XRP Whales Bought $640 Million, What are They Anticipating?

XRP has struggled to sustain a recovery over the past several days, with price repeatedly failing to gain traction near key resistance levels. Despite the hesitation, investor behavior is shifting.

Large holders appear to be increasing exposure, signaling growing confidence that current prices may offer an attractive entry point.

XRP Holders Are Imbuing Confidence

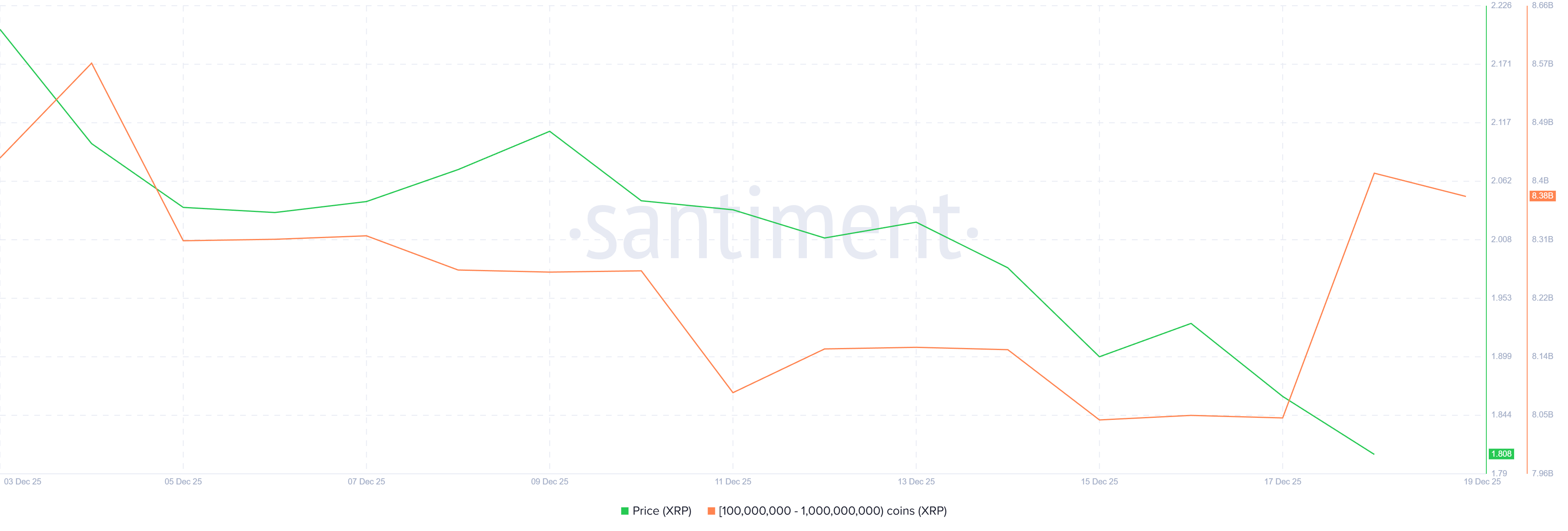

On-chain data shows a notable increase in whale accumulation. Addresses holding between 100 million and 1 billion XRP added roughly 330 million tokens over the past 48 hours.

This accumulation is valued at approximately $642 million, highlighting renewed demand from large investors.

Such behavior suggests XRP whales are capitalizing on depressed prices rather than exiting positions. Accumulation during consolidation phases often reflects expectations of recovery.

This demand can provide structural support, reducing downside risk while improving the probability of a sustained rebound.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

XRP Whale Holding. Source: Santiment

XRP Whale Holding. Source: Santiment

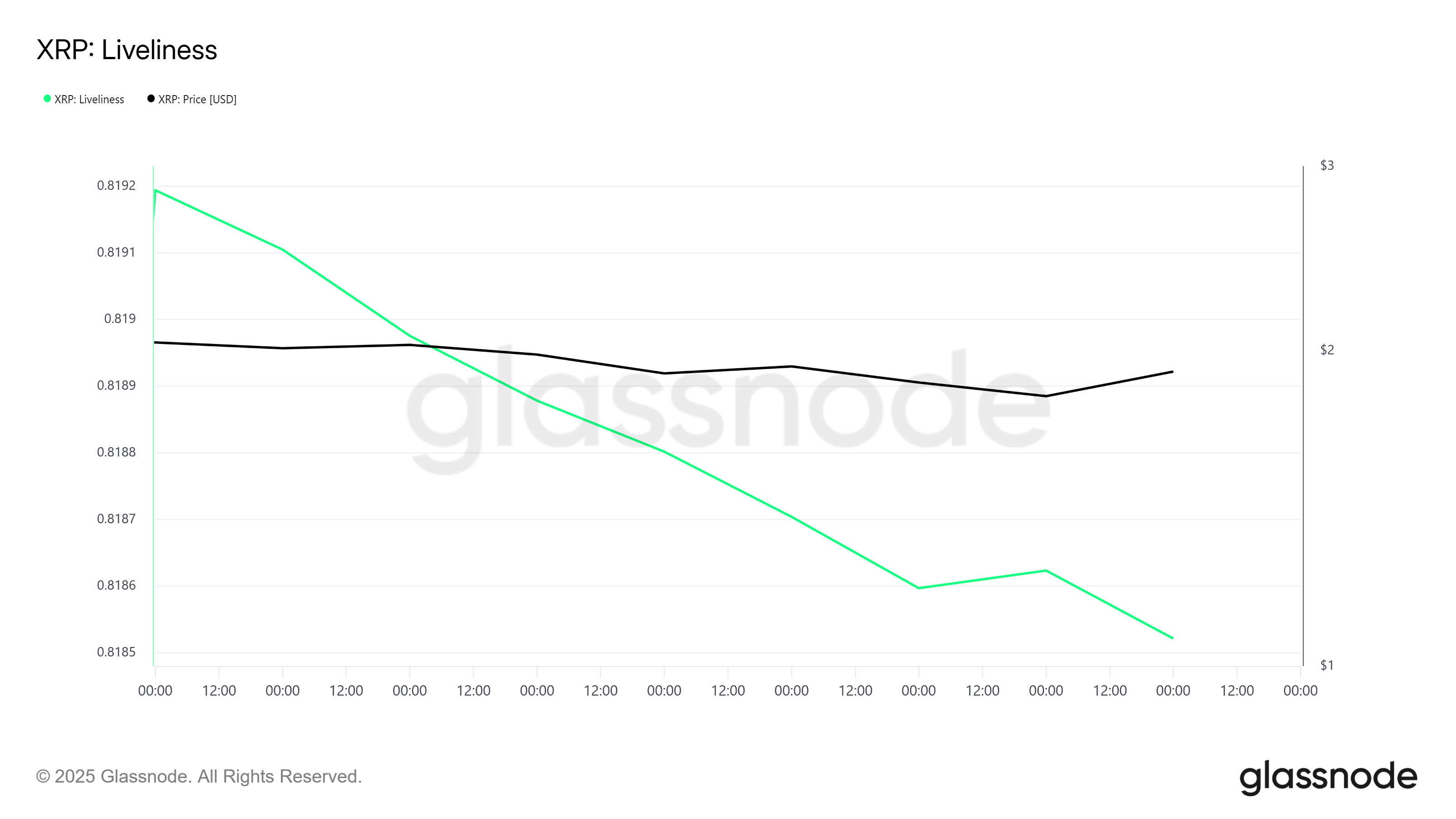

Macro indicators further support the constructive outlook. XRP’s liveliness metric has declined over the past week, signaling reduced coin movement. This trend suggests that long-term holders are shifting away from a selling behavior.

Lower liveliness readings often reflect accumulation or holding patterns. Even a pause in selling by long-term holders can stabilize price action.

Reduced distribution helps absorb short-term volatility, improving conditions for recovery when new demand enters the market.

XRP Liveliness. Source: Glassnode

XRP Liveliness. Source: Glassnode

XRP Price Can Escape

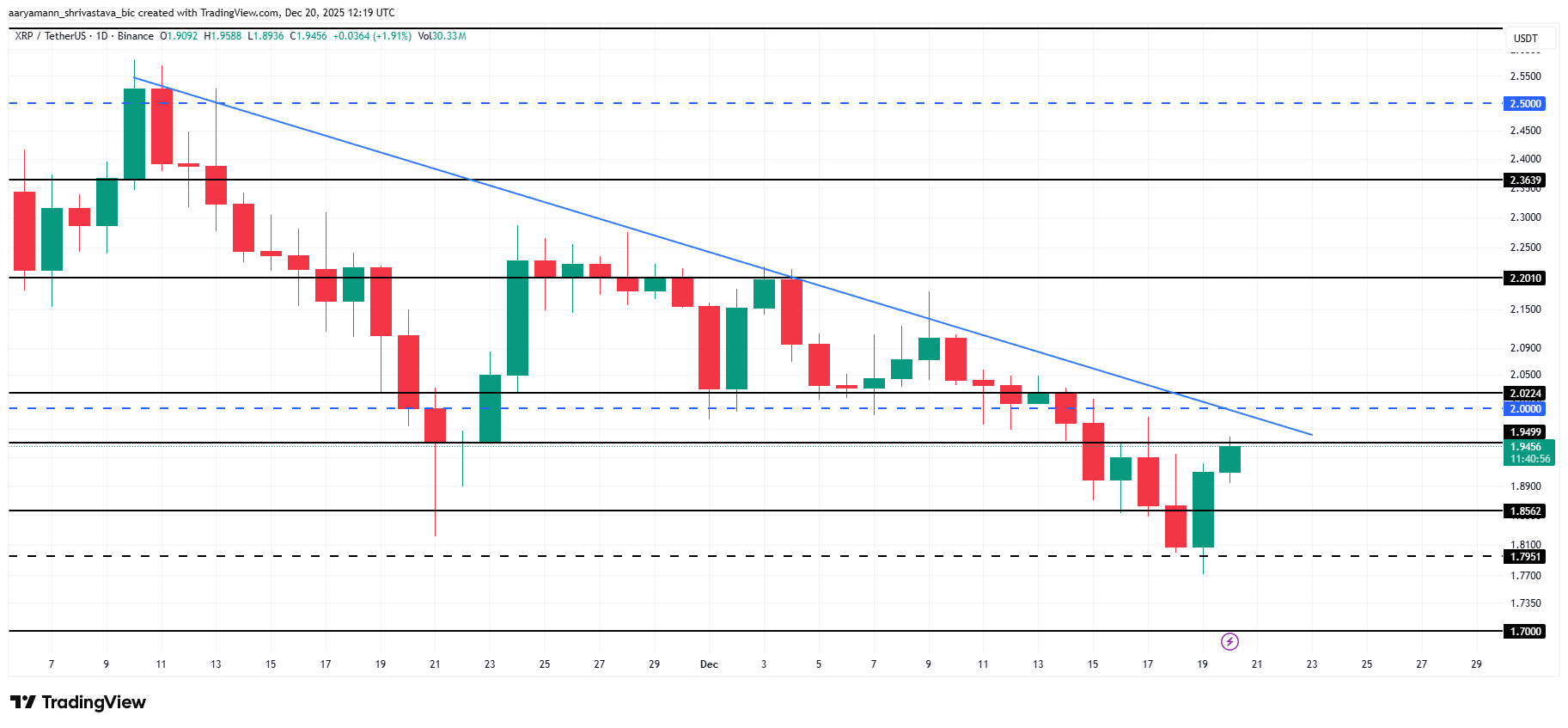

XRP trades near $1.94 at the time of writing, sitting just below a month-long downtrend that has capped upside. The immediate recovery target stands at $2.02. A break above this level would signal renewed strength and an improvement in the trend.

Accumulation by whales and declining long-term selling pressure favor a bullish scenario. If these factors persist, XRP could push past $2.02 and advance toward $2.20. Such a move would mark a clear breakout from the prevailing downtrend.

XRP Price Analysis. Source: TradingView

XRP Price Analysis. Source: TradingView

Downside risks remain if bearish pressure regains control. A failure to sustain momentum could pull XRP back toward $1.85. Further weakness may expose the $1.79 support. Losing that level would invalidate the bullish thesis and reinforce near-term downside risk.