XRP Attracts 4-Month Record Dip Buying as Price Falls 15% in a Week

XRP has been in a sharp freefall since peaking on January 6, dropping nearly 15% in just six days. Multiple support levels have already given way, and momentum remains weak. Yet beneath the sell-off, something unusual is happening. Conviction buyers are stepping in at a pace not seen since September 7.

Key XRP price zones are still holding, and demand is quietly forming under pressure. This sets up a rare divergence between price action and behavior on the blockchain.

XRP’s Freefall Hinges on One Key Trend Line

The sell-off accelerated after XRP failed to reclaim its 200-day EMA at the January 6 peak. An EMA, or exponential moving average, gives more weight to recent prices and is often used to judge short-term and long-term trend strength. When the price stays below key EMAs, sellers usually stay in control.

From the peak, XRP first lost the 100-day EMA, then the 50-day EMA. It is now hovering near the 20-day EMA, which has become the last short-term trend support.

This level matters because it often separates controlled pullbacks from deeper downside moves.

Key XRP Support: TradingView

Key XRP Support: TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

A similar setup played out in early December. When XRP lost the 20-day EMA on December 4, the price slid roughly 15% in the days that followed. That history explains why the current level is critical.

A hold keeps the structure alive, but a clean loss (daily close) risks extending the freefall.

Dip Buying Is the Strongest Since September — But From Select Holders

Despite the technical damage, dip buying, by long-term investors, or rather the conviction buyers, has intensified.

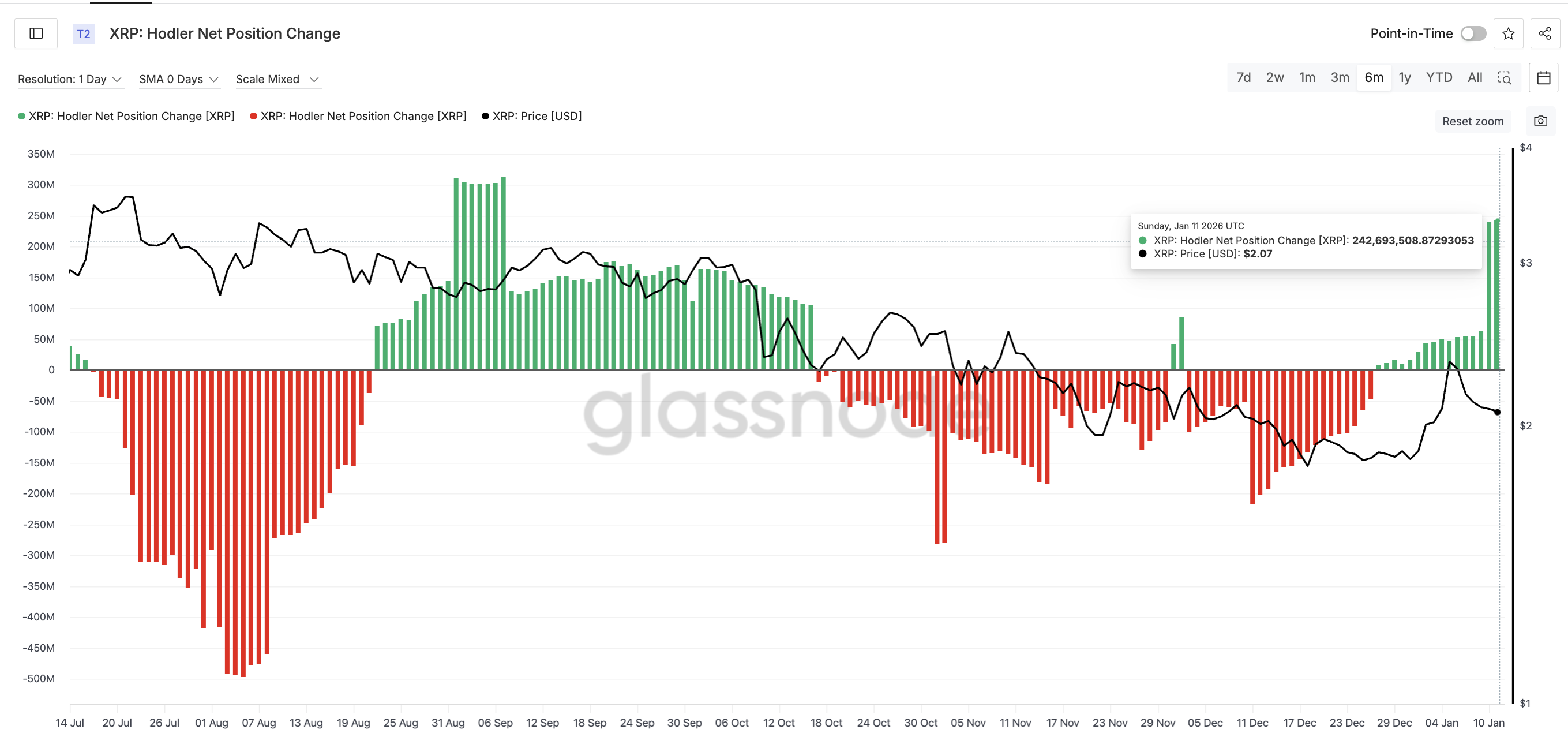

This appears in HODLer net position change, a metric that tracks whether long-term wallets are increasing or decreasing their coin balances. When the value is positive, holders are accumulating. When it is negative, they are distributing.

The strongest accumulation is coming from conviction holders, not broad whale groups. The HODLer net position change shows wallets added roughly 62 million XRP on January 9, then nearly four times that amount on each of the next two days.

On January 10 and 11, holders absorbed around 239 million XRP and 243 million XRP, even as the price continued to fall. That makes this the strongest two-day dip-buying streak since September 7.

HODLers Buying At A Clip: Glassnode

HODLers Buying At A Clip: Glassnode

Whales, by contrast, remain cautious. Only smaller whales holding between 1 million and 10 million XRP have shown activity. Their combined balances rose from 3.52 billion to 3.53 billion XRP, an increase of about 10 million XRP. At the current price, that equals roughly $20.5 million in buying.

This is not broad accumulation. It is targeted, defensive buying. Smaller whales are stepping in near key levels, but larger players are still waiting. That imbalance explains why XRP is finding support but struggling to stage a strong rebound.

Supply Clusters and XRP Price Levels Explain the Conviction

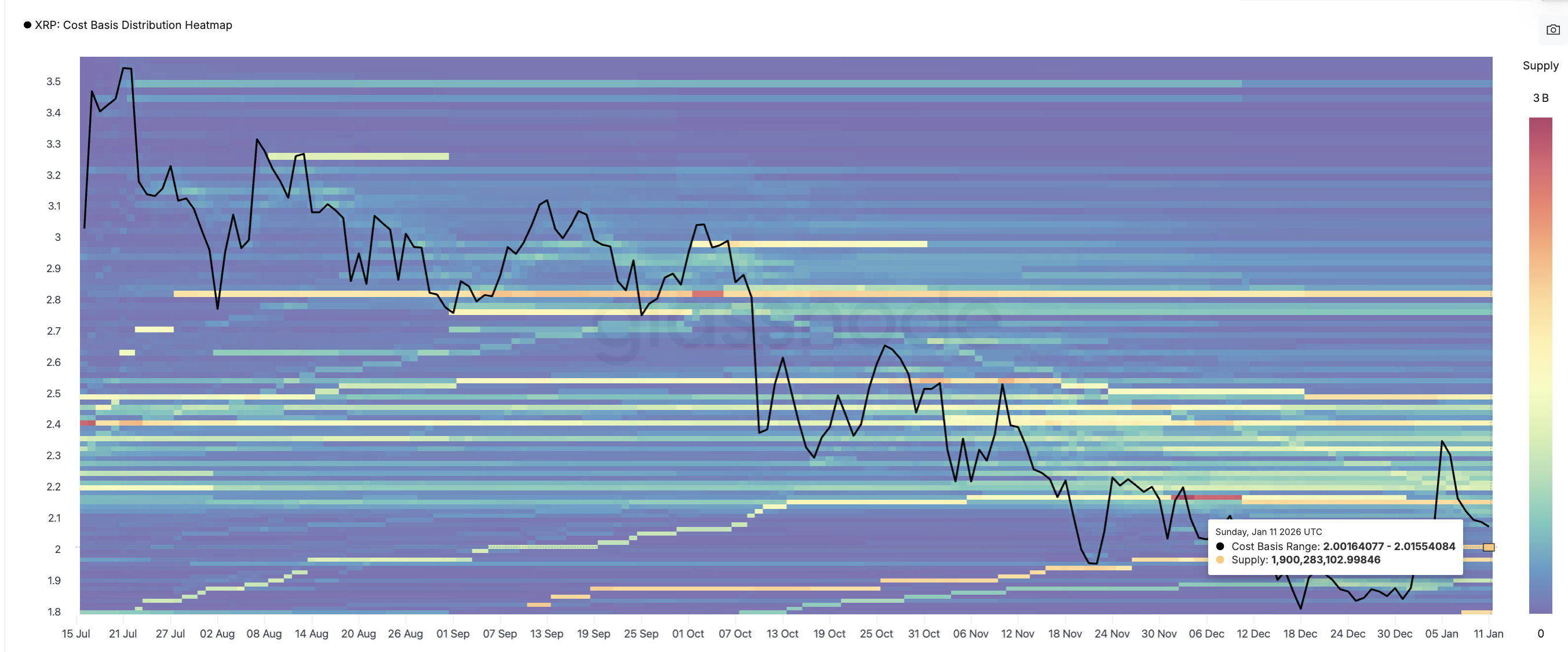

That conviction lines up closely with XRP’s cost-basis structure.

Supply clusters form where large amounts of coins were previously bought at similar prices. These zones often act as defense levels because holders near break-even tend to buy dips to protect their positions rather than sell at a loss.

Two major supply clusters sit just below the current price. The first lies between $2.00 and $2.01, where roughly 1.9 billion XRP were accumulated.

First Strong Cluster: Glassnode

First Strong Cluster: Glassnode

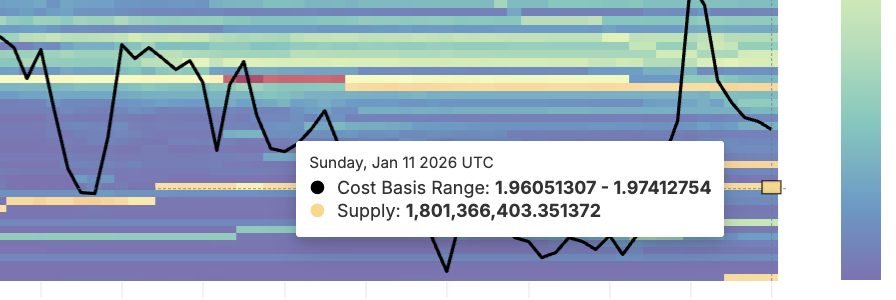

The second sits between $1.96 and $1.97, with another 1.8 billion XRP bought. These levels explain why selling pressure has slowed despite weak momentum.

Key XRP Cluster: Glassnode

Key XRP Cluster: Glassnode

As long as these clusters hold, the XRP price can form long lower wicks and attempt to stabilize. A reclaim of the 20-day EMA near $2.04 would be the first signal that this defense is working.

On the upside, XRP must reclaim $2.21 and then $2.41, the January 6 peak. Clearing $2.41 would put $2.69 back in play and flip the structure bullish again.

XRP Price Analysis: TradingView

XRP Price Analysis: TradingView

Downside risk remains. A clean break below $2.01 exposes $1.97 (the next supply cluster), followed by $1.77. Notice how the on-chain supply cluster also has active support lines on the XRP price chart.

XRP’s conviction is not coming from momentum or large whales. It comes from structure. The 20-day trend line has not fully broken, and dense supply clusters sit directly below the price. As long as these two elements hold, dip buyers are willing to step in.