Ripple Price Forecast: XRP extends consolidation above $2.00 support

- XRP holds support at $2.00 amid a relatively quiet cryptocurrency market on Friday.

- XRP Ledger on-chain activity slows, reflected by declining active addresses.

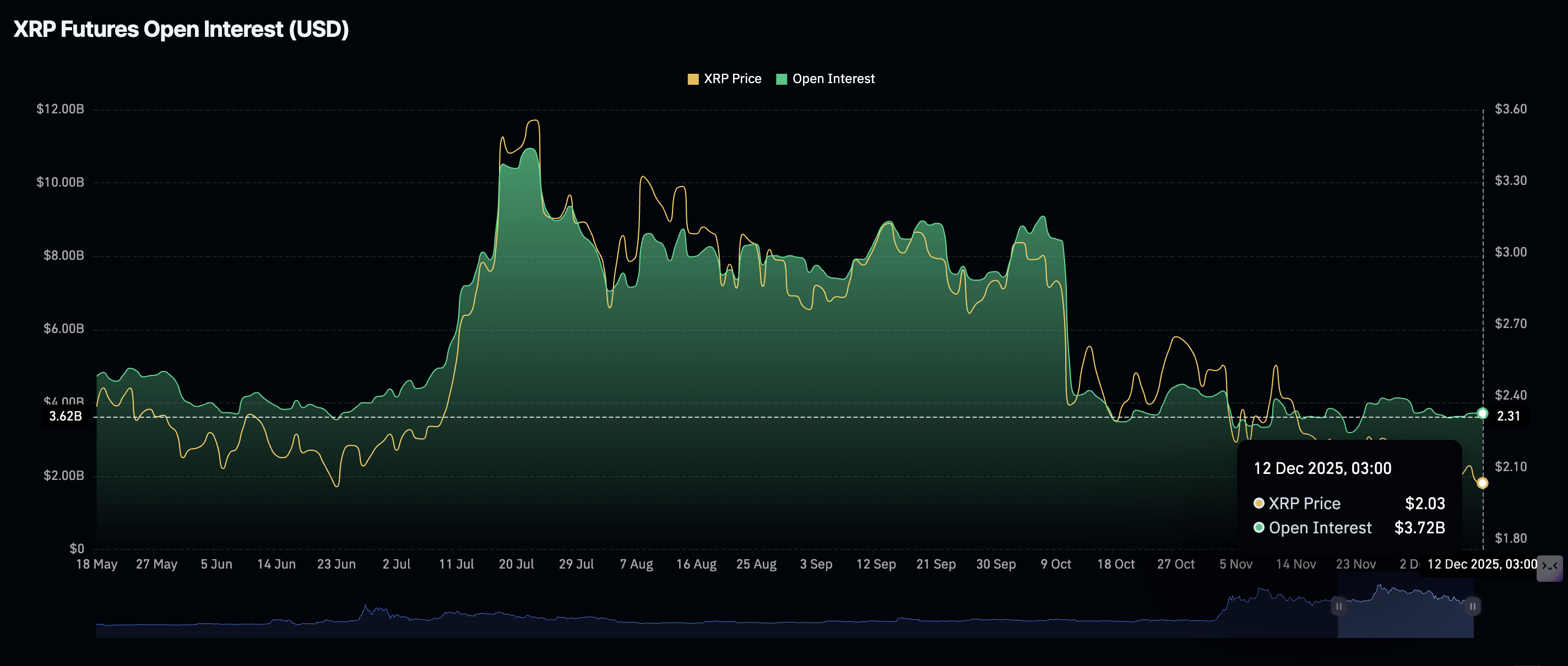

- Retail demand remains significantly suppressed, with Open Interest stabilizing at $3.72 billion.

Ripple (XRP) is extending sideways trading above support at $2.00 at the time of writing on Friday, as the dust from the Federal Reserve’s (Fed) decision settles.

The crypto market succumbed to heightened volatility as investors digested the hawkish interest rate cut by the Fed on Wednesday. Inflation risk and a weak labor market stood out as factors that could prompt the central bank to pause its monetary easing cycle, an outlook that may continue to drive macroeconomic uncertainty.

XRP adoption slows amid falling on-chain activity

The XRP Ledger (XRPL) has recorded a significant drop in the number of active addresses since early November. CryptoQuant data shows that the number of addresses actively transacting on the network averaged 20,000 as of Tuesday, down from nearly 25,000 on November 21 and approximately 32,000 on November 11.

The decline indicates that user engagement has slowed significantly, reducing XRP adoption and buying pressure.

-1765541256791-1765541256791.png)

Meanwhile, demand for XRP derivatives has stabilized, albeit at significantly lower levels, with futures Open Interest (OI) averaging $3.72 billion on Friday, down from $8.36 billion on October 10 when the crypto market crashed, liquidating $19 billion in assets on a single day. OI represents the notional value of outstanding futures contracts; hence, the persistent decline from a record high of $10.94 billion reached in July continues to suppress price recovery. Moreover, a low OI suggests investors are not convinced XRP can sustain an uptrend in the near term, and are choosing to stay on the sidelines.

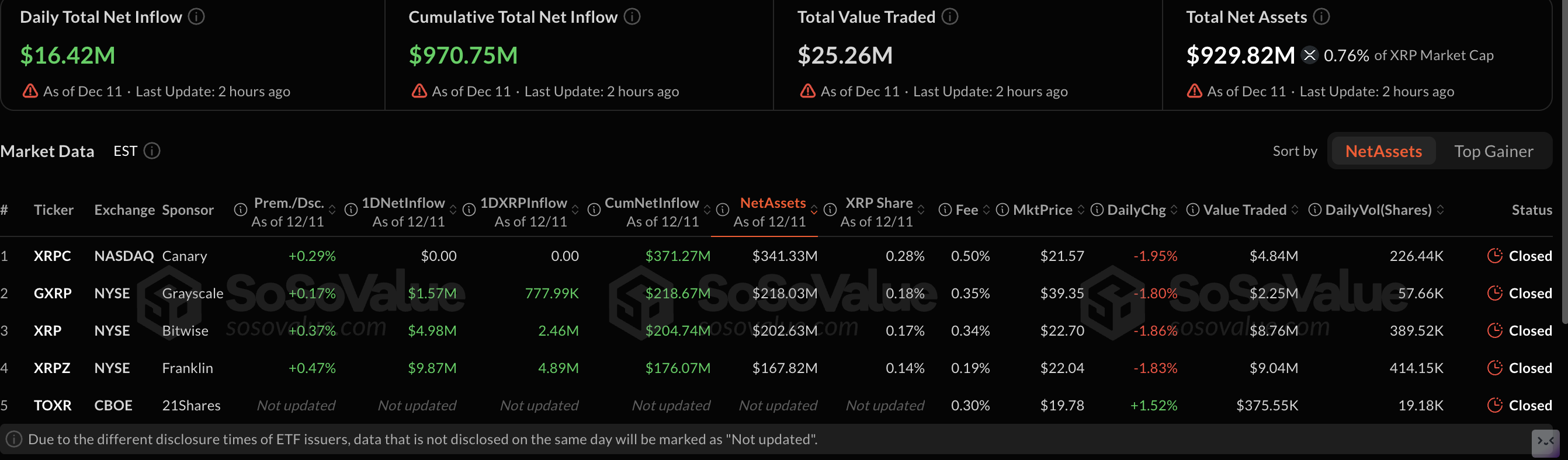

Demand for XRP Exchange Traded Funds (ETFs) remains steady, characterized by approximately $16 million in inflows on Thursday. According to SoSoValue data, the cumulative inflow volume currently stands at $971 million and is quickly approaching the $1 billion milestone. In total, XRP ETFs account for net assets of $930 million.

Technical outlook: XRP holds key support

XRP is trading sideways above support at $2.00 at the time of writing on Friday. The cross-border remittance token also sits below the descending 50-period Exponential Moving Average (EMA) at $2.06, 100-period EMA at $2.10 and the 200-period EMA at $2.17 on the 4-hour chart, which cap recovery attempts and preserves a bearish configuration.

The Moving Average Convergence Divergence (MACD) green histogram bars have flipped slightly positive, while the blue MACD line stands just above the red signal line, reinforcing a neutral tone. The Relative Strength Index (RSI) at 48 (neutral) edges higher, hinting at modest improvement in momentum.

A descending trend line from $2.58 limits gains, with resistance seen at $2.13. However, a sustained push through this barrier could encourage a broader rebound.

XRP's trend strength remains subdued as the Average Directional Index (ADA) eases to 9.76, consistent with a range-bound phase. The rising trend line from $1.82 underpins the base, offering support near $1.98 and holding above this floor would keep pullbacks contained. Conversely, a breakdown could accelerate downside pressure.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Yes. The SEC approved in January 2024 the listing and trading of several Bitcoin spot Exchange-Traded Funds, opening the door to institutional capital and mainstream investors to trade the main crypto currency. The decision was hailed by the industry as a game changer.

The main advantage of crypto ETFs is the possibility of gaining exposure to a cryptocurrency without ownership, reducing the risk and cost of holding the asset. Other pros are a lower learning curve and higher security for investors since ETFs take charge of securing the underlying asset holdings. As for the main drawbacks, the main one is that as an investor you can’t have direct ownership of the asset, or, as they say in crypto, “not your keys, not your coins.” Other disadvantages are higher costs associated with holding crypto since ETFs charge fees for active management. Finally, even though investing in ETFs reduces the risk of holding an asset, price swings in the underlying cryptocurrency are likely to be reflected in the investment vehicle too.

(The technical analysis of this story was written with the help of an AI tool)