Trove Markets Accused of $10 Million HYPE Token Dump Amid Fraud Concerns

Trove Markets is facing mounting scrutiny after allegedly dumping over $10 million in $HYPE tokens within a 24-hour period. The Web3 decentralized perpetual exchange is built on Hyperliquid’s HIP-3 protocol.

These tokens, originally acquired for staking to launch the DEX, were sold from a wallet linked to the project, raising suspicions of insider manipulation and undermining community trust.

Trove Markets Faces Allegations Over $10 Million HYPE Dump

The project had raised $20 million through an initial coin offering (ICO) to secure 500,000 $HYPE tokens, a stake required for permissionless deployment under Hyperliquid’s HIP-3 protocol.

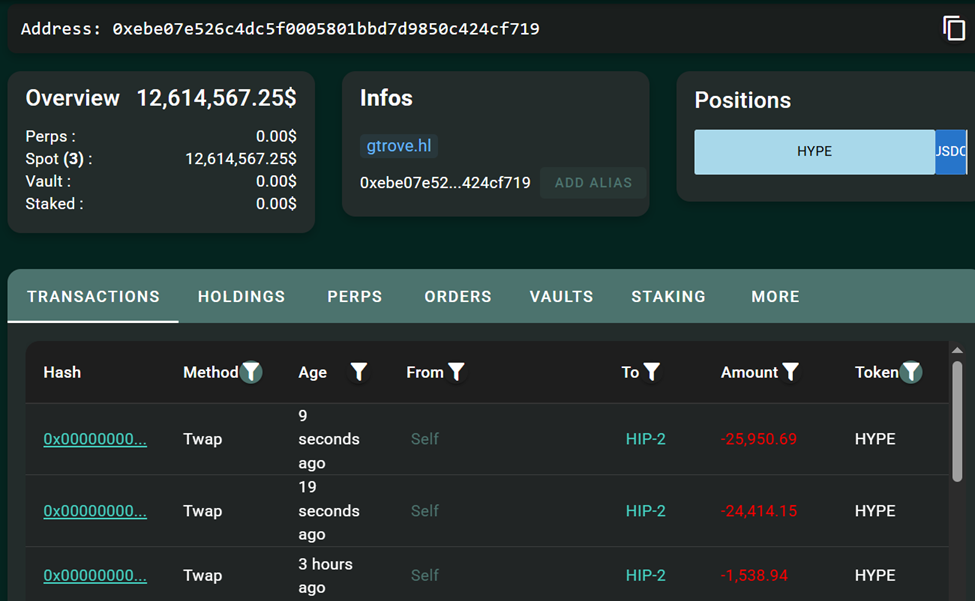

On-chain data from wallet 0xebe07e526c4dc5f0005801bbd7d9850c424cf719 confirms that sales began with a modest 6,196 $HYPE worth approximately $160,000 at current HYPE rates.

Hyperliquid (HYPE) Transactions Linked to Trove Markets. Source: Hypurrscan.io

Hyperliquid (HYPE) Transactions Linked to Trove Markets. Source: Hypurrscan.io

However, the activity quickly escalated. Hyperliquid News reported that Trove Markets initially liquidated $5 million in tokens, with total sales reaching 194,273 HYPE tokens, equivalent to roughly $10 million, within a single day.

Complicating the situation, Trove’s founder reportedly publicly denied control over the wallet and requested its shutdown. Still, the wallet resumed sales minutes later.

“A few minutes after the founder of @TroveMarkets said that he does not control the wallet, and that he is asking for the wallet to be shut down, it starts selling again, reaching 194,272.79 $HYPE in 24 hours,” Hyperliquid News reported.

The rapid continuation of sales fueled speculation of either insider fraud or compromised wallet access, intensifying community concern.

Hyperliquid Foundation Engages ZachXBT to Investigate

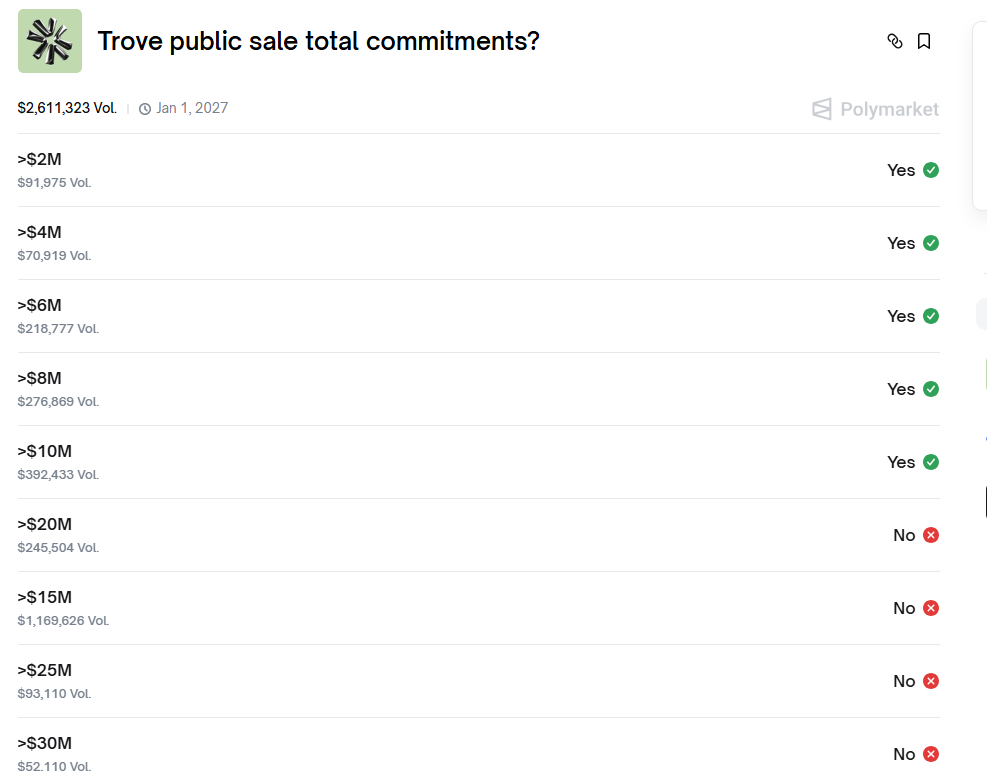

This controversy adds to existing criticism surrounding Trove Markets’ ICO. The offering was extended at the last minute and oversubscribed, ultimately raising $11.9 million at a fully diluted valuation of $20 million.

Confusion over the ICO reportedly led to losses of around $73,000 for Polymarket prediction market users.

Trove ICO Bets. Source: Polymarket

Trove ICO Bets. Source: Polymarket

Reports also emerged that the project paid influencers $5,000 per month to promote the token while allegedly concealing team members’ Iranian origins, raising further transparency concerns.

Community members, including NMTD8, also flagged Trove’s investment in the controversial XMR1 project and the delay in staking the HYPE tokens.

The general sentiment is that all these suggested a strategy to extract funds without fulfilling ICO obligations. The HYPE token has since dropped approximately 60% below its ICO price, leaving early investors exposed.

In response, the Hyperliquid Foundation donated 10,000 $HYPE to blockchain investigator ZachXBT. This signals efforts to probe the token sales and distance the protocol from potential misconduct.

ZachXBT, known for tracking crypto fraud and recovering stolen funds, is expected to provide clarity on whether the sales were part of coordinated misconduct or operational mismanagement.

Despite the controversy, Trove Markets remains operational with mainnet plans set for February 2026. However, the TGE (token generation event) has been pushed to 4 PM UTC on Monday, January 19, 2026, two hours after the initial 7 PM UTC.

Yet, partial token dumps and the erosion of trust put the project at risk of failing to meet staking requirements under HIP-3. This could prevent the DEX launch and leave investors without recourse.

Trove markets did not immediately respond to BeInCrypto’s request for comment. Nevertheless, the incident mirrors the risks inherent in newer DeFi projects, particularly those involving permissionless protocols, large token allocations, and limited transparency.