Ethereum Price Forecast: Accumulation addresses post record inflows in December despite high selling pressure

- Ethereum accumulation addresses added 3.62 million ETH in December, their highest monthly inflow on record.

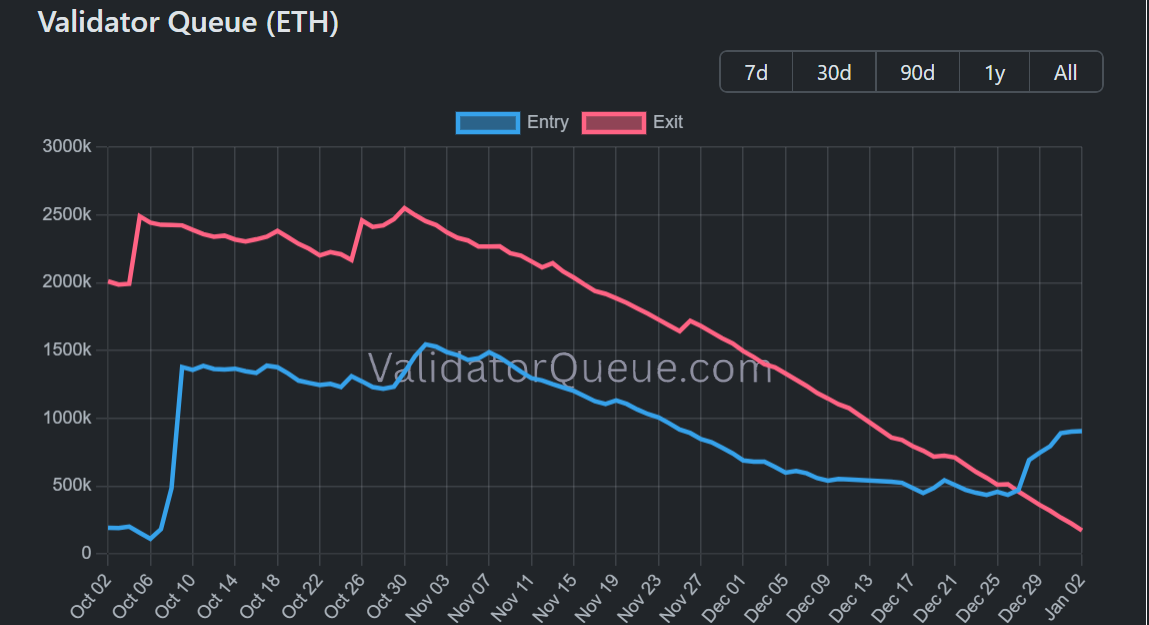

- ETH's validator entry queue has flipped upward after nearly two months in a downtrend.

- ETH is testing the $3,150- $3,250 resistance range after rising above the descending triangle's upper boundary.

Ethereum (ETH) accumulation addresses recorded their highest monthly inflow in December 2025 as the year came to a close. Despite the weak market momentum following the holidays, these wallets doubled down on their buying pressure, adding 3.62 million ETH to their cumulative balance. That figure is higher than its record 2.94 million ETH inflow in November.

-1767381629098-1767381629105.png)

Accumulation addresses are wallets with no record of selling activity, often dominated by new addresses and long-term holders.

Despite the buying pressure from accumulation addresses, ETH's exchange reserves rose by nearly 480,000 ETH — their largest increase since June. An increase in exchange reserves signals higher selling pressure. The distribution is likely driven by year-end tax-loss-related selling, which will likely reduce with the year-end, according to BitMine's Thomas Lee in a Monday statement.

Validator entry queue flips upward as BitMine begins staking

Meanwhile, Ethereum's validator entry queue has flipped upward after nearly two months in a downtrend. The amount of ETH in the queue has increased by about 120% from a low of 410,938 ETH on December 28 to 904,051 ETH on Friday, indicating more investors are committing their assets to secure the network.

The spike follows BitMine's latest update that it has begun staking portions of its ETH stash. The Ethereum treasury firm holds about 4.11 million ETH, worth over $12.8 billion at the time of publication.

Ethereum Price Forecast: ETH breaks out of descending triangle, tests $3,150-$3,250 resistance range

Ethereum saw $121.3 million in liquidations over the past 24 hours, driven by $111.9 million in short liquidations, according to Coinglass data.

ETH has crossed above the upper boundary of a descending triangle and is testing the 50-day Exponential Moving Average (EMA) after several days of sideways movement. The top altcoin could extend its upward move toward $3,470 if it clears the $3,150-$3,250 resistance range.

On the downside, ETH could bounce at the $2,900 support level if it sees a rejection near $3,150.

The Relative Strength Index (RSI) is above its neutral level, while the Stochastic Oscillator (Stoch) is in overbought territory, indicating a dominant bullish momentum.