JPMorgan Closed His Accounts, But You Don’t Throw Out a Bitcoin CEO by Accident

Strike CEO and Twenty One Capital co-founder Jack Mallers says JPMorgan Chase abruptly shut down his personal bank accounts and refused to explain why.

The move has sparked new concerns over the “debanking” of crypto executives at a time when Wall Street banks are facing mounting pressure over their relationships with digital-asset firms.

Mallers Says JPMorgan Gave No Reason: “We Aren’t Allowed to Tell You”

In a series of posts on X (Twitter), Mallers revealed that Last month, JPMorgan Chase threw him out of the bank, citing a bizarre incident that disregarded his family’s three-decade-long relationship with the bank.

Allegedly, each time he asked for an explanation, the bank reportedly repeated the same line: “We aren’t allowed to tell you.”

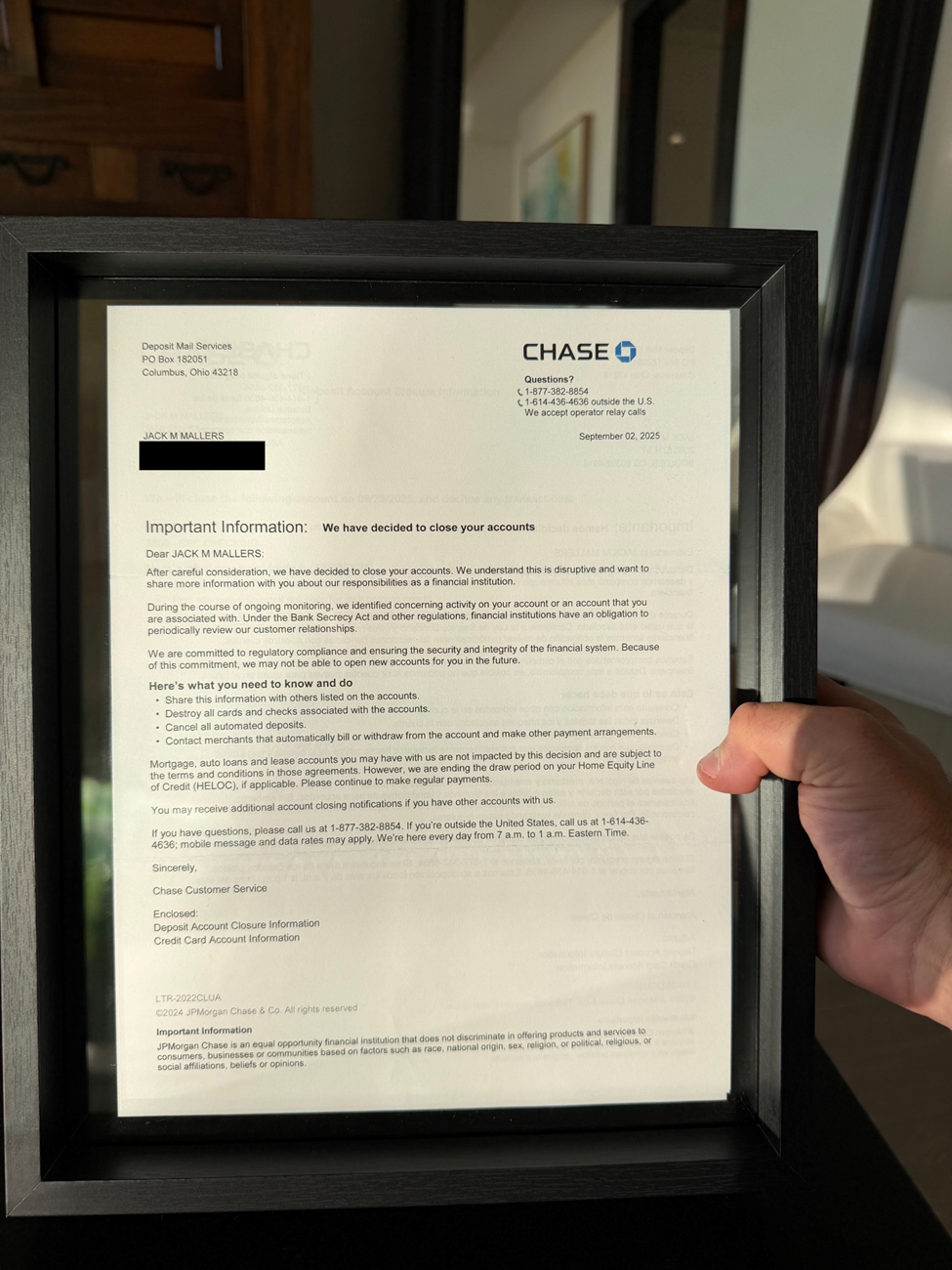

Mallers also shared an image of a letter he claims came from JPMorgan, stating that the bank had identified “concerning activity” and warning that it may not open new accounts for him in the future.

Alleged letter from JPMorgan to Jack Mallers. Source: Mallers on X

Alleged letter from JPMorgan to Jack Mallers. Source: Mallers on X

The incident has since triggered speculation online, with many users suggesting that despite changes in the White House, “Operation Chokepoint 2.0” may still be active. Notably, this rhetoric suggests that banks are under quiet pressure to sever ties with cryptocurrency businesses.

According to Tether CEO Paolo Ardoino, the move was likely for the best, with Mallers advocating forfreedom from centralized entities.

His comments added fuel to the broader debate about whether traditional banks can coexist with Bitcoin-native leaders who view decentralization as a form of resistance, not disruption.

Debanking Flashpoint Comes as JPMorgan Faces MicroStrategy Fallout

The timing of Mallers’ account closure is notable. JPMorgan is currently under scrutiny for its research surrounding a potential MSCI reclassification that could result in MicroStrategy being expelled from major equity indexes.

MSCI is considering a rule that excludes companies whose digital assets comprise more than 50% of total assets, placing MicroStrategy, which holds 649,870 BTC at an average price of $74,430, directly in its crosshairs.

JPMorgan analysts estimate this could trigger $2.8 billion in passive fund outflows tied to MSCI alone, and up to $8.8 billion if other index providers adopt similar criteria.

The backlash intensified following new Senate findings showing JPMorgan under-reported suspicious Jeffrey Epstein transactions for years. Senator Ron Wyden accused the bank of enabling Epstein’s crimes, renewing calls for criminal investigation.

For critics, Mallers’ treatment fits into a pattern of questionable judgment and selective enforcement. It also reflects the reality that when Bitcoin CEOs are pushed out of banks without explanation, the implications extend far beyond a single closed account.