IBIT Bitcoin ETF becomes BlackRock's most profitable product with nearly $245 million in revenue

- BlackRock's IBIT ETF has become the company's most profitable product, pulling in $245 million in annual revenue.

- The company's Bitcoin ETF now holds nearly $100 billion in assets under management.

- BlackRock was among the first issuers of US spot Bitcoin ETFs in January 2024.

BlackRock's iShares Bitcoin Trust (IBIT) has emerged as the asset manager's most profitable product over the past year, generating an estimated annual revenue of $245 million.

BlackRock sees $245 million in annual revenue from IBIT

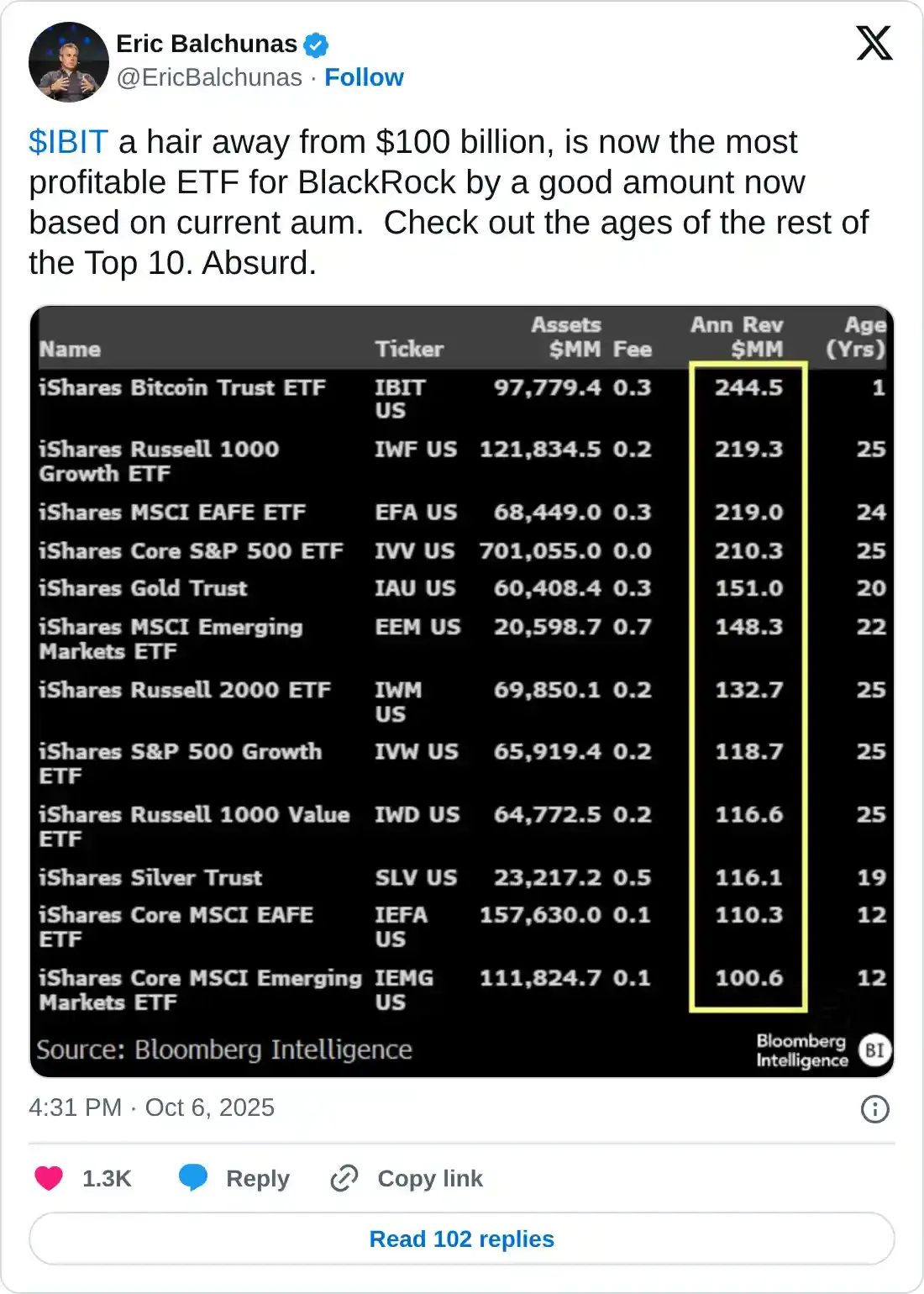

The iShares Bitcoin Trust (IBIT) has emerged as BlackRock's most profitable fund, generating $245 million in annual revenue, Bloomberg analyst Eric Balchunas stated in an X post on Monday. The product climbed above BlackRock's iShares Russell 1000 Growth ETF (IWF) and its iShares MSCI EAFE ETF (EFA) to reach the top of the ladder.

IBIT is also close to hitting $100 billion in assets under management (AUM) in just over 435 days, currently holding approximately $97.8 billion in assets. The Vanguard S&P 500 ETF (VOO) is the fastest fund to hit the $100 billion record in 2,011 days.

IBIT is one of eleven spot products that the Securities & Exchange Commission (SEC) approved in January 2024. The fund is currently the largest US Bitcoin ETF, with cumulative inflows of $62.6 billion, according to SoSoValue data.

Notably, Bitcoin ETFs attracted $3.5 billion last week, marking the largest weekly inflow on record, according to CoinShares. The move was part of a broader $5.95 billion inflow into global digital asset products last week, also the largest on record.

US spot Bitcoin ETFs have been a major price driver, with the top crypto gaining about 400% since asset managers filed for the product.

"Bitcoin [is] now up nearly 400% since ETFs were filed. Whining about, or underestimating, ETFs never ages well," wrote Balchunas in a Sunday X post.

BTC is up 2% over the past 24 hours, trading around $125,025 after hitting an all-time high of $126,199 on Monday.