Bittensor Jumps 10% After Grayscale Officially Unveils TAO Trust

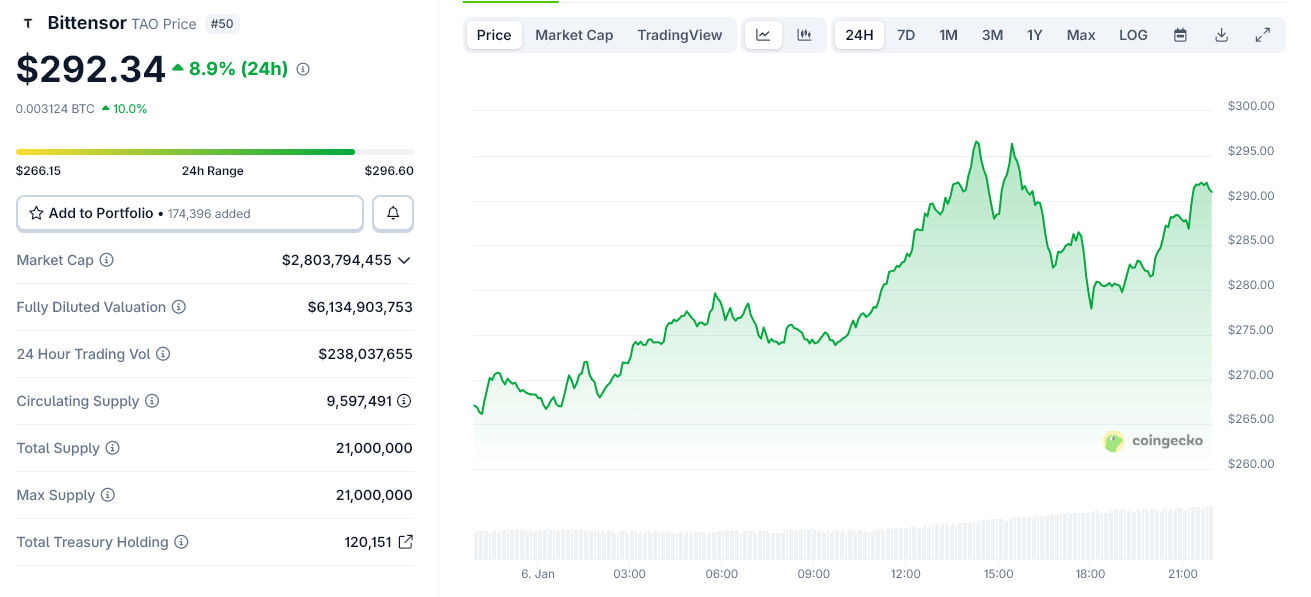

Bittensor (TAO) surged nearly 10% on Tuesday, climbing above $290, after Grayscale formally unveiled the Grayscale Bittensor Trust (GTAO). This marks one of the first regulated investment vehicles offering exposure to the decentralized AI network.

The rally pushed TAO to its highest level in weeks, with 24-hour trading volume topping $230 million. The move comes as investors react to growing institutional interest in AI-linked crypto assets, particularly those with reduced supply growth.

Grayscale Launch Opens Regulated Access to TAO

Grayscale said the Trust allows investors to gain exposure to Bittensor’s native token TAO through a traditional security structure, without the need to directly buy or custody the asset.

Shares of the Trust trade on OTC Markets under the ticker Grayscale Bittensor Trust (GTAO).

According to Grayscale, GTAO aims to track TAO’s market price using the Coin Metrics Real-Time Bittensor Reference Rate, minus fees and expenses.

As of January 5, the Trust reported a total expense ratio of 2.5% and a net asset value of $7.96 per share.

Bittensor TAO Daily Price Chart. Source: CoinGecko

Bittensor TAO Daily Price Chart. Source: CoinGecko

The launch follows a series of structural changes within the Bittensor ecosystem. In mid-December, the network completed its first halving event, cutting daily TAO emissions by roughly 50%.

The move reduced inflation and introduced tighter supply dynamics. This made Bittensor’s structure comparable to Bitcoin’s scarcity model.

Separately, Grayscale has already filed paperwork with US regulators to convert its Bittensor Trust into a spot ETF. This is part of a broader push by Grayscale Investments to expand regulated crypto exposure beyond Bitcoin and Ethereum.

While approval timelines remain uncertain, the filing has strengthened the narrative around TAO’s institutional accessibility.

Bittensor operates as a decentralized marketplace for machine intelligence, where contributors earn TAO by providing compute and AI services to the network.

The protocol has gained attention as investors look for blockchain-based alternatives to centralized AI infrastructure.

With reduced issuance, rising staking activity, and new regulated access points, TAO’s recent price action suggests markets are reassessing the asset’s long-term positioning.