALGO holders, hold their coins at a profit.

ALGO Price Prediction: Token May Extend its Decline

At press time, ALGO trades at $0.13. Readings from its price chart hint at the possibility that the altcoin will extend its price decline.

Firstly, according to its Moving Average Convergence/Divergence (MACD) indicator, its MACD line (blue) rests below its signal (red) and zero lines at press time.

Traders use this indicator to gauge price trends, momentum, and potential buying and selling opportunities in the market. When an asset’s MACD line rests under its signal and zero lines, it is a bearish sign that suggests that selling activity outweighs buying momentum.

Confirming this, ALGO’s positive directional indicator ( DMI) rests below its negative directional indicator (-DMI). These lines of the token’s Directional Movement Index (DMI) have been set up this way since July 21, signaling that the bears have market control.

If bearish sentiment lingers, ALGO’s price will drop to $0.11, marking the second such occurrence since November 2023.

Read more: Algorand (ALGO) Price Prediction 2024/2025/2030

Algorand Price Analysis. Source: TradingView

Algorand Price Analysis. Source: TradingView

However, if the trend shifts and sentiment changes from negative to positive, ALGO’s price may rally to $0.16.