Top Crypto Gainers: Filecoin rallies 50% as Dash and Tezos rebound

- Filecoin rallies 50% in the last 24 hours, with bulls aiming for the 200-day EMA at $2.433.

- Dash holds above the $100 level as MACD suggests a decline in bearish momentum.

- Tezos extends the falling wedge breakout rally as momentum indicators suggest an increase in buying pressure.

Filecoin (FIL), Dash (DASH), and Tezos (XTZ) are spearheading the broader cryptocurrency market recovery with double-digit gains over the last 24 hours. Filecoin leads the rally with 50% gains, while Dash rebounds from the $100 mark and Tezos marks a falling wedge pattern breakout.

Filecoin’s rebound aims to surpass the 200-day EMA

Filecoin extends the rally by 15% at press time on Friday after a 35% jump on the previous day. The recovery run exceeds the 100-day Exponential Moving Average (EMA) near the $2.000 psychological level.

Filecoin rally approaches a resistance trendline formed by February 21 and April 4 highs, near the 200-day EMA at $2.433. If the decentralized data storage token marks a decisive close above $2.433, it could encounter resistance at the R1 and R2 Pivot Points, located at $2.634 and $3.753, respectively.

The momentum indicators on the daily chart reflect a sudden increase in buying pressure as the Relative Strength Index (RSI) rises to 66 from near the oversold zone. Furthermore, the Moving Average Convergence Divergence (MACD) bounces off its signal line, aiming to cross above the zero line, which would confirm a bullish trend in motion.

If FIL flips bearish from $2.433, the $2.000 psychological level and the $1.270 low from Tuesday could act as immediate support levels.

Dash holds above $100 as bulls aim for $150

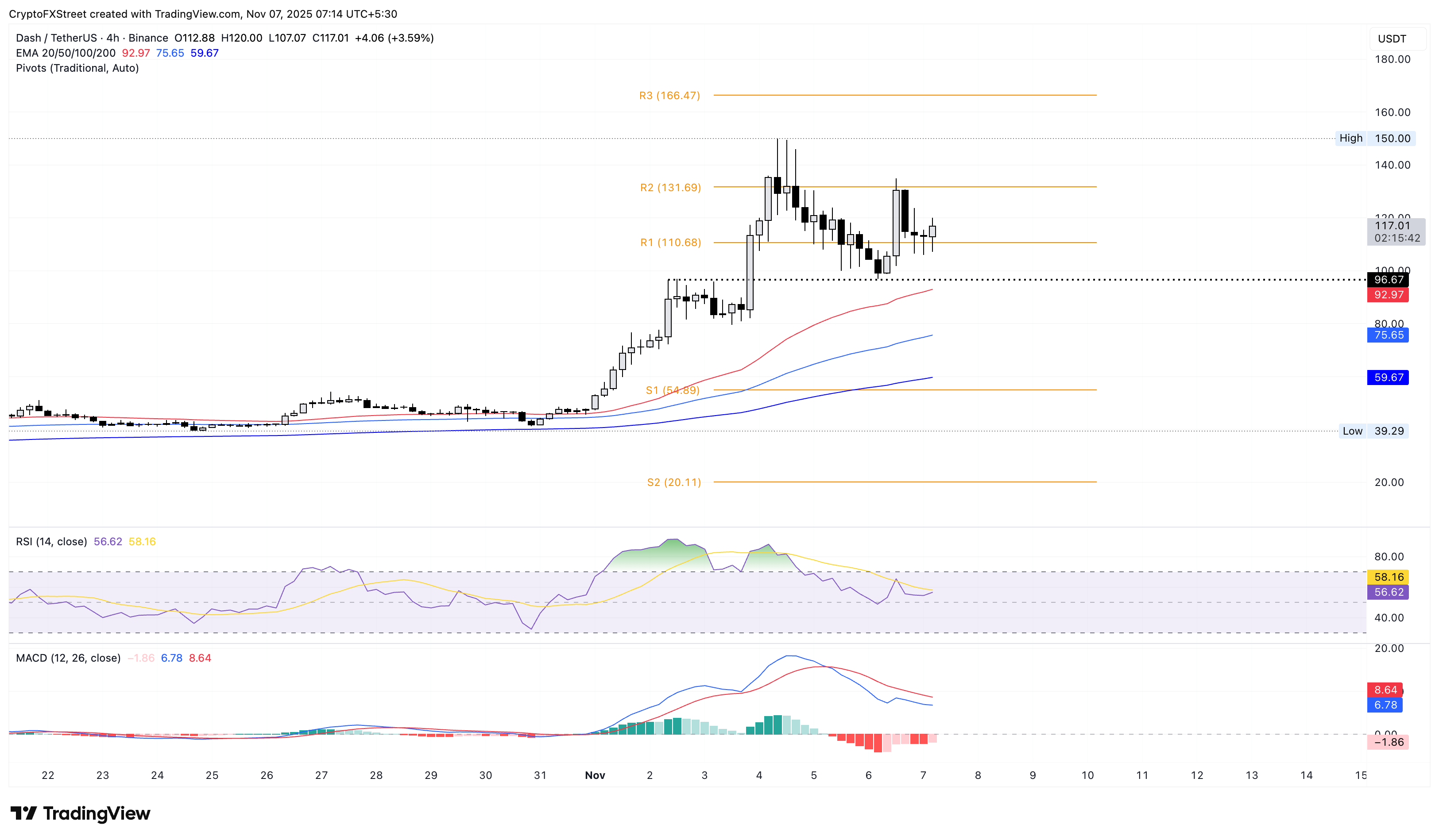

Dash trades above $115, bouncing off the $100 mark on Thursday for an 8% rise. At the time of writing, DASH extends the recovery by roughly 4% on Friday, aiming to challenge the R2 Pivot Point on the 4-hour chart at $131.

If the privacy coin successfully surpasses $131, it could aim for the $150 high from Tuesday.

The MACD flattens out after a declining trend, approaching the signal line for a potential crossover, which could confirm a bullish shift in trend momentum. Similarly, the RSI at 56 turns sideways after a decline from the overbought zone, indicating the buying pressure is stabilizing near neutral levels.

Looking down, if DASH fails to hold above Sunday’s high at $96, it could further extend the correction towards the 100-day EMA at $75.

Tezos breakout rally gains momentum

Tezos trades above $0.6000 at press time on Friday, marking its third consecutive day of uptrend. The bullish reversal gains momentum after confirming a breakout from a falling wedge on the daily chart on Thursday.

If the XTZ token clears the October 13 high at $0.6605 with a decisive close, it could test the R1 Pivot Point at $0.7617.

Corroborating the upside potential, the RSI at 55 surpasses the halfway line while the MACD extends above the signal line after a crossover on Thursday, indicating a refreshed buying pressure.

On the downside, the immediate support level for Tezos is present at $0.5541, marked by the October 11 low.