Peter Brandt Reveals How Monero (XMR) Could Print a “God Candle” Like Silver

Monero (XMR) has officially set a new all-time high after reaching $598. Its market capitalization has also crossed $10 billion for the first time. Many analysts remain bullish and believe the move has only just begun.

Veteran trader Peter Brandt has added to the optimism by comparing XMR’s price behavior to silver.

Could Monero Become the “Silver” of the Crypto Market?

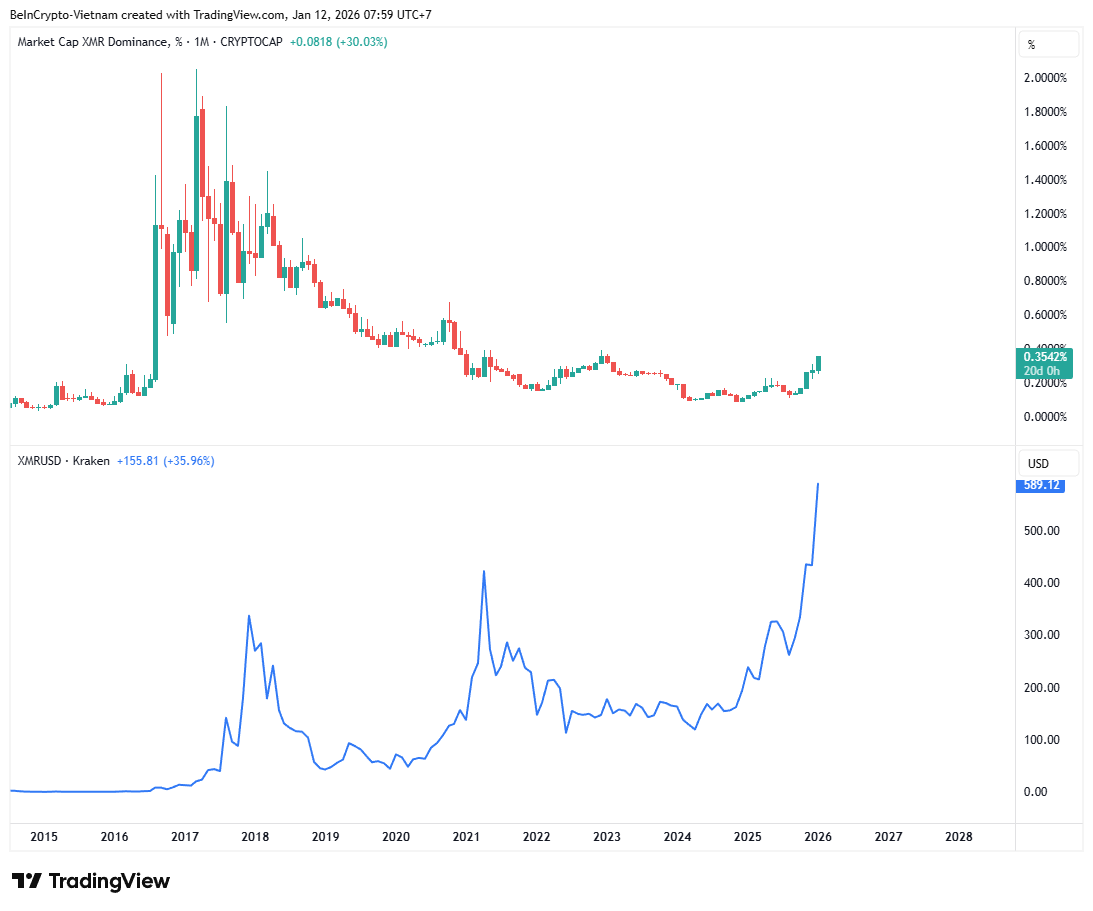

On January 12, price data from BeInCrypto showed that Monero (XMR) had surged more than 30% since the previous Saturday. It was trading above $585 with a market capitalization exceeding $10.7 billion.

Monero (XMR) Price Performance. Source: BeInCrypto

Monero (XMR) Price Performance. Source: BeInCrypto

Trading volume also climbed above $300 million. That was the highest level in the past month. The move pushed XMR above the previous cycle high of $515. Analysts believe the rally could continue.

“Price continues to trend aggressively higher. It is breaking through previous resistance levels with strong momentum and minimal pullback. The structure remains firmly bullish. Buyers are stepping in on every dip, and there are no clear signs of distribution yet,” analyst 0xMarioNawfal said.

Peter Brandt has compared XMR’s price action to silver’s historical breakout. He examined XMR on the monthly chart and silver on the quarterly chart.

Both showed two major peaks in the past that formed a long-term resistance trendline. Silver later broke above that trendline and printed a powerful “god candle.”

As usual, Brandt did not provide a specific price target for XMR. However, the comparison suggests that a similar god candle could appear on XMR’s monthly chart if it breaks its trendline.

XMR dominance has also climbed to its highest level since 2023. This metric measures XMR’s share of total crypto market capitalization.

XMR Price and XMR Dominance.Source: TradingView

XMR Price and XMR Dominance.Source: TradingView

The price has reached an all-time high while dominance remains relatively low. This combination signals further upside potential. It suggests that capital could rotate from other altcoins into XMR.

Monero Could Gain Attention Amid Geopolitical Tensions

Monero has several reasons to outperform in 2026. A recent BeInCrypto report highlighted at least three drivers. They include rising demand for privacy as tax enforcement becomes tighter and shifting investor confidence following the Zcash team’s disappointment with its holders.

Geopolitical tensions could add another powerful tailwind.

Tether recently froze more than $182 million in USDT across five Tron wallets linked to illicit finance. A report from TRM Labs stated that Tron-based USDT had been used in funding flows tied to Iran’s Islamic Revolutionary Guard Corps (IRGC). More than $1 billion moved through companies registered in the United Kingdom.

Iran has also used more than $2 billion in crypto to fund proxy militias and bypass sanctions.

When stablecoins and non-private altcoins can be tracked and frozen, capital tends to seek safer routes. In that environment, Monero is likely to become a preferred option.