Pump.fun Price Forecast: PUMP climbs on release of creator-focused callout feature

- PUMP recovers nearly 5% on Friday, holding around 15% gains so far this week.

- Pump.fun launched a new callout in the previous feature that lets creators share trending coins on the platform, boosting user activity.

- Derivatives data imply mixed retail sentiment as funding rates and Open Interest fluctuate.

Pump.fun (PUMP) edges higher by almost 5% at press time on Friday, recovering from a 3% decline the previous day. The release of the new callout feature on the Solana-based launchpad platform for creators could boost trading activity. Still, the retail sentiment remains mixed as PUMP Open Interest and funding rates teeter.

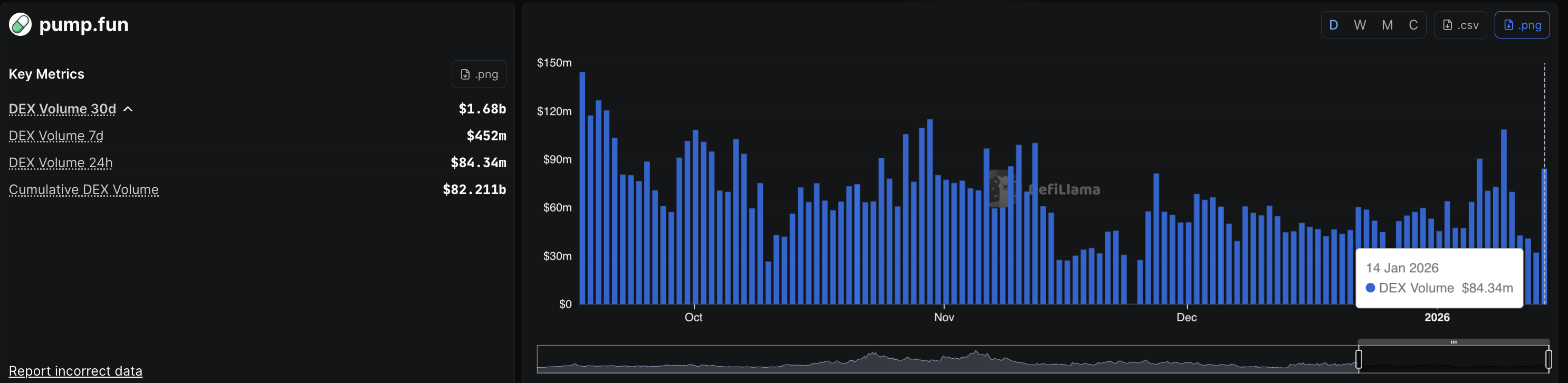

PUMP retail sentiment wavers amid DEX volume surge

Pump.fun released a callout feature on Thursday for creators to share listed coins with their followers, which could boost the social interest and trading activity on the platform. The release aligns with a recovery in DEX volume to $84.34 million, after a steady decline earlier this week.

Derivatives data show wavering retail interest in PUMP as capital flow and funding rates see-saw over the last week. CoinGlass data shows PUMP Open Interest (OI) is down 4.99% in the previous 24 hours to $218.69 million, pulled from $250 million twice so far this month. The near-term upside bias is cooling as OI continues to slope lower.

The OI-weighted funding rate is at -0.0032%, pulling into the negative territory, reflecting an incline among traders to hold short positions.

Technical outlook: Will PUMP clear the $0.003000 level?

PUMP approaches the $0.003000 round figure after facing rejection in the last two sessions. The upward slope in the 20-day Exponential Moving Average (EMA) above the 50-day EMA reflects an upward bias. Additionally, PUMP holds a steady rise above these moving averages, indicating buy strength.

The Moving Average Convergence Divergence (MACD) remains above the signal line and in positive territory, although the histogram nearly plateaus, hinting at easing bullish momentum. The Relative Strength Index (RSI) at 64 rises toward the overbought zone, consistent with this week’s recovery.

If PUMP closes the day above $0.003000, it would keep the near-term bias supported and put the R2 Pivot Point at $0.004048 in focus as the next hurdle.

A slip beneath the 20-day EMA at $0.002577 would invite a deeper pullback to the centre Pivot Point at $0.002330, where buyers would need to reassert to avoid a loss of trend quality.

(The technical analysis of this story was written with the help of an AI tool.)