Crypto Today: BTC, ETH steady and XRP slides as Fed interest-rate cut looms

- Bitcoin uptrend retests $117,000, underpinned by steady ETF inflows and optimism ahead of a widely expected Federal Reserve interest-rate cut.

- Ethereum lags recovery despite holding support at $4,500, reflecting downturn in ETF inflows.

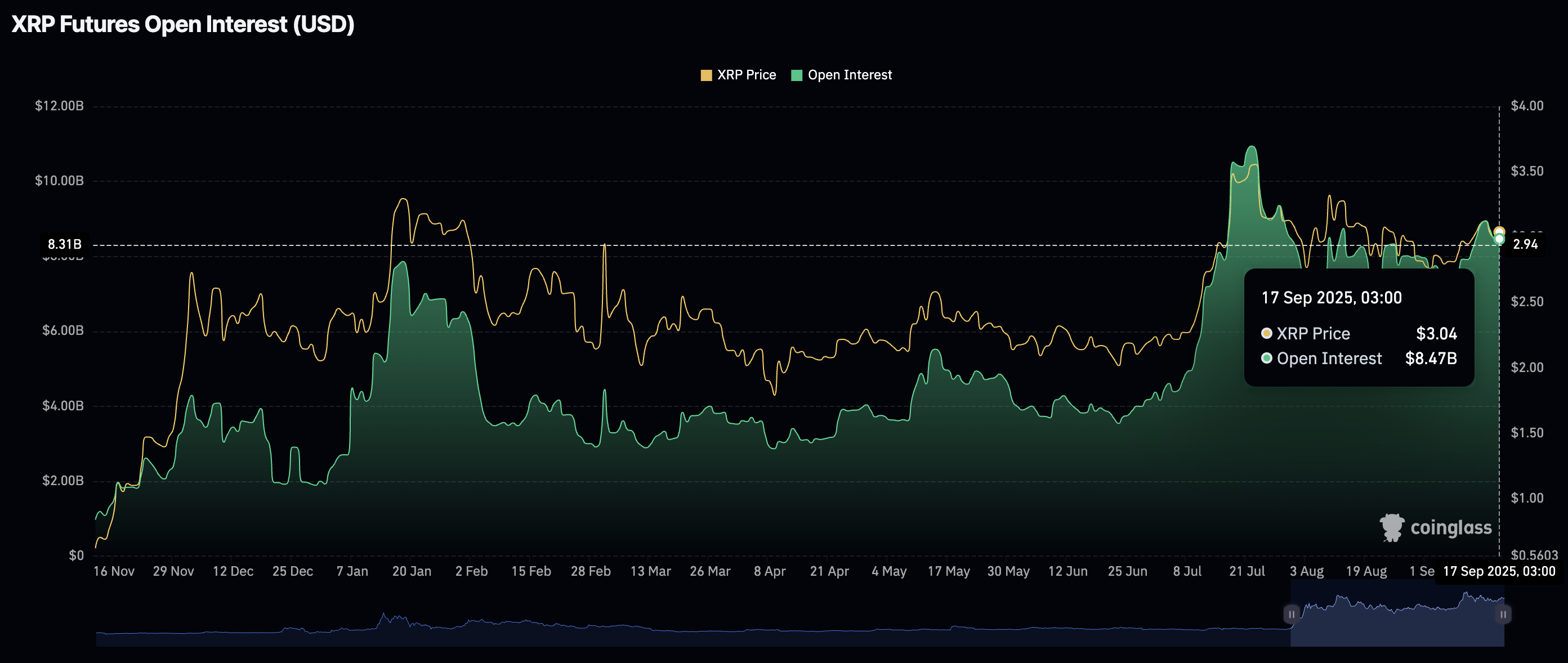

- XRP falls toward the $3.00 support level, but a relatively high Open Interest suggests the short-term bullish potential remains intact.

Bitcoin (BTC) exhibits subtle bullish potential, trading marginally below $117,000 at the time of writing after pulling back from an intraday high of $117,286. The uptick in price can be attributed to several factors, including steady United States (US) Exchange Traded Funds (ETF) inflows and growing optimism that the Federal Reserve (Fed) could deliver an interest rate cut later on Wednesday.

The rest of the cryptocurrency market remains on edge, with Ethereum showing stability above its $4,500 support but lacking immediate catalysts for a steady rebound toward the $4,956 all-time high.

Meanwhile, interest in Ripple (XRP) remains relatively high, with the futures Open Interest holding above the $8 billion mark.

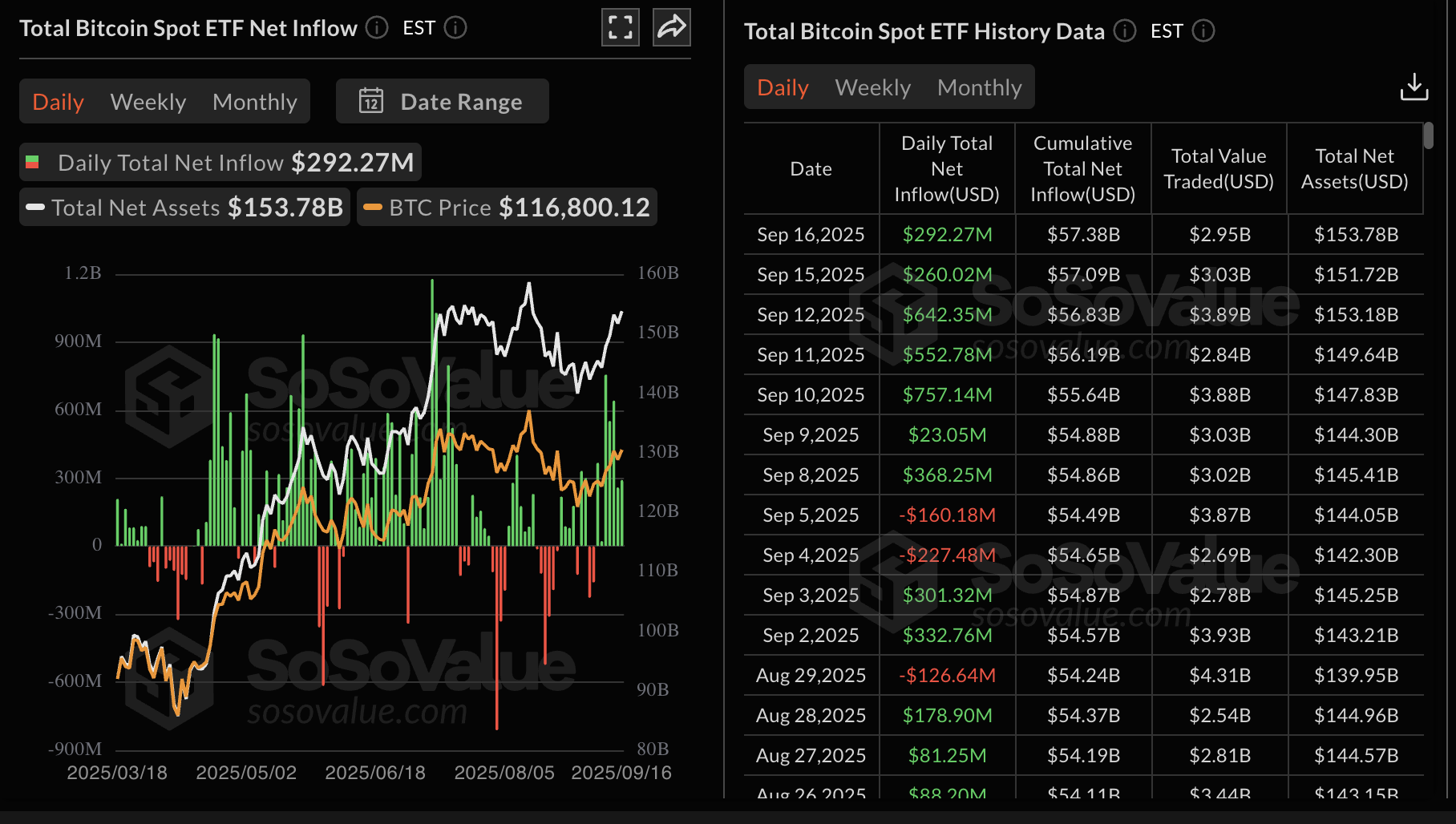

Data spotlight: Bitcoin bulls eye short-term breakout as ETF inflows steady

Institutional demand for Bitcoin through ETFs has steadily increased since September 8. SoSoValue data shows that BTC ETFs extended the inflow streak for seven consecutive day with approximately $292 million net streaming in on Tuesday.

If demand for Bitcoin ETFs increases in the coming days and weeks, it will back the coin's bullish potential for a breakout toward its record high of $124,474 reached on August 14.

Bitcoin spot ETFs stats | Source: SoSoValue

Ethereum, on the other hand, is experiencing a slowdown in ETF inflows, suggesting that risk-off sentiment is taking hold as the token approaches its record high. Outflows from ETH spot ETFs in the US averaged nearly $62 million on Tuesday, marking a break in a five-day streak of inflows into these products.

Persistent outflows or suppressed inflows could dampen Ethereum's short-term bullish case. ETF performance is worth monitoring, considering the role institutional demand played in the most recent rally to $4,956.

Ethereum spot ETFs stats | Source: SoSoValue

Meanwhile, retail demand for XRP remains relatively high, with the futures Open Interest (OI) averaging at $8.47 billion on Wednesday, up from $7.37 billion on September 7.

XRP Futures Open Interest | Source: CoinGlass

A steady OI, referring to the notional value of outstanding futures contracts, indicates that more traders are betting on short-term price increases in XRP. As risk-on sentiment improves, the path of least resistance remains upward, increasing the chances of the XRP price breaking out to its record high of $3.66, reached on July 18.

Chart of the day: Bitcoin upholds bullish structure

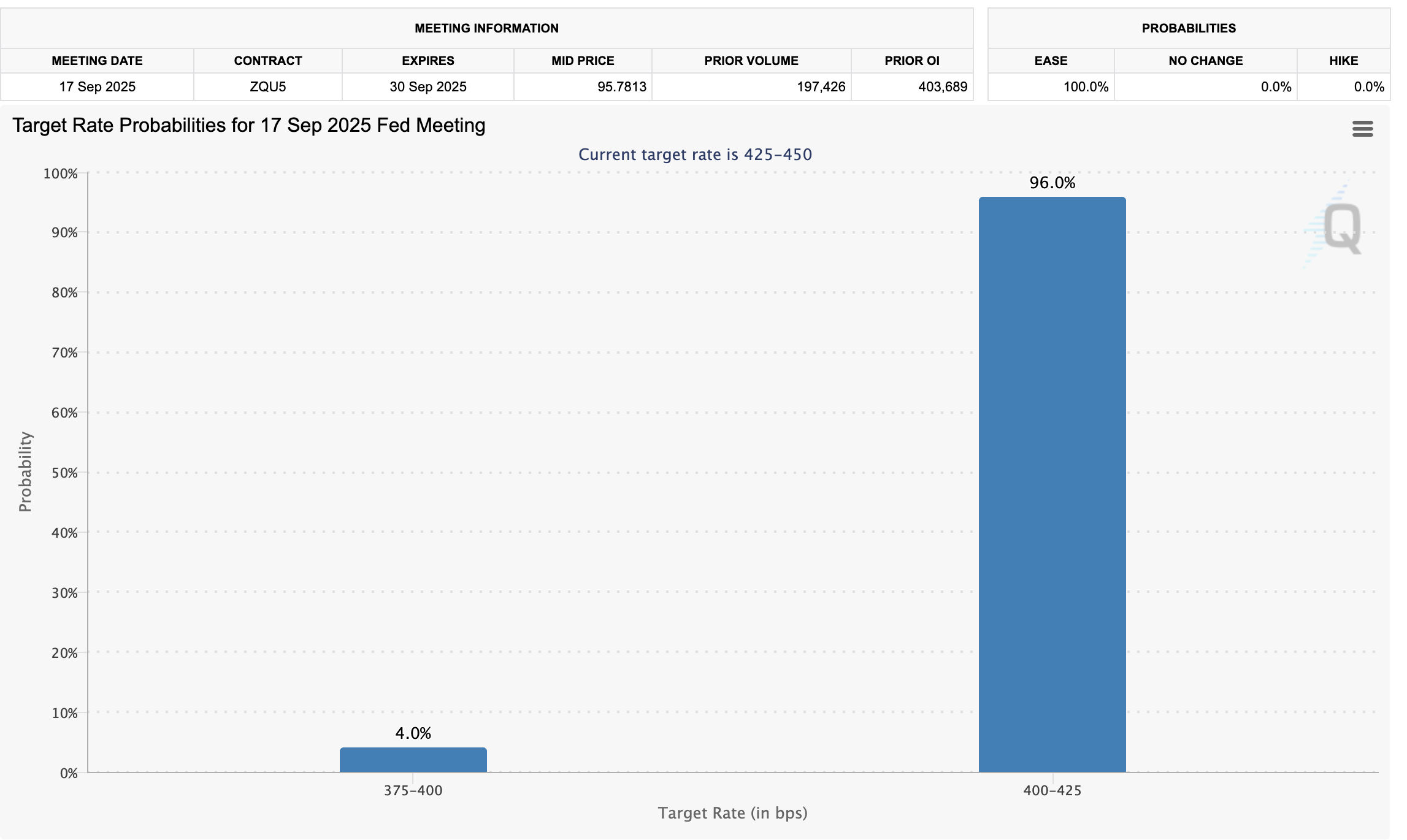

Bitcoin trades between an intraday high of $117,286 and a low of $116,160 at the time of writing on Wednesday, ahead of the much-anticipated Federal Reserve interest-rate decision.

The consensus is for a 25-basis-point cut, which would bring the interest rate in the US to a range of 4.00% to 4.25%. According to the CME Group's FedWatch tool, the odds stand at 96% in favor of a 25 bps cut.

Lower interest rates often encourage investment in riskier asset classes, such as cryptocurrencies and equities. Therefore, lower rates could boost investor interest in digital assets in the fourth quarter.

FedWatch tool | Source: CME Group

Investors should consider the daily chart's bullish Moving Average Convergence Divergence (MACD) when trading Bitcoin. A buy signal, which occurs when the blue MACD line crosses and remains above the red signal line, has remained active since September 7 and supports a bullish outcome in the short term.

The steady recovery of the Relative Strength Index (RSI) from 37 to 60 in late August indicates that bullish momentum is building. Higher RSI readings, approaching overbought territory, underpin rising demand for BTC as the price rebounds.

BTC/USDT daily chart

Still, traders should temper their bullish expectations until BTC confirms the direction of the trend following the Fed's interest-rate decision. A correction below the $116,000 level could bring the 50-day Exponential Moving Average (EMA) at $113,666 and the 100-day EMA at $111,501 within reach.

Altcoins update: Ethereum, XRP struggle near key support

Ethereum holds around the $4,500 level, following nearly a 6% pullback from its previous week's peak of $4,769. The downtrend in the RSI, from 64 to 54, implies fading bullish momentum. If the RSI extends the pullback below the midline, the chances of Ethereum sliding to test the 50-day EMA at $4,211 would increase significantly.

Still, Ethereum buyers could defend the bullish case if a significant reversal occurs from the short-term $4,500 support. From here, the next key level is the area around $4,800, leading up to the record high of $4,956.

ETH/USDT daily chart

As for XRP, it remains above $3.00 after correcting from last week's high of $3.18. The RSI at 53 is pointing toward the midline, which supports a scenario where bullish momentum continues to fade ahead of the Fed interest-rate decision.

In addition to the demand at the $3.00 mark, reinforced by a descending trend line, the 50-day EMA at $2.94 is poised to absorb the selling pressure if the pullback persists. Beyond this level, the 100-day EMA at $2.82 and the 200-day EMA at $2.57 could prevent a full-blown sell-off.

XRP/USDT daily chart

Still, the MACD indicator backs XRP's short-term bullish case, maintaining a buy signal since September 8. Investors will consider increasing their exposure to XRP with the blue MACD line remaining above the red signal line. Bullish targets are the $3.35 level, which was previously tested on August 14, and the record high of $3.66.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.