Solana Bulls Eye $145 Breakout as Institutional Flows and Derivatives Align

- Gold rises to near $5,150 as Trump’s tariffs boost haven demand, US-Iran talks eyed

- Top 3 Price Prediction: BTC breakdown hints at deeper correction as ETH and XRP extend losses

- Gold drifts higher to $5,000 on heightened US-Iran tensions

- Gold climbs above $5,200 on geopolitical tensions, trade uncertainty

- Gold gains above $5,150 as US tariff uncertainty drive demand, eyes on US-Iran talks

- Top 3 Price Prediction: BTC, ETH and XRP remain range-bound as breakdown risks rise

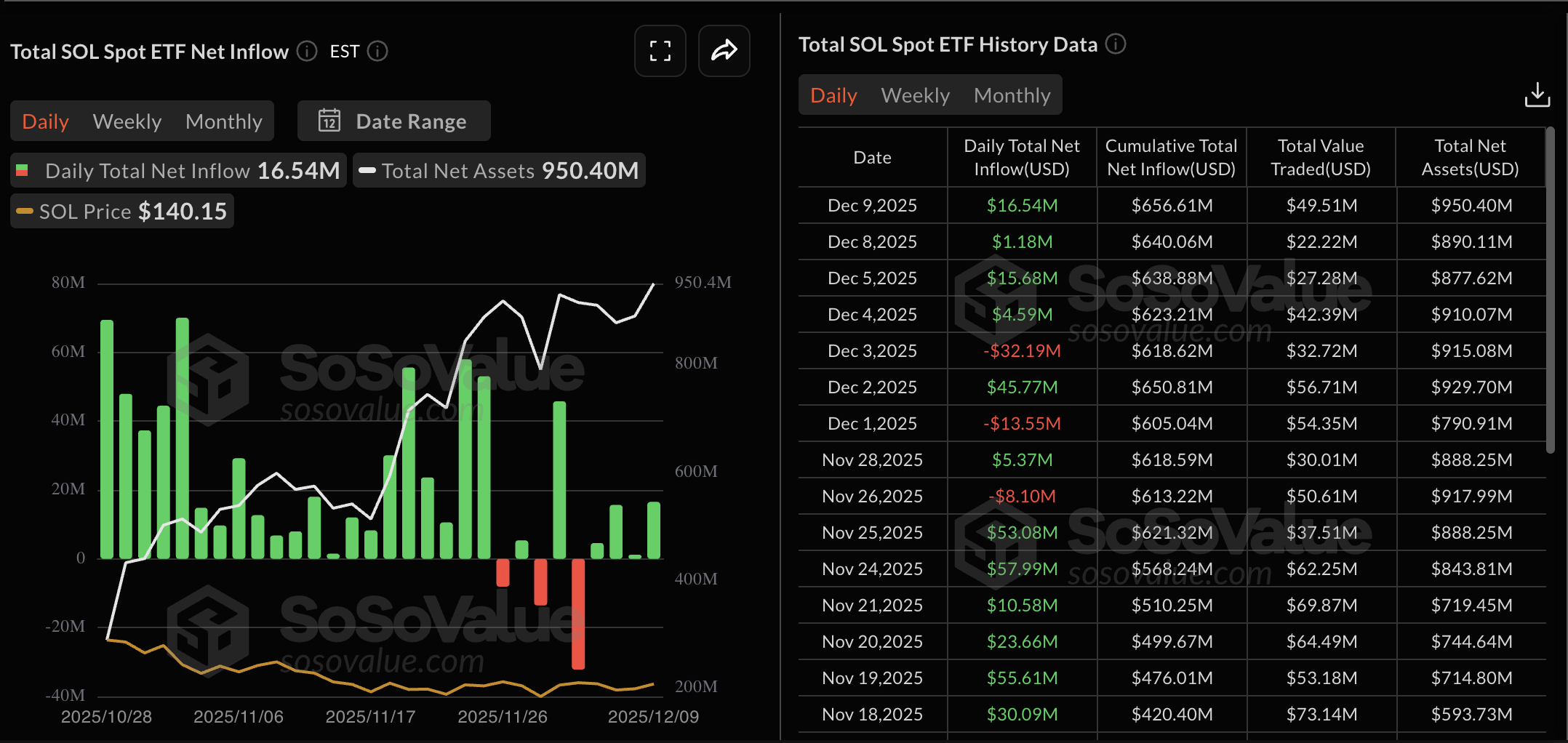

Smart Money Returns: Solana ETFs have logged four consecutive days of net inflows, marking the most consistent institutional buying streak in recent weeks.

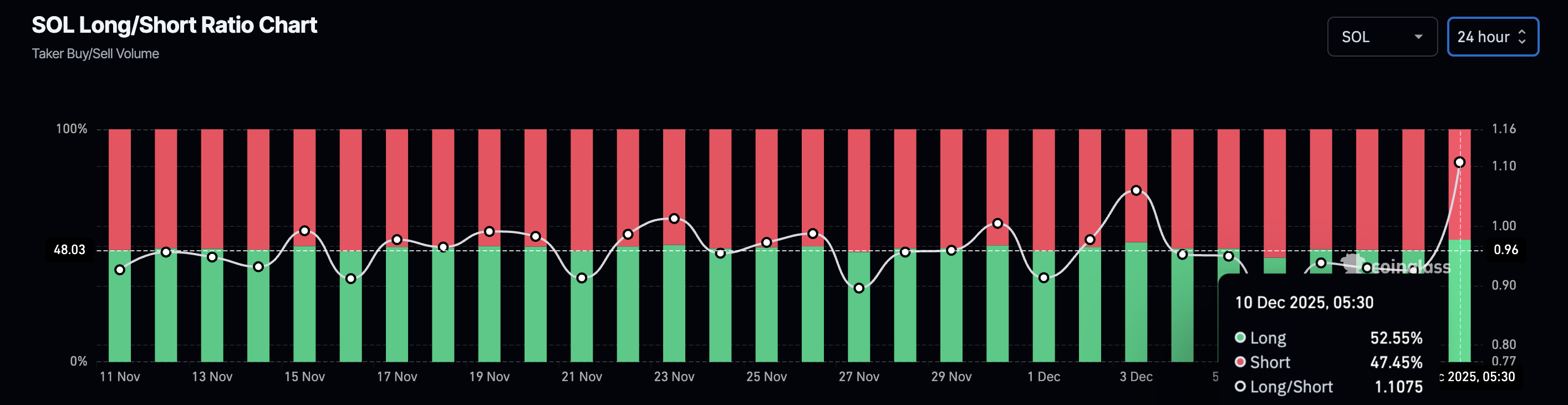

Derivatives Flash "Risk-On": Rising open interest and a flip in the long-to-short ratio suggest traders are aggressively positioning for a breakout.

The Technical Ceiling: SOL is grinding toward critical resistance at $145; a clear close above this level puts the 50-day and 200-day EMAs in play.

Solana (SOL) extended its winning streak to a third session on Wednesday, pushing against the upper bounds of its $121–$145 consolidation channel. The token gained roughly 3% on Tuesday, but the real story isn't just price action—it is the synchronized return of bullish conviction across both institutional and speculative desks.

After a period of drift, the market structure is tightening. Persistent inflows into Solana-focused Exchange Traded Funds (ETFs) suggest institutions are methodically building exposure, while derivatives data indicates that traders are willing to pay a premium to hold long positions.

Institutional Appetite Revives The flow data signals a shift in sentiment. Solana investment products have recorded four straight days of net inflows, pulling in $16.54 million on Tuesday alone—the largest daily injection since December 2.

For market watchers, this consistency is a key indicator. It suggests that the recent "de-risking" phase has paused, replaced by steady accumulation from larger players looking past the daily volatility.

Derivatives: Traders Chase the Upside The "plumbing" of the market is also turning constructive. According to CoinGlass, aggregate futures open interest (OI) has climbed to $7.26 billion, a 2.89% jump in 24 hours. Crucially, this rise in OI is accompanying rising prices, a classic signal that fresh capital is entering the market to bet on further gains.

Sentiment among active traders has flipped decisively. The long-to-short ratio surged to 52.55% from 44.83% on Saturday, aligning with an OI-weighted funding rate of 0.0224%. This positive rate implies that longs are dominating the order book and are willing to pay shorts to keep their exposure open.

The liquidation tape confirms this buy-side dominance: over the last 24 hours, $9.64 million in short positions were wiped out compared to just $5.20 million in longs, fueling the upward grind.

On-Chain Fundamentals & Technical Levels Under the hood, the network’s vitals are stabilizing. Data from DeFiLlama shows Solana’s Total Value Locked (TVL) ticked up nearly 2% to $8.984 billion, while stablecoin liquidity on the chain expanded by roughly 3% to $15.586 billion over the past week. This growing liquidity base provides the "dry powder" needed to sustain on-chain trading and lending activity.

Technically, SOL sits at a pivotal juncture. Trading near $140 at press time, the token is testing the ceiling of its current range, anchored by the November 14 high at $145.

A confirmed daily close above $145 would clear the path for a run toward the 50-day Exponential Moving Average (EMA) at $152 and the 200-day EMA at $172. Meanwhile, momentum indicators like the RSI (48) and MACD are recovering from oversold territory, suggesting the path of least resistance is gradually tilting higher. Support remains firm at $126, with a deeper floor at April's low of $95.

Read more

The above content was completed with the assistance of AI and has been reviewed by an editor.