USD/CHF falls sharply to near 0.7910 as the US Dollar underperforms amid firm Fed dovish bets.

The Fed is widely anticipated to cut interest rates on Wednesday.

Inflation in the Swiss economy at the producer level has declined again.

The USD/CHF pair falls sharply to near 0.7915 during the European trading session on Tuesday. The Swiss Franc pair faces selling pressure as the US Dollar (USD) underperforms its peers amid firm expectations that the Federal Reserve (Fed) will cut interest rates in the monetary policy announcement on Wednesday.

At the time of writing, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, posts a fresh seven-week low near 97.00.

US Dollar Price Today

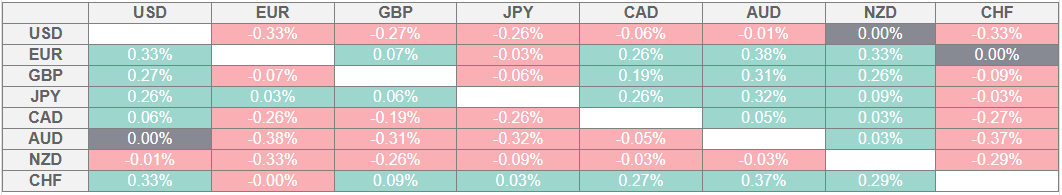

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the weakest against the Euro.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

According to the CME FedWatch tool, there is a 96% chance that the Fed will reduce interest rates by 25 basis points (bps) to 4.00%-4.25%, while the rest support a bigger reduction of 50 bps.

Fed dovish expectations have been boosted by slowing United States (US) benchmark revision report for 12 months ending August showed that 919k fewer jobs were created than what had been anticipated earlier.

Meanwhile, a majority of Fed officials, including Chair Jerome Powell, have also warned of downside labor market risks in the wake of tariffs imposed by President Donald Trump.

In the Swiss economy, Producer and Import Prices for August have declined again. Inflation at the producer level dropped at a pace of 0.6%, faster than the prior reading of 0.2%. Economists expected the producer inflation to have grown by 0.1%. Signs of producers lowering prices to cope up with weak demand are likely to force Swiss National Bank (SNB) to consider pushing interest rates into the negative territory.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.