US Jobless Claims Drop Sharply, Fed Rate Cuts Look Less Urgent

US initial jobless claims fell sharply in the final week of December, reinforcing signs of labor market resilience and complicating expectations for early interest rate cuts in 2026.

Initial claims for the week ending December 27 dropped to 199,000, the lowest level since late November and well below forecasts of 220,000. The prior week’s figure was revised higher to 215,000, making the latest decline more pronounced.

Strong Labor Data Pushes Back Fed Easing Expectations

At a headline level, the data signals that layoffs remain limited. Employers continue to hold onto workers despite slower hiring and elevated borrowing costs.

That supports the view that the US economy is cooling gradually rather than slipping into recession.

As a result, the report weakens the case for rapid monetary easing. A labor market that shows little stress reduces pressure on the Federal Reserve to act quickly, especially with inflation still above target.

This dynamic aligns closely with the FOMC December meeting minutes. Policymakers acknowledged that labor conditions have softened but emphasized that job losses have not accelerated meaningfully.

Several officials argued it would be “appropriate to keep the target range unchanged for some time” to assess incoming data.

Moreover, inflation remains a key constraint. Low jobless claims suggest continued wage stability, which can slow progress toward the Fed’s 2 percent inflation goal, particularly in services.

The minutes noted that inflation “had not moved closer to the 2 percent objective over the past year,” reinforcing caution.

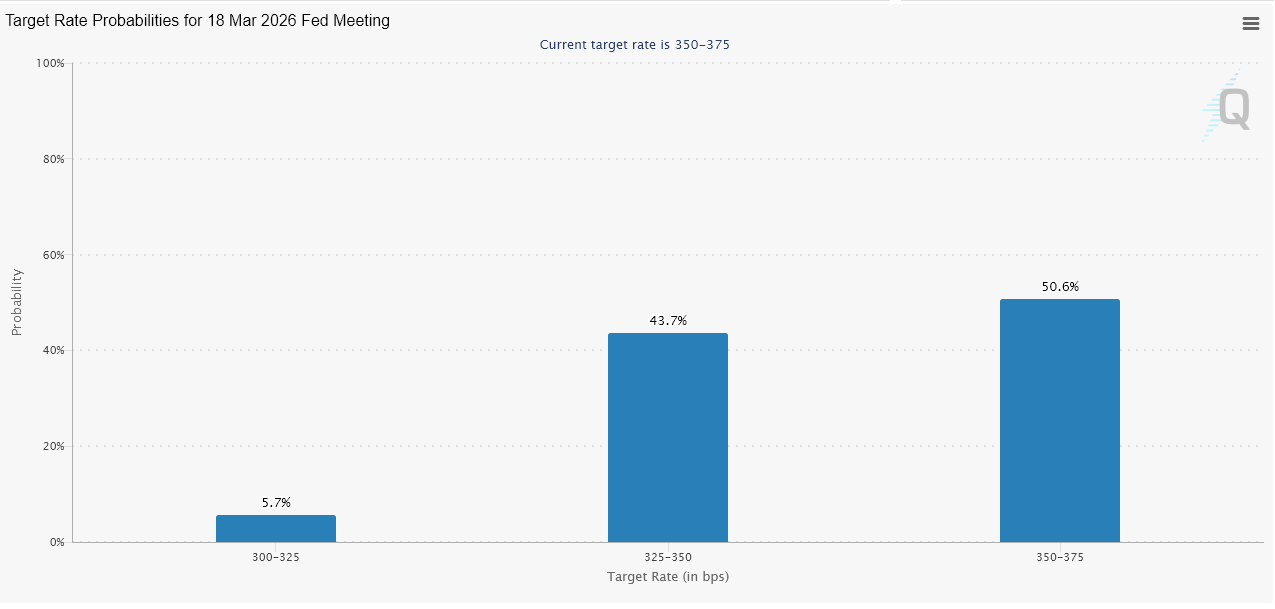

Fed Rate Cut Expectations for March 2026 Drop Further After December’s US Jobless Claims Data. Source: CME FedWatch

Fed Rate Cut Expectations for March 2026 Drop Further After December’s US Jobless Claims Data. Source: CME FedWatch

Taken together, the data reduces the likelihood of rate cuts in early 2026. While markets had already ruled out a January move, the latest labor figures make a March cut less automatic unless inflation shows clearer signs of cooling.

The Fed appears more comfortable waiting than risking a premature easing cycle.

For crypto markets, this backdrop is challenging. Bitcoin has struggled to regain momentum in recent weeks as higher-for-longer rates keep real yields elevated and liquidity tight.

Strong labor data removes one of the key arguments for faster policy relief.

Looking ahead, crypto’s near-term direction may remain tied to macro data. Unless labor conditions weaken or inflation falls more decisively, the Fed is likely to stay on hold through much of the first quarter.

That stance could keep pressure on risk assets as 2026 begins.