Louisiana Pension Takes $3.2 Million Microstrategy Stake | US Crypto News

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee and settle in because what’s happening with Bitcoin, MicroStrategy, and pension funds isn’t your typical market story. From quiet institutional moves to complex capital strategies, the latest filings reveal a mix of opportunity, risk, and debate.

Crypto News of the Day: Louisiana Pension Enters MicroStrategy as Bitcoin Strategy Sparks Debate

The Louisiana State Employees’ Retirement System (LSERS) has disclosed a $3.2 million position in MicroStrategy (MSTR). The move signals a growing institutional appetite for indirect Bitcoin exposure.

Bitcoin Treasuries cited a recent 13F filing, indicating that the pension fund holds 17,900 shares of Strategy.

This represents just 0.2% of its $1.56 billion portfolio. It reflects the growing interest of public retirement funds in crypto-linked assets.

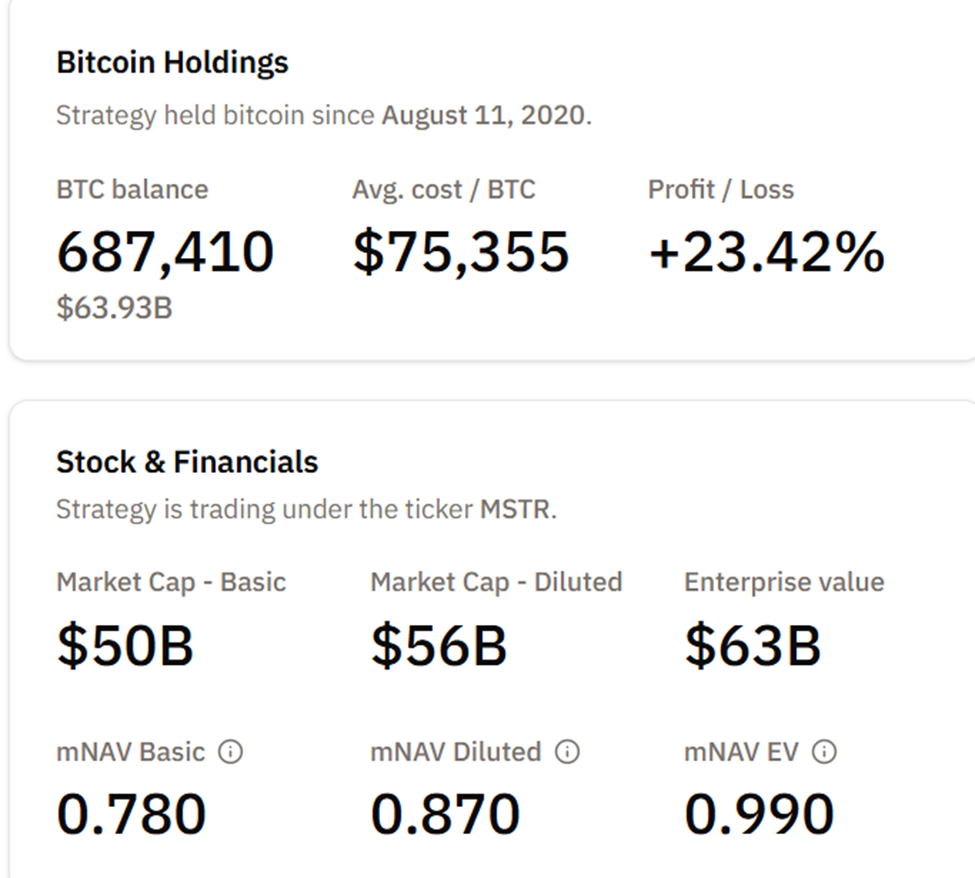

MicroStrategy, led by CEO Michael Saylor, now owns over 687,000 BTC, making MSTR a proxy bet on Bitcoin itself.

Supporters argue that Saylor’s approach is more than simple accumulation. By issuing equity and debt instruments, the company effectively converts capital demand into large-scale Bitcoin purchases. This tightens the circulating supply and reinforces the balance sheet.

“The real innovation is that the market treats these STRC-style instruments almost like sound money. There were no forced liquidations, no structural failure. The framework held firm. It behaves like a battle tank—volatility doesn’t destroy it because there’s no short-term debt pressure,” wrote Joss, a popular user on X.

MicroStrategy’s Bitcoin Accumulation Sparks Bullish Momentum and Dilution Concerns

Recent MSTR activity reflects this strategy in motion. BeInCrypto reported Strategy’s plan to acquire another 13,627 BTC for $1.25 billion. Such a move would push the company’s total holdings to well over 700,000 BTC, roughly 3.3% of the total Bitcoin supply.

Traders point to technical breakouts in MSTR and continued purchases as evidence that Saylor’s Bitcoin engine is gaining momentum.

However, not all investors are convinced. Critics warn that preferred instruments like STRC, while useful for raising capital, dilute the residual Bitcoin exposure of common MSTR shareholders.

Every new preferred issuance reduces the BTC claim of existing stockholders. At the same time, it necessitates more MSTR issuance to cover dividends, potentially eroding shareholder value over time.

“The more STRC that gets issued, the less BTC MSTR holders actually have a claim to,” stated Pledditor, a popular user on X.

Chart of the Day

Strategy BTC Holdings. Source: Bitcoin Treasuries

Strategy BTC Holdings. Source: Bitcoin Treasuries

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- Gold hits record high as Bitcoin falls on escalating US–EU tariff tensions.

- Five bear market signals are flashing woes for Bitcoin this January.

- Crypto fund flows top $2 billion amid rising global macro risk.

- Solana ETFs record first outflows in four weeks as SOL price falls to $130.

- Prediction markets hit record trading volume amid concerns about fragmentation.

- Aliens confirmed? Ex-Bank of England insider ties Bitcoin to cosmic theory.

- Four high-impact US economic events set to influence Bitcoin sentiment this week.

- Bitcoin’s 13% breakout path survives 150% profit booking surge, charts explain how.

Crypto Equities Pre-Market Overview

| Company | Close As of January 16 | Pre-Market Overview |

| Strategy (MSTR) | $173.71 | $174.27 (+0.32%) |

| Coinbase (COIN) | $241.15 | $241.15 (+0.00%) |

| Galaxy Digital Holdings (GLXY) | $34.31 | $34.45 (+0.41%) |

| MARA Holdings (MARA) | $11.36 | $11.45 (+0.79%) |

| Riot Platforms (RIOT) | $19.23 | $19.31 (+0.44%) |

| Core Scientific (CORZ) | $18.89 | $18.98 (+0.48% |