Binance CEO CZ sentenced to four months in prison, BNB price slightly recovers

- Judge Richard Jones sentences Changpeng Zhao to four months in prison.

- CZ's team didn't ask for house arrest, just proposed it as an option. Actual ask is for probation.

- BNB and the crypto market could recover following CZ's short sentence.

Binance (BNB) founder and ex-CEO Changpeng Zhao (CZ) will spend four months in jail after Judge Richard Jones sentenced him on Tuesday. CZ earlier pleaded to one count of violating the Bank Secrecy Act in November 2023.

Read more: BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

CZ to spend four months in prison

After pleading guilty to one count of violating the Bank Secrecy Act earlier in November 2023, the former Binance CEO was sentenced to four months in prison by Judge Richard Jones for failure to establish robust anti-money laundering procedures. The judge rejected the DoJ's 36-month sentence request to land at the decision. He stated, "There needs to be an effort by this court to impose a sentence that's appropriate and reasonable."

Considering CZ pleaded guilty and cooperated with authorities, the Federal sentencing guidelines set a maximum sentence of 18 months — under normal circumstances, such a charge would carry up to 10 years in prison.

The DoJ requested a three-year sentence, arguing that the Binance founder willfully allowed illegal trades on Binance, failed to report thousands of suspicious criminal activities and garnered profits of around $1.6 billion from such transactions. In contrast, CZ's team requested probation and proposed house arrest as an option.

Also read: Binance founder Changpeng Zhao could face three-year jail time

When the hearing got underway, Judge Richard Jones disagreed with the DoJ's request to extend the sentence to three years, stating, "There's no evidence that the defendant was ever informed of illegal activity," according to reporter Nikhilesh De. In response, the DoJ argued that CZ was aware of illicit activity.

DOJ attorney: CZ deliberately tried to tap U.S. financial system. "Violating the law was integral to that endeavor; we're not guessing here, Mr Zhao said that himself - ask for forgiveness, not permission"

— @nikhileshde@journa.host (@nikhileshde) April 30, 2024

While the judge seemed to agree with the 10-16 months prison sentence and 1-3 years supervised release recommended by the Probation Office, the DoJ attorney argued otherwise. The DoJ stated that it would serve as an incentive for others to break the law on a large scale.

The defense attorney reiterated CZ's and Binance's compliance throughout the process. Binance agreed to pay $4.3 billion in fines, while CZ would pay $50 million — a fraction of his $33 billion net worth, according to Forbes.

After several exchanges, the judge rejected the DoJ's request for three years and sentenced CZ to four months in prison.

Read more: Binance cuts off $10 billion venture capital arm, BNB price takes 6% loss

CZ's sentencing comes off the back of former FTX CEO Sam Bankman-Fried’s 25-year prison sentence for his role in the collapse of the FTX exchange.

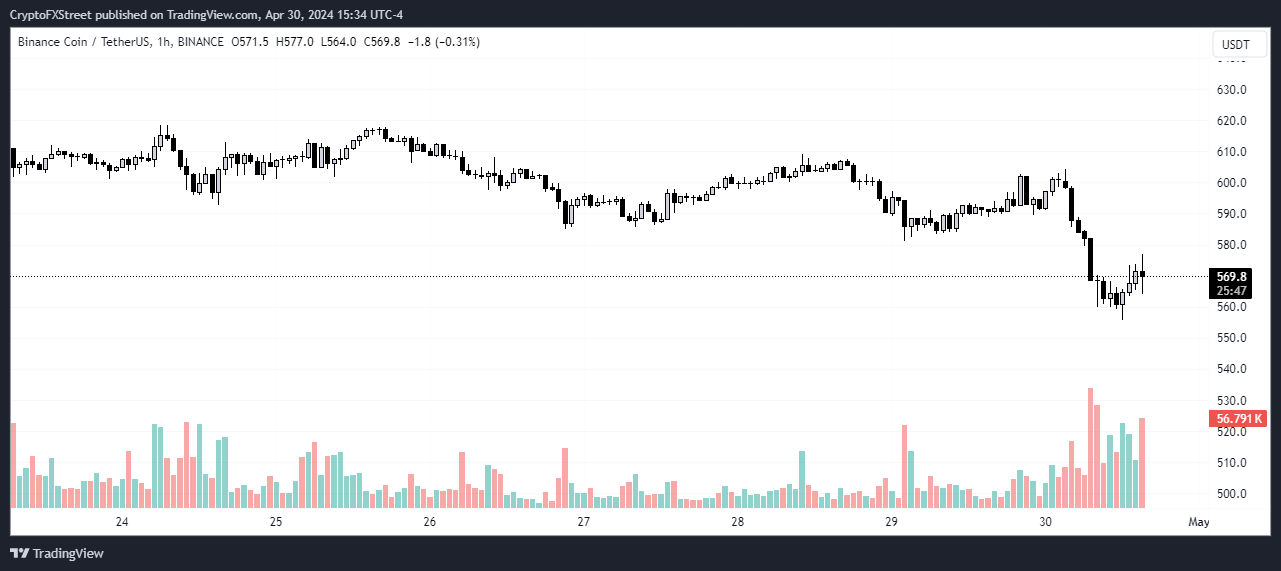

In the immediate aftermath, BNB is showing recovery signs after bouncing from a low of $556.20 to $570.60.

BNB/USDT 1-hour chart

The general crypto market is also warming up to the news, considering CZ's and Binance's wide influence in the space. Many expect the crypto market to see a slight recovery from recent dumps following CZ's short sentence.