Bittensor Price Forecast: Safello’s staked TAO ETP boosts momentum, bulls aim for $500

- Bittensor rebounds near $450, with bulls aiming for a breakout rally to $500.

- Deutsche Digital Assets and Safello plan to launch staked TAO ETP on SIX Swiss Exchange.

- Positive funding rates and a surge in futures Open Interest suggest that bullish sentiment surrounding Bittensor prevails.

Bittensor (TAO) extends the uptrend for the sixth consecutive day, rising towards $450 as Deutsche Digital Assets and Safello plan to launch a staked TAO Exchange Traded Product (ETP) (STAO) on SIX Swiss Exchange in November. At the time of writing, TAO is up 1% on Thursday, aiming for a breakout rally to the $500 milestone as derivative traders bet on further gains.

Safello staked TAO ETP boosts demand for Bittensor

Deutsche Digital Assets, a Germany-based regulations provider for ETPs, partners with Safello to launch Bittensor’s TAO-based ETP with staking. The STAO ETP will launch in November and provide returns to investors based on TAO’s market value appreciation and staking rewards, while charging an expense ratio of 1.49%.

The institutional demand for Bittensor and its decentralized AI network of “subnets” with their alpha tokens is on the rise following Yuma's CEO, Barry Silbert, investing $10 million in two flagship funds, as previously reported by FXStreet.

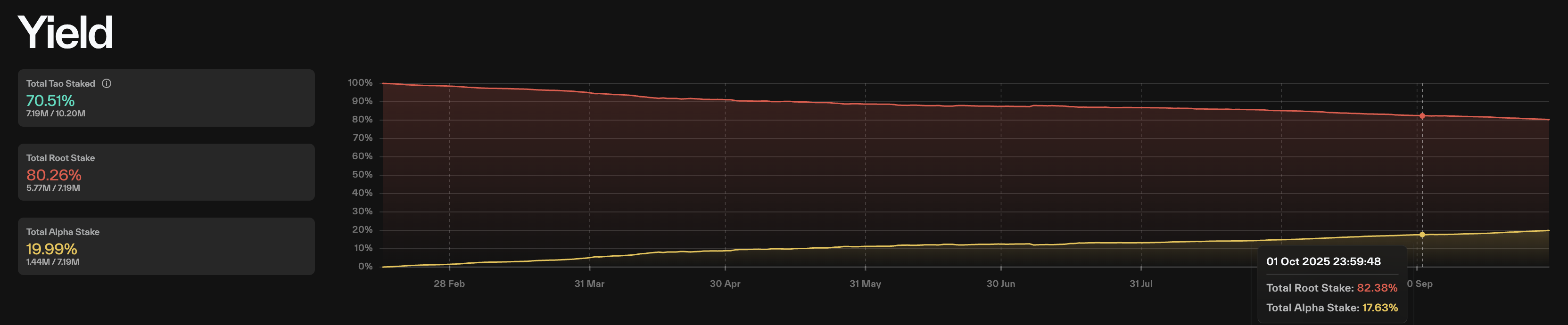

The demand for alpha tokens with yields higher than TAO's reflects increased risk appetite among users. As of Thursday, out of 7.19 million TAO staked, 19.99% (1.44 million) tokens have been swapped for alpha tokens, up from 17.63% on October 1.

TAO staking distribution. Source: Taostats

Aside from network demand, retail demand for Bittensor is rising as traders increase their risk exposure. CoinGlass data shows that the TAO futures Open Interest (OI) has risen by 7.91% over the last 24 hours to $331.65 million, suggesting an increase in the notional value of all outstanding contracts, driven by either increased leverage or additional long positions.

Corroborating the demand surge, the OI-weighted funding rate is at 0.0020%, up from -0.0022% on Wednesday, indicating a bullish incline in traders’ sentiment.

TAO derivatives data. Source: CoinGlass

Bittensor rally hits the crucial crossroads at $451

Bittensor faces opposition at the R1 Pivot Point at $451, bouncing back from the 50-period Exponential Moving Average (EMA) at $413 on the 4-hour chart. The AI token reignites the triangle breakout rally, aiming to surpass Tuesday’s high.

If TAO holds a 4-hour candle above $451, it could extend the uptrend to the $500 psychological level, surpassing the monthly high at $479.

The Moving Average Convergence Divergence (MACD) separates from the signal line to the upside, avoiding a bearish crossover. This indicates a renewed buying pressure.

However, as TAO revisits $451, the Relative Strength Index (RSI) at 65 forms a lower high, signaling a bearish divergence and indicating fragile buying pressure.

TAO/USDT 4-hour price chart.

If TAO reverses from $451, it could form a potential double top pattern with a neckline at $410, aligning with Wednesday’s low. If the TAO reversal drops below $410, it could extend the decline to the 200-period EMA at $381.