Bittensor (TAO) Investors Remain Skeptical Despite the Recent 50% Price Rally

Bittensor (TAO) price marked an impressive growth, with the altcoin rising from $217 to $331, indicating potential for further growth.

However, the crypto asset might fall short of a solid rally since the investors seem unsure of what profits TAO can bring them.

Bittensor Investors Are Doubtful

TAO price could note some resistance in rising further. This is because despite TAO noting a 51% rise, the asset’s Sharpe Ratio remains at 1.5. While this is a positive indicator, it is not particularly alluring to investors who may be seeking higher risk-adjusted returns.

The Sharpe Ratio, though positive, does not suggest an exceptionally strong performance relative to the risk involved. Investors often look for higher Sharpe Ratios to ensure that the returns justify the risks taken, and a ratio of 1.5 may not meet their criteria.

TAO Sharpe Ratio. Source: MacroAxis

TAO Sharpe Ratio. Source: MacroAxis

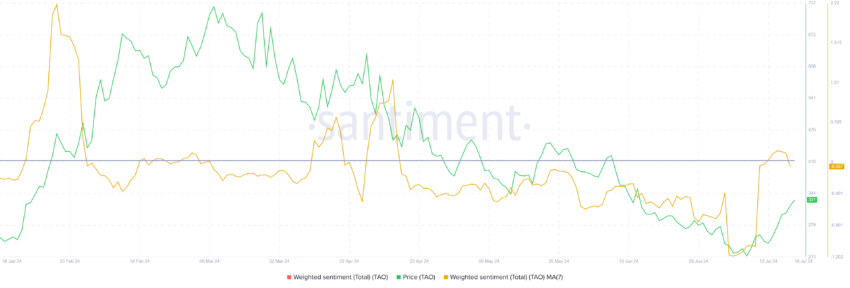

Adding to the cautious sentiment, TAO holders themselves are skeptical about a bullish outcome. This skepticism is evident in their neutral-bearish weighted sentiment, indicating a lack of strong confidence in the asset’s future performance.

The neutral-bearish sentiment among TAO holders suggests that many are uncertain or pessimistic about the asset’s prospects. This collective sentiment can significantly influence market dynamics, potentially hindering further bullish momentum for TAO.

Read More: Top 9 Safest Crypto Exchanges in 2024

TAO Investor Sentiment. Source: Santiment

TAO Investor Sentiment. Source: Santiment

TAO Price Prediction: The Future Is Sideways

TAO price trading at $331 is up by 51% in the last ten days, however, this rally might halt before it can flip $351 into support. The aforementioned factors present potential sideways movement under $351.

Any potential drawdown could bring TAO price down to $257, with the altcoin consolidating above it under $304.

Read More: How To Invest in Artificial Intelligence (AI) Cryptocurrencies?

Bittensor Price Analysis. Source: TradingView

Bittensor Price Analysis. Source: TradingView

If the altcoin falls below it, the consolidation thesis could be invalidated with the investors losing a chunk of their gains. This would only extend their losses.