Aerodrome Finance Price Forecast: Key support under pressure despite 155 million token buyback

- Aerodrome Finance corrects on Wednesday after an 8% bounce from a key support level the previous day.

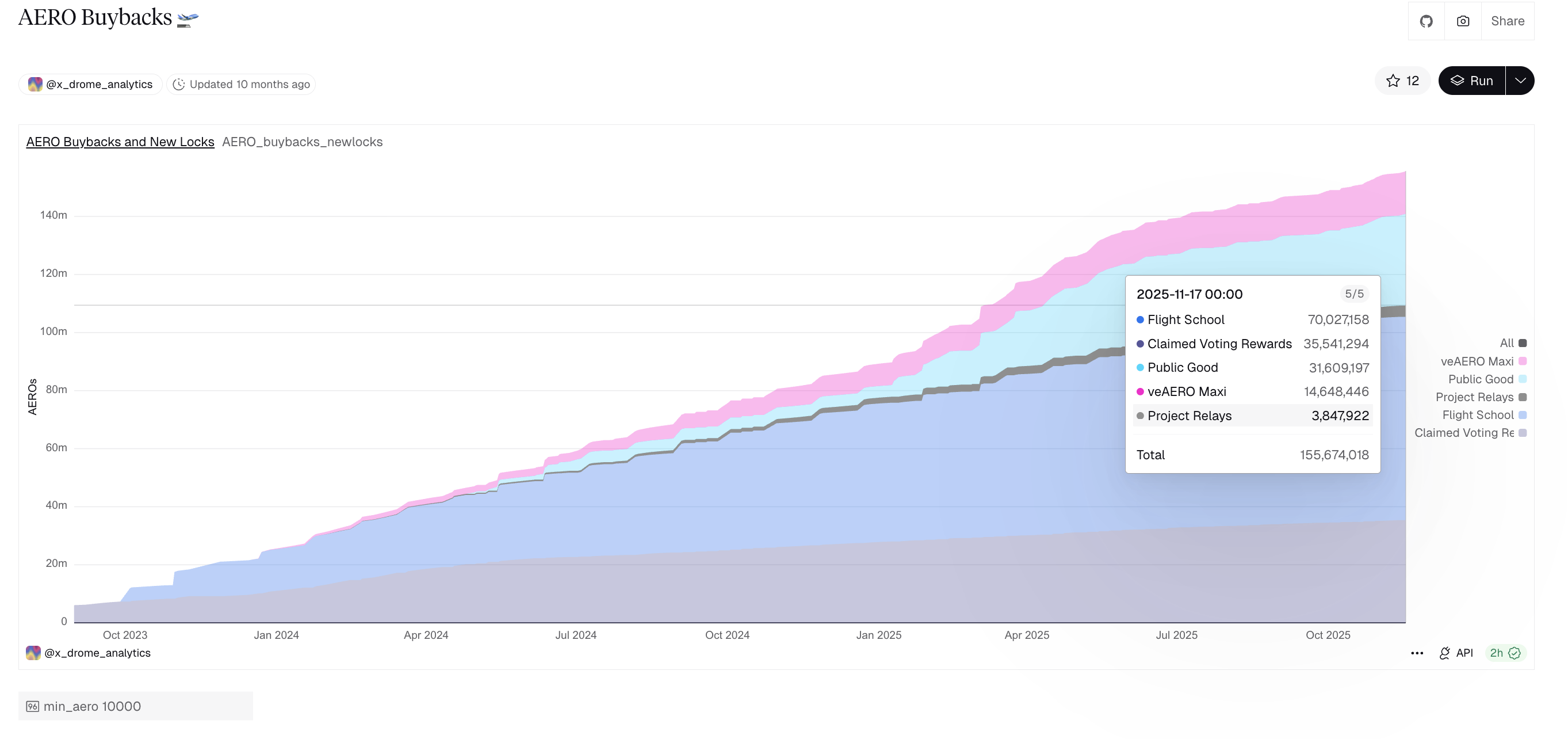

- The Aerodrome buyback program now holds 155 million AERO tokens, accounting for 17% of the circulating tokens, reducing the supply pressure.

- The technical outlook remains mixed, with AERO holding the $0.75 demand zone amid an emerging Death Cross pattern.

Aerodrome Finance (AERO) retraces by 3% at press time on Wednesday, after the 8% rise on the previous day, signaling a quick reversal in trading activity. The token buyback program amounts to over 155 million AERO tokens, resulting in a 17% decline in circulating supply.

Still, the technical outlook remains mixed, as AERO holds at a key support zone while the 50-day and 200-day Exponential Moving Averages (EMAs) form a Death Cross pattern.

Roughly 155 million AERO were bought back to reduce supply pressure

Aerodrome Finance’s buyback program includes Public Goods Fund, Project Relay, Flight School, veAERO maxi, and the token locks from claimed voting rewards. As of Wednesday, over 155 million AERO tokens have been purchased with the Flight School fund – an incentive program for AERO staking users – with the lion’s share held by 70 million tokens.

Typically, a steady buyback reduces the available supply pressure, which could bolster the upside potential in the token's price. In the case of AERO, buybacks account for over 17% of the circulating supply of 905.11 million tokens.

Aerodrome Finance hits the demand zone from last month

Aerodrome Finance’s token trades above $0.80 at the time of writing on Wednesday, after the bounce back on the previous day which reflected the persistent demand near the $0.71-$0.75 zone. Since mid-October, AERO has recorded three successful rebounds from this zone, but has failed to sustain a daily close above $1.19 since October 2.

If the AERO token successfully extends the rebound, it could target the 200-day EMA at $0.96, followed by the $1.19 resistance at the October 2 close.

However, the Death Cross pattern between the 50-day and 200-day EMAs signals increased short-term bearishness.

Furthermore, the trend momentum indicators on the daily chart reflect an increase in bearish pressure as the Moving Average Convergence Divergence (MACD) advances on a declining slope, with the signal line entering negative territory.

At the same time, the Relative Strength Index (RSI) at 43 trends below the midline, indicating a sell-side dominance. Furthermore, the space on the downside before reaching the oversold zone signals bearish potential.

Looking down, if AERO slips below the $0.71-$0.75 zone, it could test the S1 Pivot Point at $0.49.