Ethereum Whale Nets $274 Million Profit in Strategic Exit Amid Market Jitters

An early Ethereum investor has likely completed a full exit from their ETH position after on-chain data showed the transfer of holdings to a centralized exchange. The sell-off is estimated to have generated around $274 million in profit.

This comes as ETH continues to face selling pressure from US institutional investors as well. Still, some market analysts remain optimistic about the prospects of the second-largest cryptocurrency.

Ethereum OG Whale Exits With 344% Gain

Blockchain analytics firm Lookonchain reported that the investor accumulated 154,076 ETH at an average price of $517. Since late last week, the wallet began transferring ETH to Bitstamp, a centralized cryptocurrency exchange.

“Over the past 2 days, he deposited another 40,251 ETH ($124 million) into Bitstamp and still holds 26,000 ETH ($80.15 million),” Lookonchain posted on January 10.

Several hours ago, the investor moved the final 26,000 ETH to the exchange. According to Lookonchain, the investor has made an estimated total profit of around $274 million, representing a gain of approximately 344%.

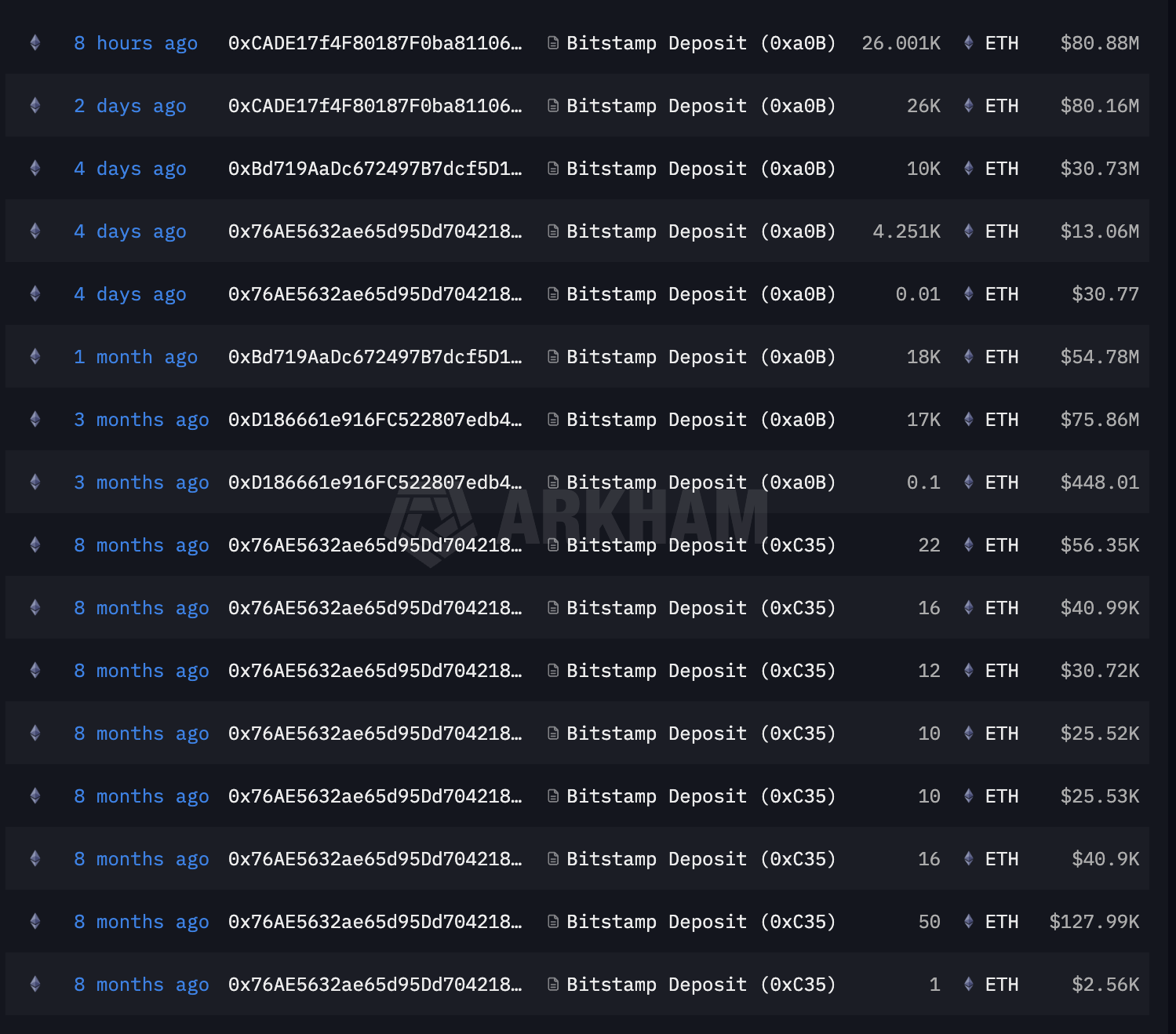

These latest transfers follow a pattern of gradual deposits that began much earlier. Arkham data indicates that the investor initially sent a total of 137 ETH to Bitstamp approximately eight months ago.

This was followed by a transfer of 17,000 ETH three months ago and another 18,000 ETH roughly one month ago, suggesting a long-term, staged exit strategy rather than a single sell-off.

Ethereum “OG” Investor’s Transfers. Source: Arkham

Ethereum “OG” Investor’s Transfers. Source: Arkham

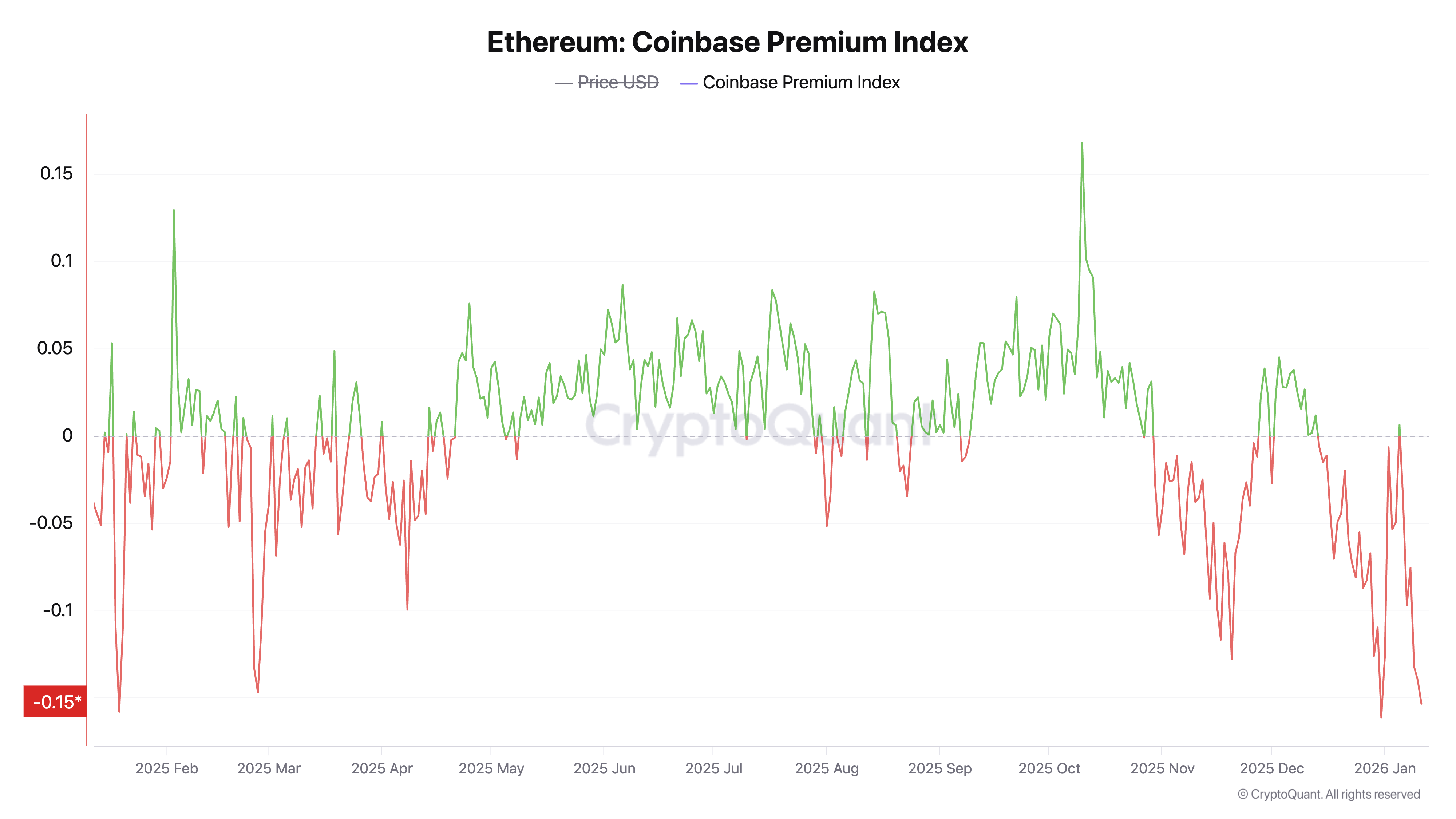

The timing of the whale’s exit also aligns with broader signs of institutional caution. The Coinbase Premium Index for ETH remains deeply negative. The metric tracks the price difference between Coinbase, often used as a gauge of US institutional sentiment, and Binance, which reflects broader global retail activity.

A negative reading indicates that ETH is trading at a discount on Coinbase compared to offshore platforms, suggesting elevated selling pressure from US-based institutional participants. This trend has persisted into 2026, signaling continued risk-off positioning among professional investors.

ETH Coinbase Premium Index. Source: CryptoQuant

ETH Coinbase Premium Index. Source: CryptoQuant

Is Ethereum “Undervalued?”

Despite the ongoing selling pressure, some analysts maintain a positive outlook on ETH, choosing to look beyond short-term volatility.

Quinten François has suggested that Ethereum appears “massively undervalued” when comparing its economic activity with its price.

Similarly, Milk Road added that the clear mismatch becomes evident when examining the data. According to the post, the volume of economic activity settling on Ethereum has continued to grow, even during periods when ETH’s price has lagged behind that expansion.

The analysis noted that large investors continue to prioritize Ethereum for its uptime, liquidity, settlement reliability, and regulatory clarity.

“As more activity moves onchain, transaction volume and fee generation increase, raising the economic weight placed on Ethereum’s base layer. When usage stays high, ETH has historically struggled to remain flat for long. We will go higher as adoption continues. Always zoom out,” Milk Road stated.

From a technical perspective, analysts are identifying key patterns that could support a price recovery.

The push and pull between short-term selling and market confidence make the current Ethereum market a complex one. Early adopter exits and a negative Coinbase Premium signal caution, while growing economic activity underpins ecosystem strength. Whether the ETH price ultimately aligns with these fundamentals remains to be seen.