Ethereum Whales Accumulate Aggressively: 394K ETH Worth $1.37B In Just 3 Days

Ethereum is attempting to regain stability after the sharp selloff on Tuesday that sent its price plunging below $3,100. The drop triggered widespread liquidations across the crypto market, with ETH briefly touching multi-week lows before finding support. As of today, bulls are trying to reclaim the $3,350 level, a short-term resistance zone that could determine whether the asset stages a broader recovery or faces another leg down.

Despite the volatility, on-chain data reveals a different story beneath the surface. Large investors — often referred to as whales — have continued to accumulate ETH, signaling long-term confidence in the network’s fundamentals. Their steady buying activity stands in stark contrast to the broader market’s fear-driven behavior, suggesting that major holders view the recent correction as a buying opportunity rather than a reversal.

Historically, whale accumulation during deep pullbacks has often preceded strong rebounds, as institutional and long-term capital step in while retail sentiment weakens. The challenge now lies in whether Ethereum can maintain momentum above key technical levels, especially as overall market confidence remains fragile. If buying pressure continues to build, ETH could find the foundation for a sustained recovery heading into mid-November.

Whales Accumulate ETH, Hinting at Impulsive Move Ahead

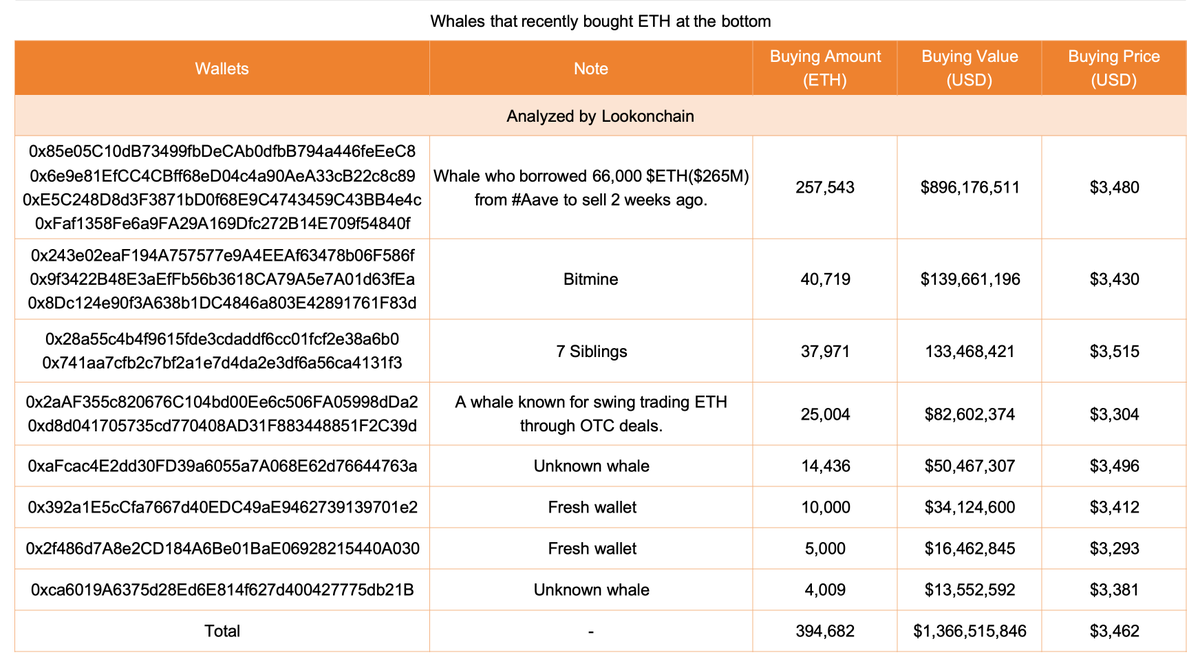

According to Lookonchain, Ethereum whales have collectively accumulated 394,682 ETH, worth approximately $1.37 billion, over the past three days. This wave of large-scale buying comes as prices consolidate below $3,400, signaling that deep-pocketed investors are positioning ahead of a potential market rebound.

Such aggressive accumulation often indicates smart money confidence in future upside potential. Historically, when whales buy during periods of widespread fear and weak price action, it suggests they are anticipating an impulsive phase — a sharp move driven by renewed liquidity and market sentiment recovery. The scale and speed of this accumulation reinforce the idea that these entities expect Ethereum to outperform once selling pressure fades.

This trend also aligns with broader market behavior seen after major liquidations, where institutional players tend to absorb supply from shaken-out traders. If ETH holds above its key support around $3,100, the combination of whale accumulation, improving on-chain inflows, and reduced leverage could act as the catalyst for a breakout toward the $3,600–$3,800 range.

ETH Finds Support at 200-Day MA

Ethereum’s daily chart shows that the asset has found temporary relief after Tuesday’s sharp selloff, which dragged prices below $3,100 for the first time in weeks. The decline brought ETH down to test its 200-day moving average (red line) — a key long-term dynamic support that historically acts as a springboard during corrective phases.

Currently, Ethereum is trading around $3,380, showing signs of a modest rebound. However, bulls face immediate resistance near the $3,500–$3,600 range, where the 50-day (blue) and 100-day (green) moving averages converge. This area has repeatedly rejected upward moves since late October and will likely define short-term direction.

A decisive break above these averages could shift momentum back in favor of the bulls, opening the door for a recovery toward $3,800. On the downside, a failure to hold above the 200-day MA may trigger further weakness toward $3,000 or even $2,850, where previous demand zones exist.

Featured image from ChatGPT, chart from TradingView.com