Week Ahead: Crypto market eyes a bullish turnaround

A new week has begun, but crypto markets seem to be doing the same thing they have for the past few weeks – consolidate. However, this week will likely bring new opportunities as Bitcoin begins to show signs of revival.

Bitcoin outlook remains unchanged

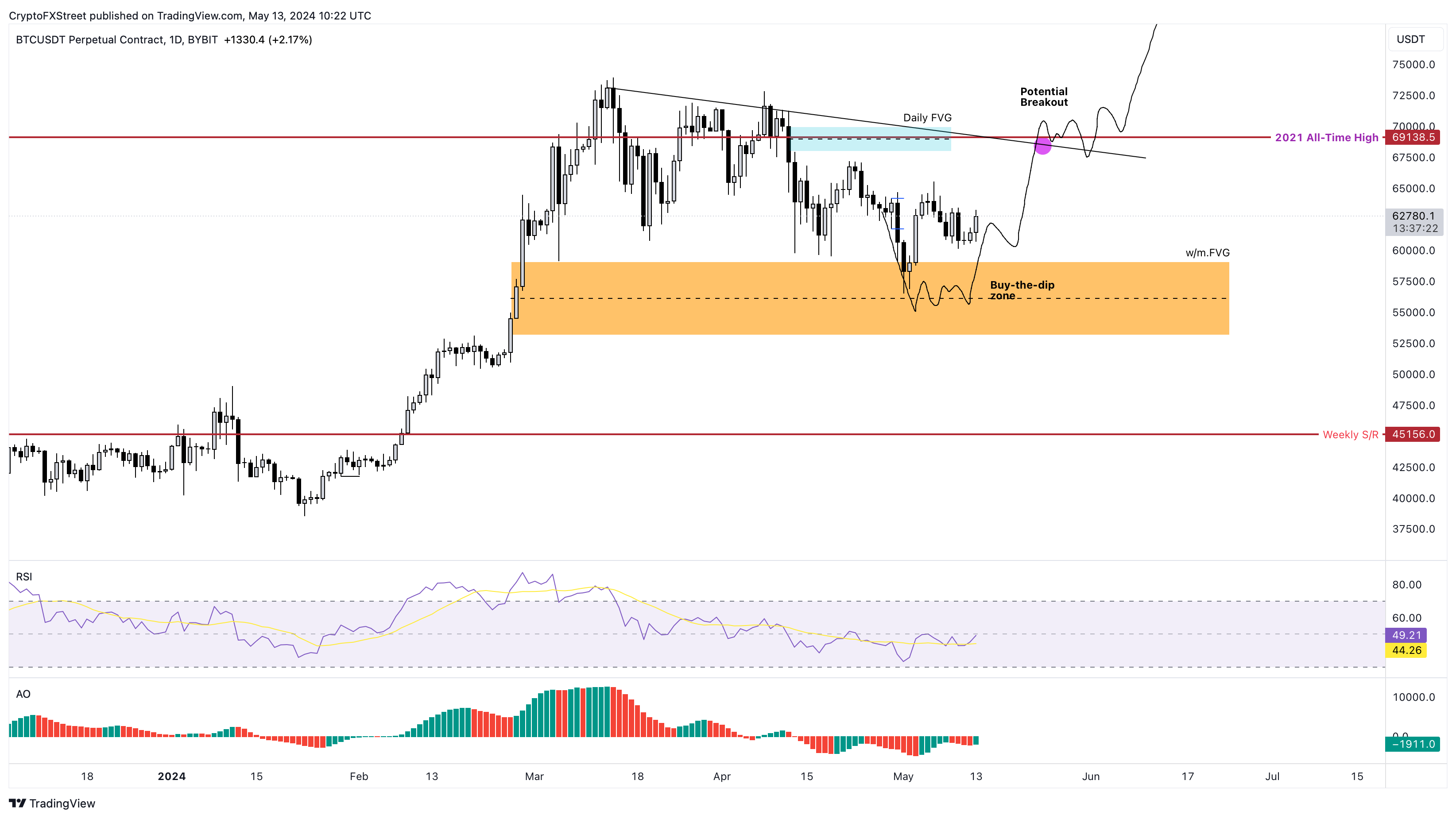

Bitcoin (BTC) price has been slowly sliding lower and currently trades at $63,000. This consolidation has been underway for nearly two months. After the May 1 correction, BTC should have seen a positive spike in buying pressure, but it failed to sustain. Since that crash, the pioneer crypto has set up a higher high at $65,540 and a higher low at $60,111, indicating a potential shift in market structure favoring bulls.

Going forward, investors can expect Bitcoin price to climb higher and retest the trend line that connects the all-time high (ATH) of $73,949 and subsequent lower highs. If BTC can overcome this declining resistance level, the chances of resuming the bull rally will increase exponentially.

BTC/USDT 1-day chart

With Bitcoin showing signs of a potential bullish reversal, the ripple effect from it could see altcoins break out from their consolidation as well. In addition to the positive BTC outlook, there are two important macroeconomic events this week that could add volatility to the mix.

Macroeconomic events this week

- May 14 - Fed Chair Jerome Powell's speech at 14:00 GMT

- May 15 - US CPI inflation report at 12:30 PM GMT

Crypto token unlocks this week

This week will see altcoins worth $1.2 billion flood the crypto markets. Here are the top three unlocks:

- May 15 - Aevo (AEVO) - $961 million

- May 16 - Arbitrum (ARB) - $92 million

- May 15 - Stark (STRK) - $77 million

Although token unlocks are generally bearish, one or all of the three altcoins could see an uptick in buying pressure before the unlock. This development could lead to a sell-the-news event for the underlying token, where the altcoin reverses the bullish trend.

Stark’s STRK token could see a bullish recovery rally since it is retesting the declining trendline after a breakout on May 2. Stark price could see a 25% to 45% rally that retests the $1.483 and $1.749 hurdles.

STRK/USDT 12-hour chart

Top 3 reads:

Bitcoin price retests $60,600, wiping out Thursday gains in American session

Ethereum declines briefly, JP Morgan sees a spot ETH ETF approval despite recent Wells notice

XRP drops below $0.50 support as Ripple, SEC are set to file letters to seal motions and evidence

Top 3 altcoin reads:

Could Worldcoin price shoot up 45% ahead of OpenAI’s live stream on Monday?

Pepe price primed for 25% rally as PEPE bulls ignore Friday’s correction

Dogecoin’s dilemma offers day traders opportunity to scalp DOGE