Bitcoin Price Forecast: BTC slips below $111,000 as Fed hawkish tone offsets US-China trade optimism

- Bitcoin price extends drop below $111,000 on Thursday after closing under a key ascending trendline the previous day.

- The Fed’s hawkish stance dampened risk appetite, pressuring Bitcoin and broader crypto markets.

- A positive outcome from the Trump-Xi meeting failed to lift sentiment as traders remain cautious.

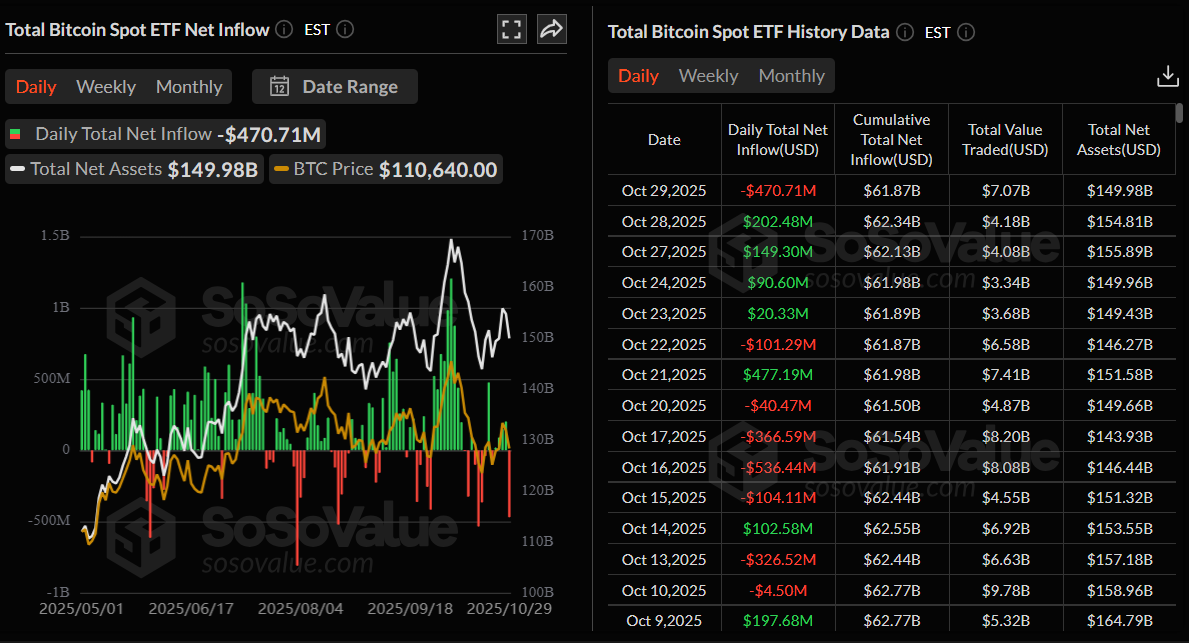

- US-listed spot Bitcoin ETFs saw $470.70 million in outflows on Wednesday, ending a four-day inflow streak.

Bitcoin (BTC) extends its correction, trading below $111,000 at the time of writing on Thursday, as macroeconomic headwinds continued to pressure risk assets. Despite a seemingly positive outcome from the meeting between US President Donald Trump and Chinese leader Xi Jinping, the Federal Reserve’s (Fed) hawkish tone and lingering concerns over the prolonged US government shutdown weighed on the largest cryptocurrency by market capitalization.

Fed’s hawkish stance weighs on BTC

Bitcoin price continued its three-day correction closing at $110,021 on Wednesday, and has reached a low of $107,925 at the time of writing on Thursday.

The correction deepened on Wednesday after Fed Chair Jerome Powell pushed back against market expectations of another interest rate cut in December despite delivering a widely anticipated 25-basis-points (bps) cut at October meeting. This hawkish stance by the Fed could strengthen the US Dollar (USD) and, in turn, weigh on cryptocurrencies, given their inverse correlation.

Apart from this, the US government shutdown has now entered its fourth week amid a deadlock in Congress on the Republican-backed funding bill, heightening economic uncertainty and dampening sentiment toward risk assets such as Bitcoin.

US-China trade talks fail to provide support for BTC

The US-China trade narrative took a fresh turn on Thursday after US President Donald Trump announced that China would immediately resume soybean purchases and that all rare-earth issues had been resolved following his meeting with President Xi Jinping.

However, the positive outcome failed to lift market sentiment, as traders remain cautious amid broader economic uncertainty.

Institutional demand shows early signs of weakness

Bitcoin institutional demand showed early signs of weakness on Wednesday, as spot Bitcoin ETFs recorded an outflow of $470.71 million, ending a four-day inflow streak since October 23. Moreover, this outflow recorded was the highest since October 16, signaling a cautious stance among investors. If these outflows continue and intensify, BTC could extend its ongoing price correction.

Total Bitcoin spot ETF netflow daily chart. Source: SoSoValue

Bitcoin Price Forecast: BTC closes below the ascending trendline support

Bitcoin price was rejected from the 78.6% Fibonacci retracement level (drawn from the April 7 low of $74,508 to the October 6 all-time high of $126,199) at $115,137 on Monday, and declined by 4% on Wednesday, closing below the ascending trendline. At the time of writing on Thursday, BTC hovers at around $110,100.

If BTC continues its correction, it could extend the decline toward the 61.8% Fibonacci retracement level at $106,453.

The Relative Strength Index (RSI) on the daily chart reads 44, slipping below its neutral level of 50, indicating bearish momentum gaining traction. The Moving Average Convergence Divergence (MACD) lines are also converging, with decreasing green histogram bars signaling fading bullish momentum.

BTC/USDT daily chart

However, if BTC recovers and closes above the 50-day EMA at $113,093, it could extend the advance toward the 78.6% Fibonacci retracement level at $115,137.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.