Tether Surpasses 500 Million Users as Growth Accelerates—But Risks and USDT Peg Concerns Persist

Tether’s USDT has crossed a major milestone, surpassing 534 million users, even as the broader crypto market remains under pressure following a sharp contraction that began in October 2025.

According to the company’s Q4 2025 USD₮ Market Report, the stablecoin added more than 35 million users in the quarter, marking the eighth consecutive quarter of adding over 30 million users.

USDT Expands as a Global Store of Value Even as Crypto Market Cap Contracts

The growth comes during a period of declining risk appetite. Since the October 10 liquidation cascade, the total crypto market capitalization has fallen by more than one-third (30%). Meanwhile, USDT’s supply has continued to expand modestly.

Tether reported that its market capitalization rose to $187.3 billion, up $12.4 billion in Q4, even as some competing stablecoins shrank.

USDT, USDC, and USDe Market Cap Performances. Source: TradingView

USDT, USDC, and USDe Market Cap Performances. Source: TradingView

Tether attributes the resilience to demand for savings, payments, and cross-border transfers rather than purely speculative trading.

On-chain metrics cited in the report show rising wallet balances among long-term holders and record transaction volumes.

However, the estimates of total users include both on-chain wallets and approximations of exchange users, making independent verification difficult.

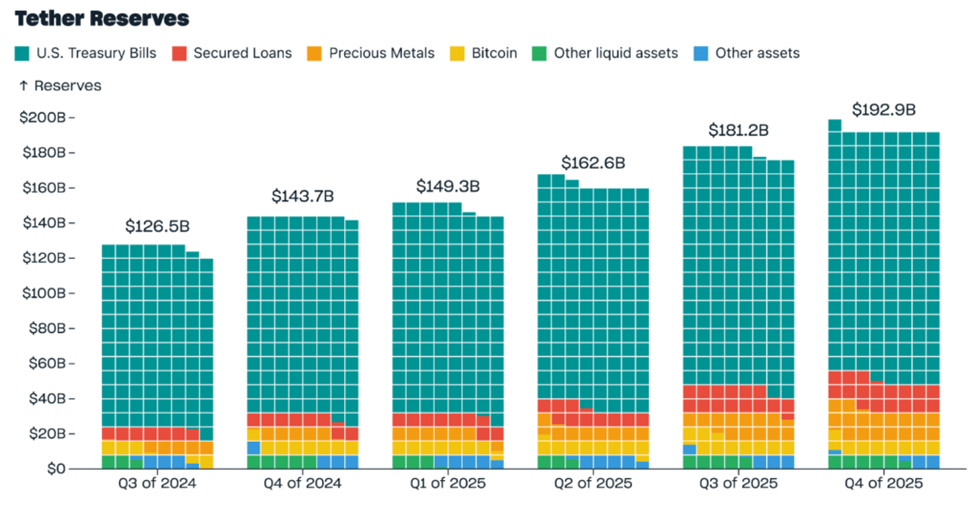

Reserve disclosures also show continued expansion. Total reserves reached $192.9 billion, including $141.6 billion in US Treasuries, a level that would place Tether among the largest Treasury holders globally if it were a country.

Tether Reserves. Source: Q4 2025 Market Report

Tether Reserves. Source: Q4 2025 Market Report

The company also increased its Bitcoin holdings to 96,184 BTC and its gold reserves to 127.5 metric tons, reflecting a strategy to diversify collateral beyond cash-equivalent assets.

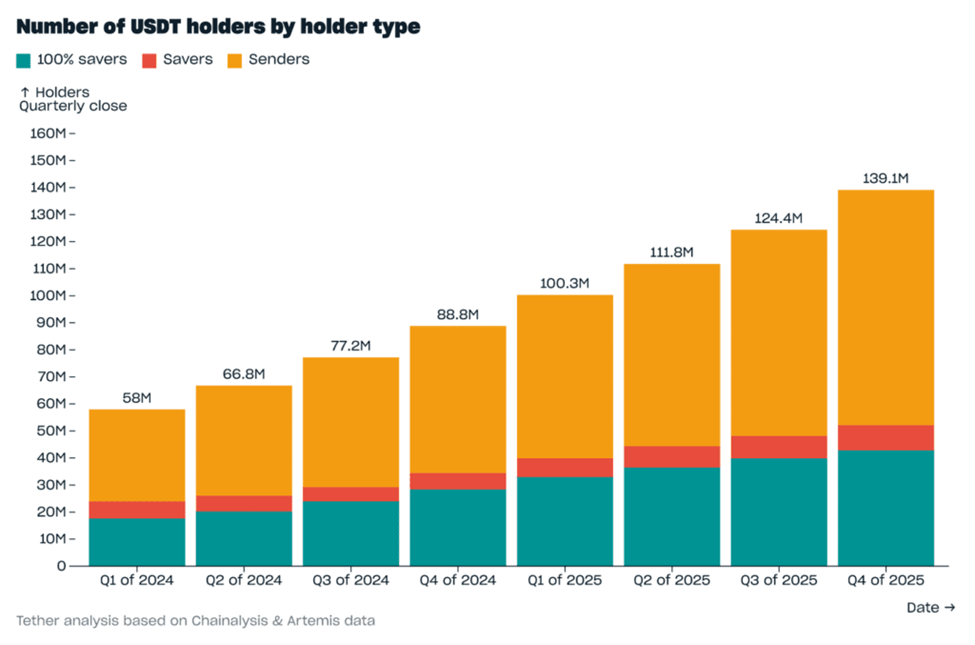

On-chain activity continued to grow rapidly. The number of USDT holders rose to 139.1 million, while monthly active users reached 24.8 million, both record highs.

Number of USDT Holders by Holder Type. Source: Tether Q4 2025 Report

Number of USDT Holders by Holder Type. Source: Tether Q4 2025 Report

The value transferred on-chain reached $4.4 trillion in Q4, and USDT’s share of spot trading volumes on centralized exchanges climbed to 61.5%. This highlights its role as the dominant settlement asset in crypto markets.

Minting Surge, Peg Wobbles, and Flippening Talk Highlight USDT’s Growing Systemic Role

Recent issuance activity suggests demand has carried into early 2026. On February 4, blockchain analytics account Lookonchain reported that Tether minted $1 billion in USDT, part of roughly $3 billion in stablecoins issued by Tether and Circle over three days.

Large issuances are often interpreted by traders as a signal of incoming liquidity, although newly minted tokens are not always immediately circulated.

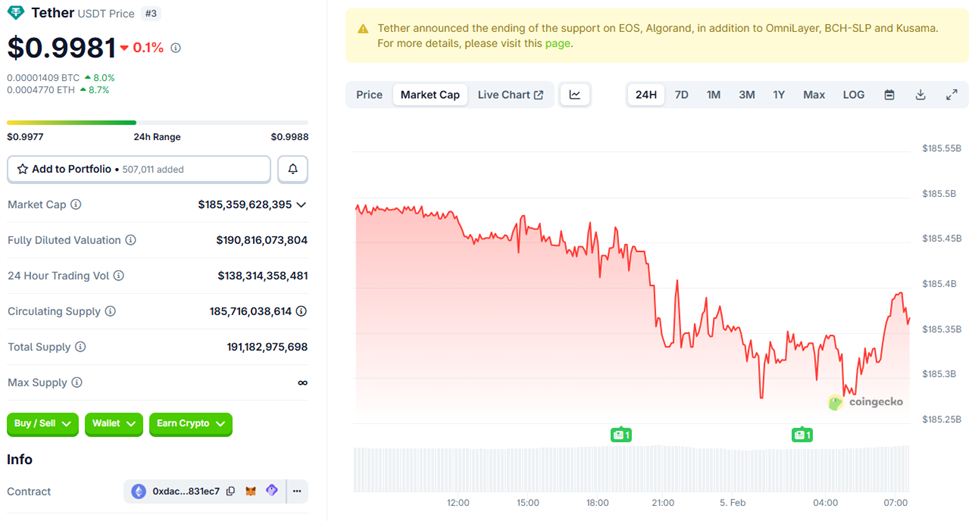

At the same time, Tether’s growing dominance has intensified scrutiny. Market attention briefly turned to USDT’s stability after the token slipped to around $0.9980, its weakest level in more than 5 years.

While the deviation was small and short-lived, any sustained loss of confidence in the peg could have outsized consequences, given the stablecoin’s central role in trading infrastructure.

Tether’s USDT Depegs from $1. Source: CoinGecko

Tether’s USDT Depegs from $1. Source: CoinGecko

Market estimates often suggest that most crypto trading volume flows through USDT pairs, making it a critical pillar of liquidity.

The scale of Tether’s expansion has also fueled debate over its place in the crypto hierarchy. Some market observers have speculated that, if current trends continue, USDT could eventually challenge Ethereum’s position as the second-largest cryptocurrency by market capitalization, particularly during prolonged periods of risk aversion when capital rotates into stable assets.

Meanwhile, the latest data shows that USDT is expanding in terms of users, reserves, and transaction volume, even as the broader market contracts.

Yet that same growth is concentrating liquidity and systemic importance in a single instrument. The stability of Tether’s peg is increasingly tied not just to one company, but to the resilience of the crypto market itself.