Strive’s Semler Scientific Acquisition Lifts Bitcoin Holdings but Sends Stock Down 12%

Strive has received shareholder approval to acquire Semler Scientific in an all-stock transaction. This will push the combined firm to become the 11th largest corporate hodler of Bitcoin (BTC).

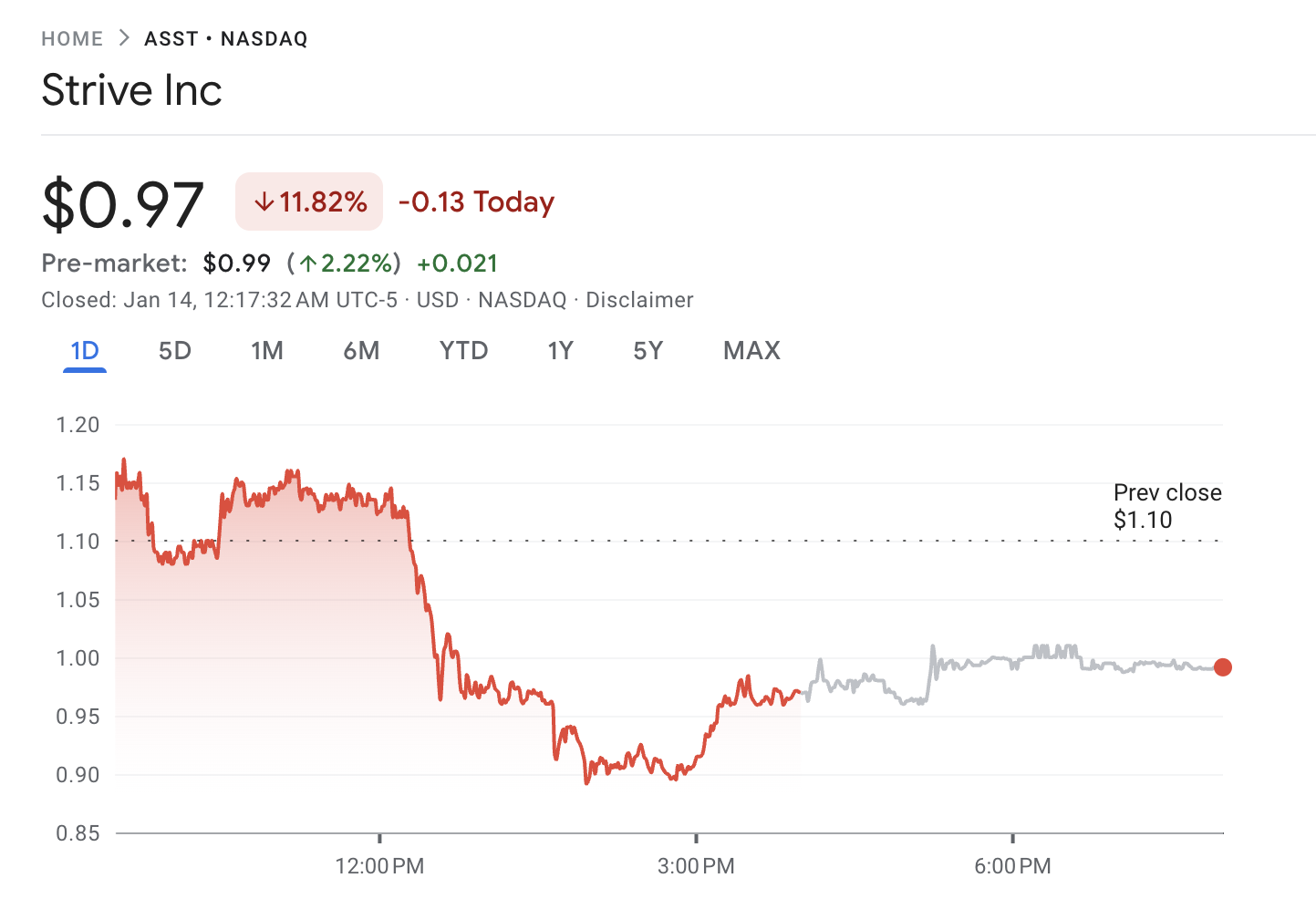

However, the market reaction to the merger has been tepid, with Strive’s stock (ASST) falling nearly 12% on Tuesday.

Strive Expands Bitcoin Treasury With Semler Scientific Deal

The voting process for the acquisition commenced in late December 2025, with a special meeting scheduled for January 13 to approve the merger. As announced in the press release, Semler Scientific shareholders voted in favor of the deal. This will transfer ownership of 5,048.1 Bitcoin to Strive.

Strive also disclosed that it recently purchased an additional 123 Bitcoin at an average price of $91,561 per coin. This brings its standalone holdings to 7,749.8 Bitcoin. With the acquisition, the combined entity is expected to hold 12,797.9 Bitcoin.

This would place the company among the largest corporate Bitcoin holders globally, surpassing both Tesla and Trump Media & Technology Group. The firm would rank as the 11th largest corporate holder of Bitcoin, closely trailing CleanSpark, which holds 13,099 BTC.

“The Semler Scientific deal will continue Strive’s leading yield generation since inception of our Bitcoin strategy, boosting our 2026 1st quarter Bitcoin yield to over 15%, and is a win for both Strive and Semler Scientific shareholders. We are showing the market how to execute with Bitcoin as your hurdle rate,” Strive’s CEO Matt Cole said.

Furthermore, following the completion of the transaction, Eric Semler, Executive Chairman of Semler Scientific, will join Strive’s board of directors. Cantor Fitzgerald is acting as the financial advisor to Strive, with Davis Polk & Wardwell serving as legal counsel. Meanwhile, LionTree Advisors and Goodwin Procter are advising Semler Scientific.

Beyond expanding its Bitcoin reserves, Strive also plans to monetize Semler’s operating business within 12 months of the transaction close and evaluate options to retire the company’s existing debt obligations.

This includes a $100 million convertible note and a $20 million loan from Coinbase. These initiatives will depend on prevailing market conditions.

Finally, in parallel with the merger, the board authorized a 1-for-20 reverse stock split for the combined company’s Class A and Class B common shares. Ben Werkman, Chief Investment Officer, stated that the move aligns the company’s share price to levels more suitable for institutional investors and broadens participation.

Nonetheless, following the news, Strive’s stock faced a sharp decline. Google Finance data showed that ASST dipped nearly 12%, closing at $0.97 on January 13. Still, in pre-market trading, the stock has gained over 2%.

Strive Stock Performance. Source: Google Finance

Strive Stock Performance. Source: Google Finance

Besides stock performance, the company also faces substantial unrealized losses on its existing holdings. Its standalone Bitcoin holdings are valued at around $738.84 million. This represented an unrealized loss of approximately 15.4%, or $135.2 million, based on recent market prices.