Binance Coin (BNB) Fails to React as SEC Seeks to Amend Complaint in Binance Suit

In a court filing on Tuesday, the Securities and Exchange Commission (SEC) confirmed its decision to drop its demand for a court ruling on whether the “Third Party Crypto Asset Securities” listed on Binance are securities.

Despite this positive development, the price of Binance Coin (BNB) has shown little reaction. The token’s value has increased by only 2% in the past 24 hours, while trading volume has seen a modest 1% uptick.

Binance Coin Awaits Bullish Breakout

At press time, BNB traded at $584.27. Although it has grown by 2% in the past 24 hours, the coin’s performance has remained muted despite the SEC’s decision to amend its complaints to no longer seek a ruling on whether certain tokens listed on Binance are securities. This is partly due to the coin’s sideways movements in the past few weeks.

BNB has trended within a horizontal channel since the beginning of July. This channel is formed when an asset’s price consolidates within a price range for a specific period. It happens when there is a relative balance between buying and selling pressures, preventing the asset’s price from trending strongly in either direction.

The upper line of a horizontal channel forms resistance, while the lower line forms support. Since it began to trend sideways, BNB has faced resistance at $597.50 and has found support at $554.40.

Binance Coin Analysis. Source: TradingView

Binance Coin Analysis. Source: TradingView

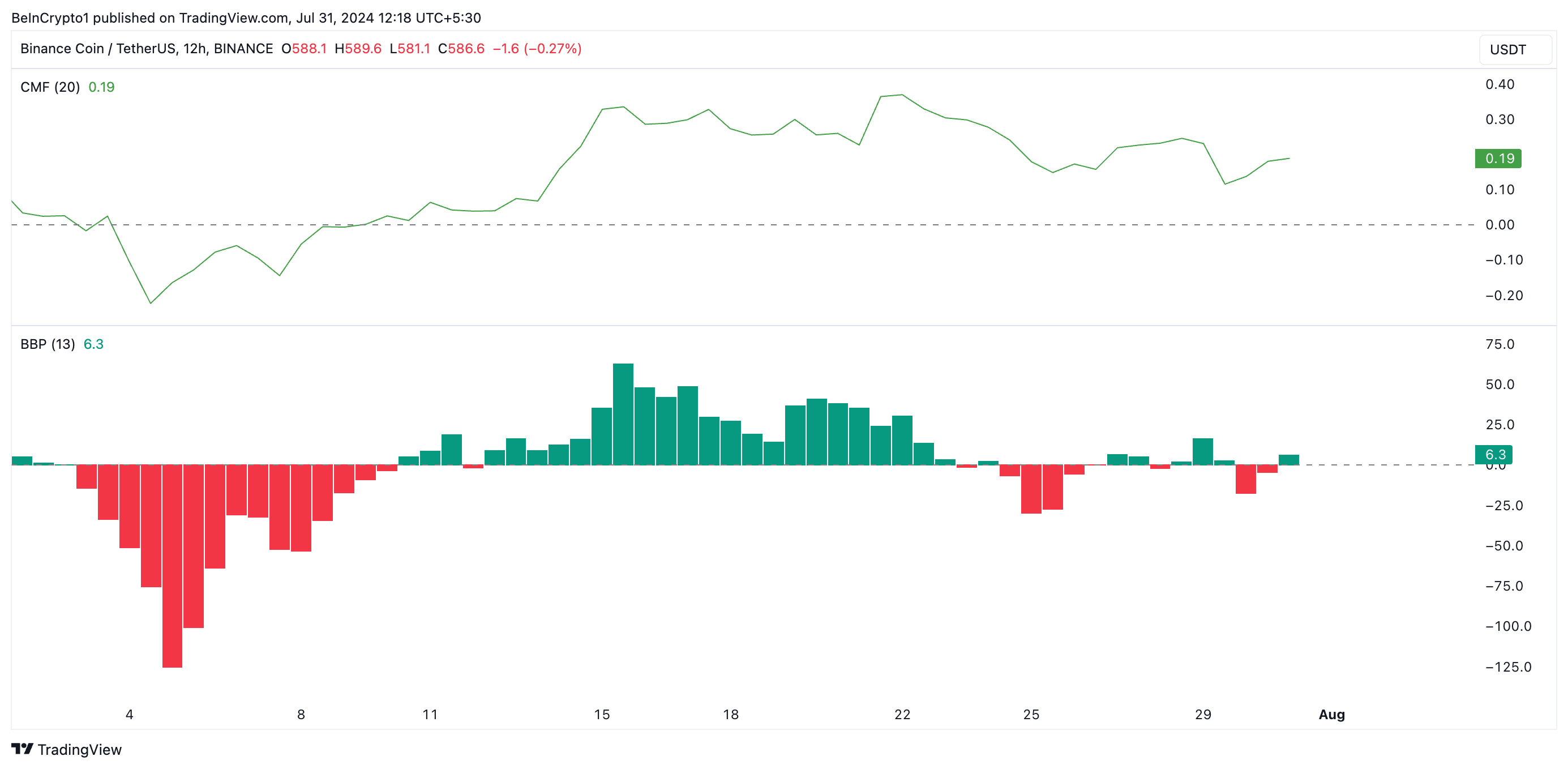

The coin may, however, be poised for a bullish breakout as bullish sentiment begins to gain momentum. According to readings from its Chaikin Money Flow (CMF), the BNB market continues to see liquidity inflow. At press time, the coin’s CMF rests above zero at 0.19.

This indicator tracks how money flows into and out of an asset. A CMF value above zero is a sign of market strength.

When an asset’s CMF rises while its price trends sideways, it often means that investors are buying into the asset. However, selling pressure is also present, keeping the price in check.

If BNB’s buying pressure increases and outweighs selling activity, it may mark the commencement of a rally and a move toward breaking above the horizontal channel’s resistance line.

Further, BNB’s Elder-Ray Index is positive at press time. Despite the coin’s sideways movements, its value has mostly been above zero in the past few weeks. As of this writing, the indicator’s value is 6.3.

Read More: Binance Coin (BNB) Price Prediction 2024/2025/2030

Binance Coin Analysis. Source: TradingView

Binance Coin Analysis. Source: TradingView

This indicator measures the relationship between the strength of buyers and sellers in the market. When its value is positive, it means that bull power dominates the market.

The positive readings from BNB’s Elder-Ray Index suggest that while there is a relative balance between buying and selling pressure, the bullish bias toward the coin is still significant.

BNB Price Prediction: Is a Rally Above $600 on the Cards?

If the bullish sentiment continues to grow and the demand for BNB spikes, the coin’s price may rise above $600. It may even rally to exchange hands at a high of $618.80.

Binance Coin Analysis. Source: TradingView

Binance Coin Analysis. Source: TradingView

However, if the market becomes overwhelmed by bearish sentiments, the coin’s price may fall to $557.10.