Gold climbs to $4,350 as safe-haven flows ignore firm US Dollar, yields

- Gold holds near $4,344 after rebounding from $4,309, resilient despite higher yields and a firmer US Dollar.

- US consumer sentiment weakens as households expect rising unemployment and cut spending on durable goods.

- BoJ rate hike lifts global yields, but Fed uncertainty and thin holiday liquidity keep gold supported.

Gold (XA/USD) surges during the North American session on Friday, up 0.30% despite rising US Treasury bond yields and of the US Dollar, which is poised to finish the week with modest gains of 0.25%. At the time of writing, XAU/USD trades at $4,344 after bouncing off daily lows of $4,309.

Bullion advances late Friday despite rising US yields, steadier US Dollar

On Friday, the US economic docket is scarce, as the last 'formal' trading week of the year comes to an end, as most trading desks get off for the Christmas holidays. The Consumer Sentiment Index by the University of Michigan for December missed the mark, as people surveyed see a rise in the unemployment rate, and as buying for durable goods tumbled for the fifth straight month.

Earlier, New York Federal Reserve (Fed) President John Williams said that he doesn’t have a “sense of urgency on changing monetary policy.” Williams' posture shifted from dovish to neutral-hawkish as the Greenback recovered some ground, while Gold prices retreated to $4,320, before hitting a daily high.

In the week, Gold prices hit a weekly high of $4,374 on Thursday, but buyers remained reluctant to test the year-to-date (YTD) high of $4,381, as global bond yields rose. US Treasury yields rose as the Bank of Japan increased rates from 0.50% to 0.75% on Friday.

Next week, the US economic docket will be busy on December 23, due to a shortened week by the Christmas holidays. Traders will digest the ADP Employment Change 4-week average, growth figures for Q3 on its preliminary release, October’s Durable Goods Orders and Industrial Production prints for October and November.

Daily digest market movers: Gold price jumps as Consumer Sentiment dips

- Gold price rallies despite both US yields and the US Dollar are posting solid gains. The US 10-year Treasury note yield is up two and a half basis points to 4.147%. US real yields, which correlate inversely with Gold prices, surge nearly three basis points to 1.907%.

- The US Dollar Index (DXY), which tracks the buck’s value against a basket of six currencies, rises 0.22% to 98.63.

- US Consumer Sentiment was revised down in December from 53.3 to 52.9, felling short of expectations of a print of 53.5. The University of Michigan survey also updated that inflation expectations for one year climbed to 4.2%, while five-year expectations held at 3.2%, indicating that longer-term inflation views remain elevated but stable.

- New York Fed President John Williams said that recent data point to further disinflation, while noting that the uptick in the unemployment rate may reflect temporary distortions, possibly by around one-tenth of a percentage point, and therefore was not a surprising development. He added that he does not sense any urgency to adjust monetary policy at this stage.

- On Thursday, the US Consumer Price Index (CPI) for November rose by 2.7%, below the previous print of 3%. Despite this, economists warned that data should be taken with a pinch of salt, due to the 43-day shutdown of the US government, which could distort some data.

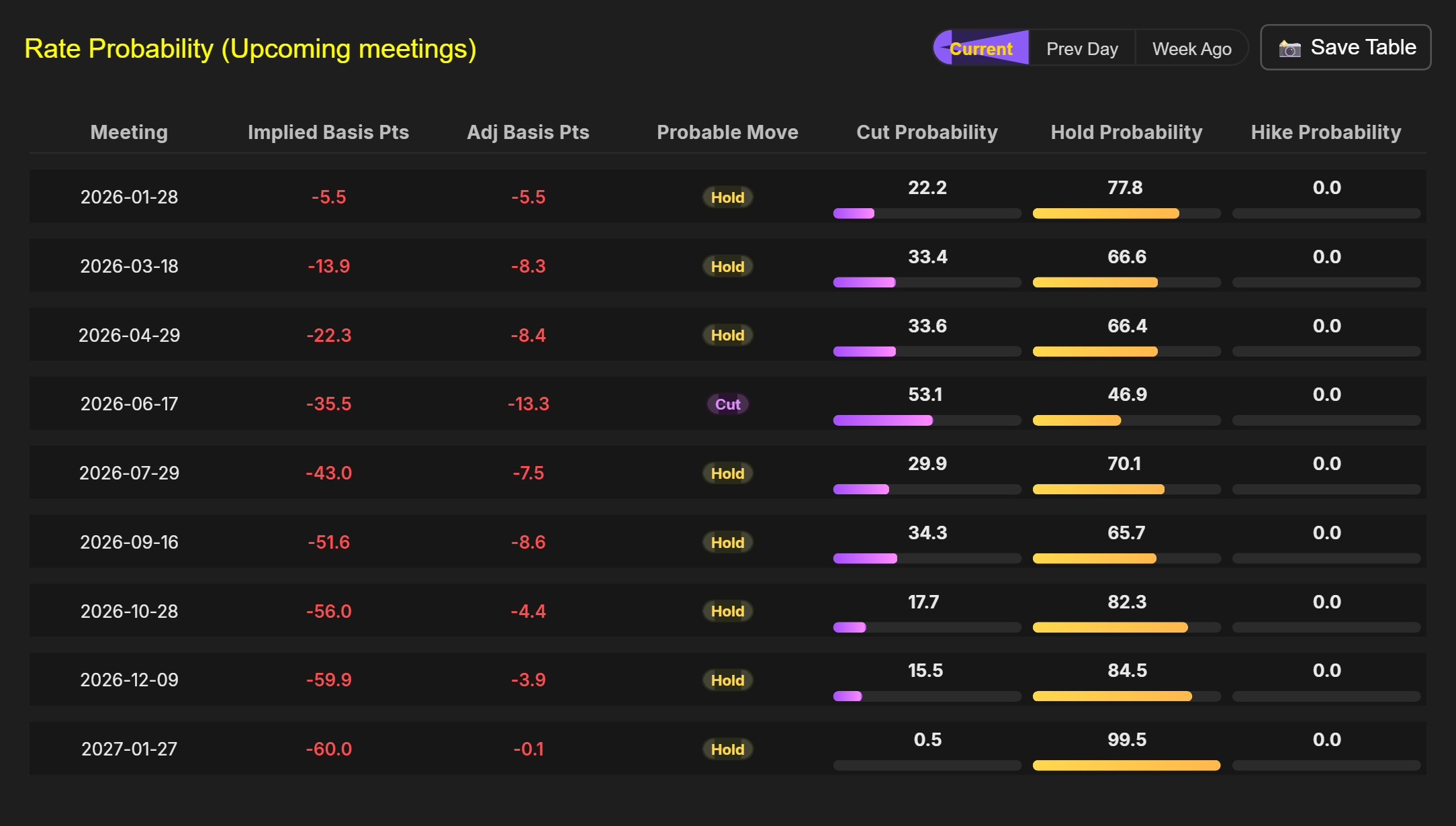

- Expectations that the Fed will cut rates at the next meeting on January 28 remain unchanged at 22%, according to Capital Edge Rate probability data. Nonetheless, for the full year ahead, investors had priced 60 basis points of easing, with the first cut expected in June.

Technical analysis: Gold loses steam as it falls to punch through $4,381 peak

Gold’s uptrend stalled as the yellow metal consolidates ahead of the year’s end. Nevertheless, Bullion is poised to end with an appreciation of more than 60%, set to test $4,500 and $5,000 in the next year.

For a bullish continuation, XAU/USD needs to surpass the record high of $4,381 ahead of $4,400. A breach of the latter exposes $4,450 and $4,500. On the other hand, if Gold slides below $4,300, traders could challenge the December 11 high at $4,285, followed by $4,250, and the $4,200 psychological mark.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.