DASH Faces 3 Hidden Risks That Could Catch Holders Off Guard

Dash (DASH) — the third-largest privacy coin by market capitalization after XMR and ZEC — is currently facing several risks that many holders may be overlooking. Positive discussions around privacy coins are dominating the community and may be masking these warning signs.

These signals could serve as important alerts. They may repeat historical patterns, potentially causing losses for DASH holders.

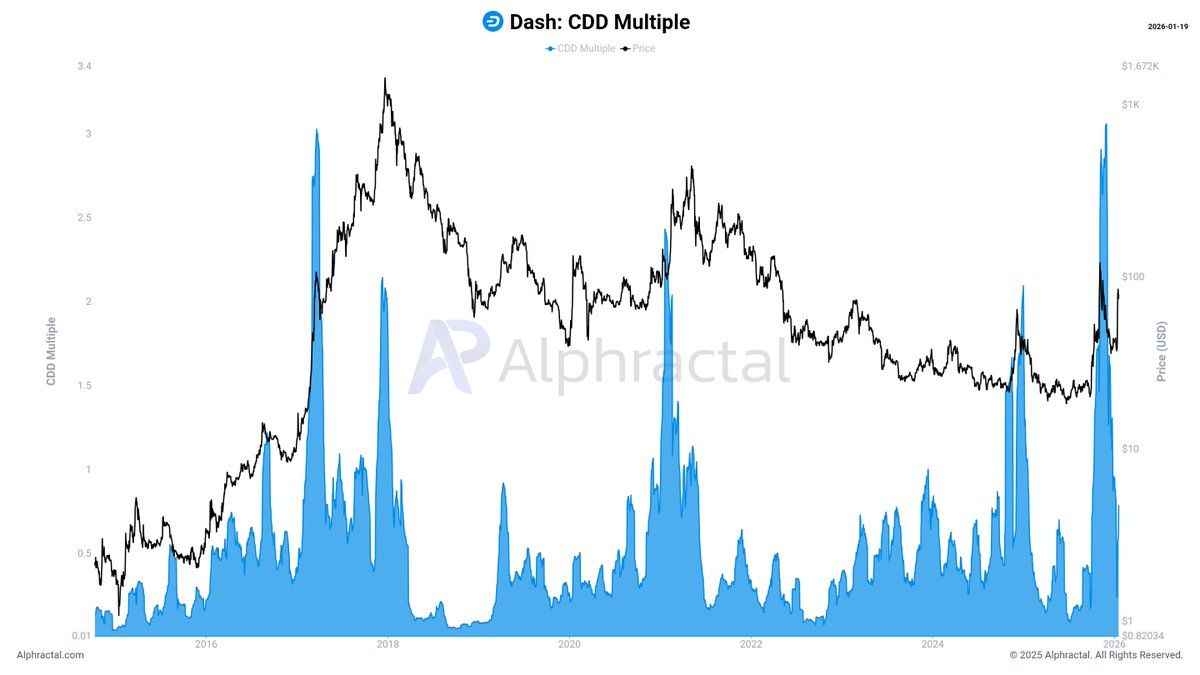

DASH Dormant Coins Signal a Distribution Phase

First, long-dormant DASH coins experienced a wave of reactivation in November 2025. This shift signaled a change in holder behavior. Large reactivations of old supply usually occur when early investors and long-term holders begin distributing coins near the top of market cycles.

The Coin Days Destroyed (CDD) metric tracks this behavior. It multiplies the volume of coins by the length of time they remained inactive. When this metric spikes, it often indicates that significant portions of old supply are re-entering circulation.

Historically, major CDD surges have appeared near key price tops in cryptocurrency markets.

DASH CDD Multiple. Source: Alphractal

DASH CDD Multiple. Source: Alphractal

“DASH — long-dormant coins were heavily reactivated in November; activity has since declined. Historically, large movements of long-inactive supply tend to appear near cycle tops,” said João Wedson.

The continued decline in reactivation activity does not necessarily mean risk is decreasing. Distribution phases often last weeks or even months, not just days. This timeline allows large holders to exit positions quietly. Over time, however, it can create significant downward pressure on prices.

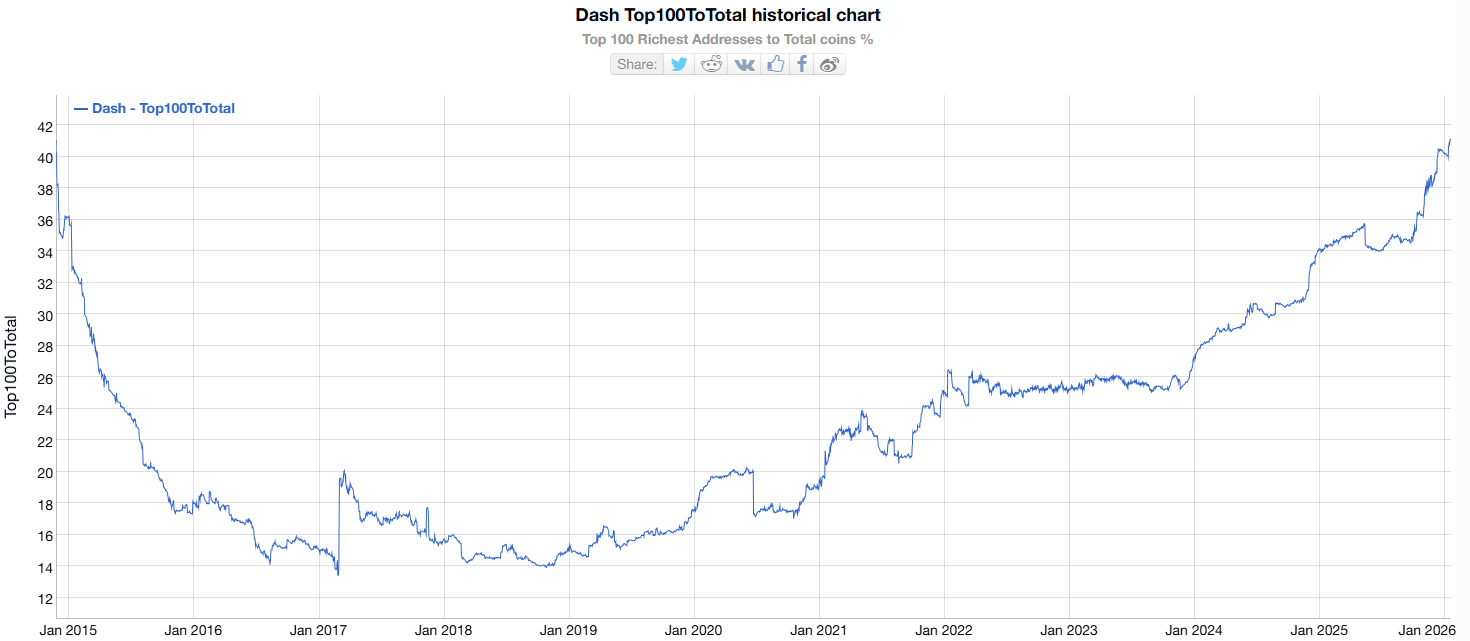

DASH Whale Concentration Hits New Highs

The second risk comes from growing supply concentration. The top 100 richest DASH wallets now control more than 41% of the total supply. This marks the highest level in over a decade, according to data from Bitinfocharts.

Dash Top 100 Richest Addresses to Total Coins. Source: Bitinfocharts

Dash Top 100 Richest Addresses to Total Coins. Source: Bitinfocharts

Charts show that this share has risen steadily from 15.5%, the level recorded when DASH reached its all-time high in December 2017.

High supply concentration can provide stability if large investors remain confident. Major holders can absorb volatility and commit to long-term positions.

However, such concentration also carries a serious risk. When a small number of addresses control a large share of supply, their actions can significantly impact the market. Coordinated or even uncoordinated selling by whales can overwhelm order books. This can trigger sharp declines and spill over into derivatives markets.

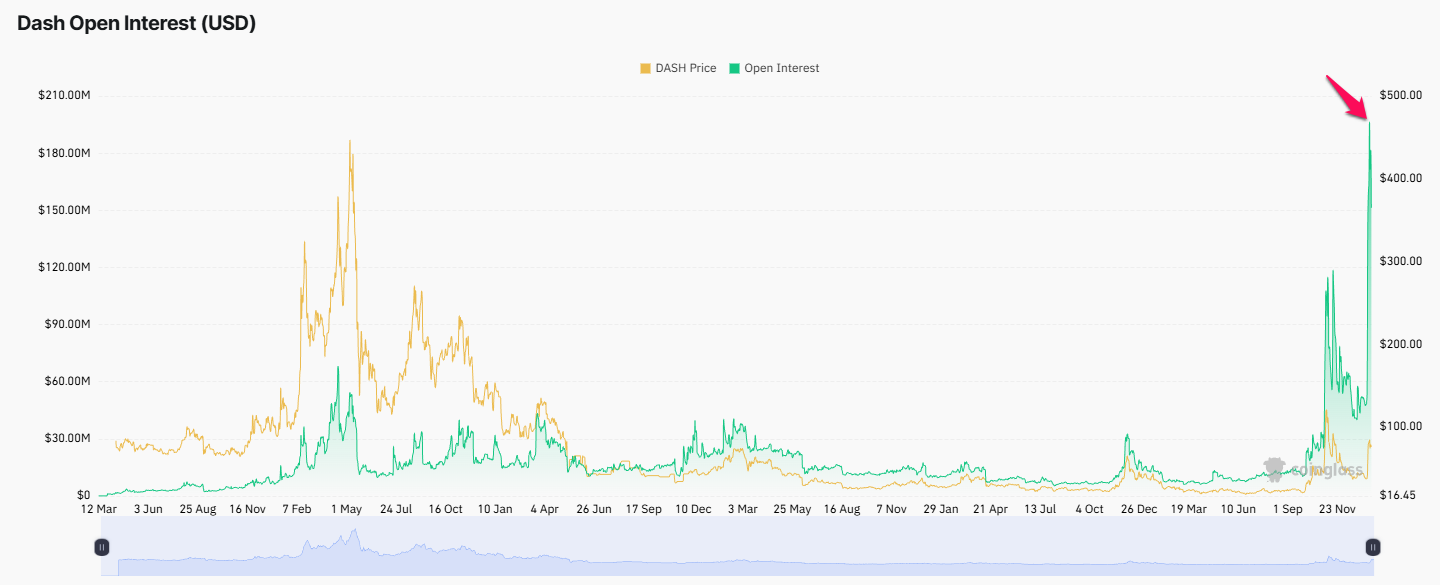

DASH Open Interest Hits ATH, Raising Liquidation Risks

The third risk comes from a surge in DASH open interest across derivatives markets.

Although DASH is currently trading at only half of its November price, near $150, open interest has spiked above $180 million. This level is double that of November and marks the highest open interest ever recorded for DASH.

Dash Open Interest. Source: Coinglass

Dash Open Interest. Source: Coinglass

This trend reflects an unprecedented level of leveraged exposure among DASH traders. Such conditions create a fertile environment for large-scale liquidations. These events can also spill over into the spot market.

In addition, a recent BeInCrypto report highlighted a shift in capital flows toward lower-cap privacy coins. This trend suggests declining investor expectations for large-cap assets. It may further challenge DASH’s ability to sustain upward momentum throughout the month.