BoC expected to cut interest rate as growth slows and the labour market weakens

The Bank of Canada is expected to reduce its key interest rate to 2.50%.

The Canadian Dollar maintains a positive tone vs. the US Dollar this month.

The BoC kept a steady hand in the last three monetary policy meetings.

The impact of US tariffs on the economy should remain centre stage.

The Bank of Canada (BoC) is widely anticipated to reduce its benchmark interest rate by a quarter percentage point on Wednesday, taking it to 2.50% after three consecutive ‘on hold’ decisions.

The chances of the BoC resuming its easing cycle have increased due to weak growth, a soft labour market, and relatively controlled inflation.

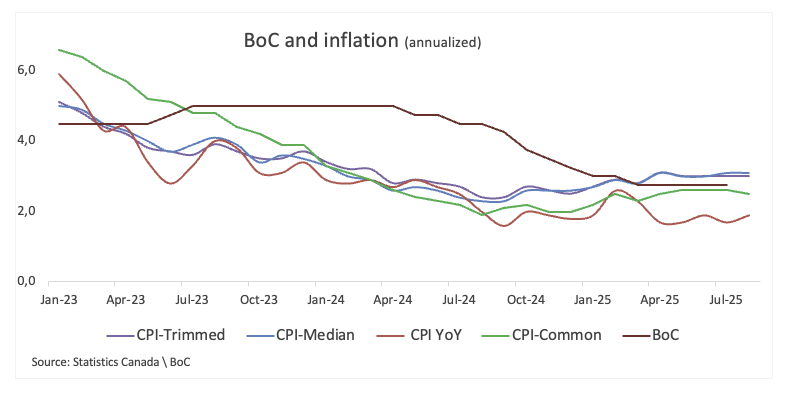

Canada’s economy contracted by 1.6% in the second quarter, a sharper decline than expected, while employment fell by more than 100K in July and August, lifting the jobless rate to 7.1%. Dovish forecasts were bolstered by August inflation figures released on Tuesday, which came in better than expected. The Consumer Price Index (CPI) rose by 1.9% YoY, below the 2% forecast, while the core CPI remained steady at 2.6%.

"Inflation remained largely unthreatening in August, making the expected Bank of Canada interest rate cut tomorrow a relatively easy decision," said Andrew Grantham, senior economist at CIBC Capital Markets, per Reuters.

The central bank left interest rates unchanged at its gathering on July 30, a move that came as little surprise to markets. However, the decision has raised a more significant question: Has the cycle of rate cuts already reached its peak?

Governor Tiff Macklem explained that the pause was driven by inflation that just won’t fully budge. The bank’s preferred measures, the trim mean and trim median, are still hovering around 3%, and a broader range of indicators have also ticked higher. Macklem acknowledged that this persistence has drawn the attention of policymakers, who will closely monitor it in the coming months.

However, he quickly clarified that not all of the current price pressures are permanent. A stronger Canadian Dollar (CAD), softer wage growth, and an economy running below capacity should all work to bring inflation lower over time.

Previewing the BoC’s interest rate decision, analyst Taylor Schleich at the National Bank of Canada (NBC) noted, "After holding steady for the last three meetings, the Bank of Canada’s Governing Council (GC) is set to lower the overnight target by 25 bps to 2.5%. OIS markets judge a cut to be likely with ~90% implied easing odds. An inflation report just over 24 hours before the decision is a source of uncertainty, but we don’t expect it to derail a cut.”

When will the BoC release its monetary policy decision, and how could it affect USD/CAD?

The Bank of Canada will publish its policy decision on Wednesday at 13:45 GMT. After that, Governor Tiff Macklem will attend a press conference at 14:30 GMT.

Market participants have largely anticipated a rate cut on Wednesday, while implied rates suggest nearly 45 basis points of easing by year-end.

According to FXStreet’s Senior Analyst, Pablo Piovano, the Canadian Dollar (CAD) has been appreciating at a firm pace against the US Dollar (USD) in the last few days, with USD/CAD easing toward the 1.3750 region.

He notes that renewed selling could see the pair drift back toward the August floor in the 1.3730-1.3720 band. Further support sits at the weekly base at 1.3575 (July 23) and the June valley at 1.3556 (July 3), before reaching the year’s bottom at 1.3538 (June 16).

On the topside, resistance is pegged at the August top at 1.3924 (August 22), followed by the 1.4000 round level, with the May ceiling at 1.4015 (May 13) being reinforced by the proximity of the significant 200-day Simple Moving Average (SMA).

From a broader perspective, Piovano argues that the bearish bias stays intact as long as spot trades beneath its 200-day SMA.

That said, momentum signals remain mixed: the Relative Strength Index (RSI) has broken below the 43 level, hinting at strengthening downside momentum, while the Average Directional Index (ADX) near 16 suggests that the broader trend still lacks juice.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.