a16z Predicts Three Crypto Narratives Will Shine In 2026

Venture firm a16z has released its annual crypto predictions, outlining a sweeping shift in how blockchains, AI agents, and global payments will operate by 2026.

The research highlights three core forces — autonomous agents, disappearing payment rails, and a new era of privacy-first blockchains. All of these developments together signal a structural redesign of the internet’s financial layer.

AI Agents Will Force a Massive Shift

The most consequential shift, according to a16z, is the rise of AI agents as economic participants. For every human in financial services, agents now outnumber workers nearly 100 to 1.

However, these autonomous systems still lack identity, permissions, or compliance structures. The firm argues that 2026 will introduce the first version of KYA: Know Your Agent, a cryptographic identity layer linking agents to their owners, constraints, and liabilities.

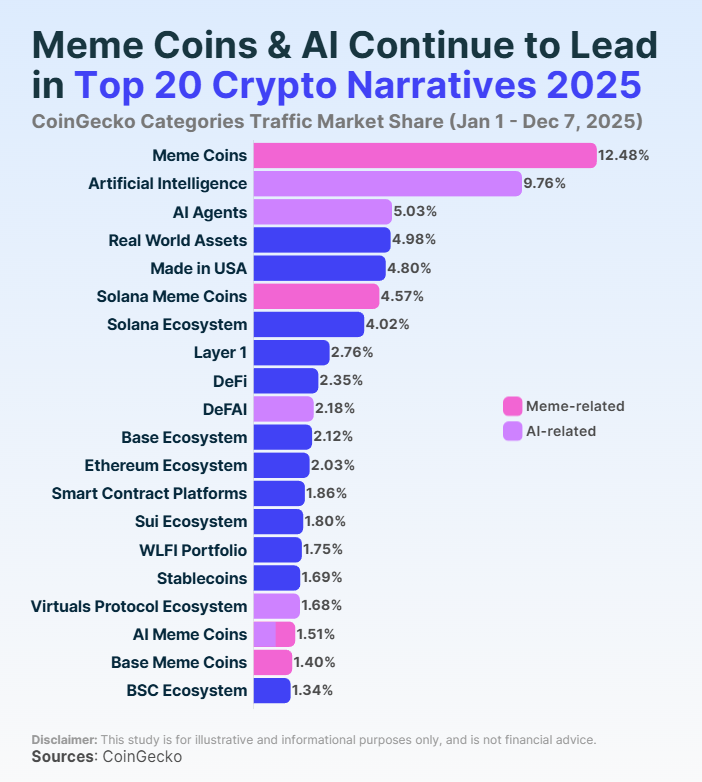

Top Crypto Narratives From 2025. Source: CoinGecko

Top Crypto Narratives From 2025. Source: CoinGecko

Without this, agents will remain “unbanked ghosts,” unable to transact safely or access real markets. With it, they become programmable market actors capable of spending, trading, and settling value in real time.

Payments Vanish into the Internet’s Plumbing

This shift drives the second major prediction: payments will vanish into the network itself. As AI agents trigger transactions automatically — buying data, paying for GPU time, or settling API calls — money must move with the same speed and granularity as information.

Emerging primitives like x402 enable value transfer to occur instantly, permissionlessly, and without intermediaries.

In this model, payments stop being an application layer and become a native network behavior. Banks, stablecoins, and settlement systems become invisible infrastructure running under agent-to-agent commerce.

Privacy Chains Will Dominate

Privacy forms the third pillar of a16z’s 2026 outlook. The firm argues that privacy will become the strongest moat in crypto, far outweighing performance or throughput.

More specifically, once transactions become private, users face real friction when switching chains because moving secrets leaks metadata. This creates “privacy lock-in,” a winner-take-most effect for the chains that get privacy right.

Arthur Hayes echoed the same point earlier, stating that institutional adoption cannot scale on public-by-default blockchains.

“These large institutions don’t want their information public or at risk of going public,” he said, noting that Layer-2 privacy solutions may emerge first while Ethereum remains the underlying security substrate.

Other a16z crypto predictions highlight rising stablecoin infrastructure, the shift from tokenization to on-chain origination, verifiable cloud computing through faster SNARKs, and the emergence of “staked media,” where commentators prove credibility through on-chain commitments.