Here is what you need to know on Tuesday, September 16:

The US Dollar (USD) stays under modest bearish pressure early Tuesday as investors adjust their positions ahead of the Federal Reserve's critical two-day policy meeting. In the second half of the day, August Retail Sales, Import Price Index and Export Price Index data will be featured in the US economic calendar.

US Dollar Price This week

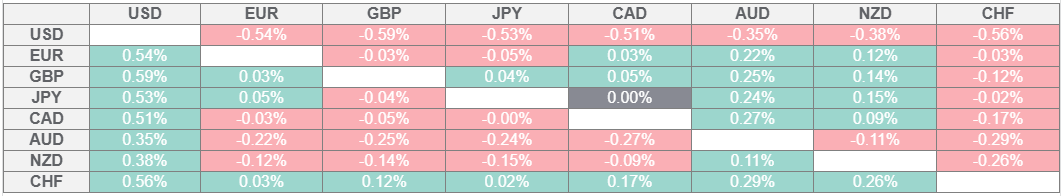

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the weakest against the British Pound.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The USD Index closed in negative territory on Monday, pressured by the improving risk mood in the American session. Wall Street's main indexes opened on a bullish noted and closed in positive territory. Early Tuesday, the USD Index continues to push lower and was last seen trading at its lowest level in over two months, slightly above 97.00. Meanwhile, US stock index futures trade mixed.

The UK's Office for National Statistics (ONS) reported in the European morning that the ILO Unemployment Rate remained unchanged at 4.7% in the three months to July, as anticipated. In this period, annual wage inflation, as measured by the change in the Average Earnings Excluding Bonus, edged lower to 4.8% from 5% to match the market expectation. GBP/USD builds on Monday's gains and was last seen trading above 1.3620. The ONS will publish August inflation data on Wednesday.

EUR/USD benefits from the broad-based USD weakness and rises toward 1.1800 in the European morning on Tuesday. Later in the session, ZEW Survey - Economic Sentiment data for Germany and the Eurozone, and July Industrial Production data for the Euro area will be watched closely by market participants.

After losing nearly 0.5% on Monday, USD/CAD edges lower and trades below 1.3800 in the European session on Tuesday. In the early American session, Statistics Canada will publish Consumer Price Index (CPI) data for August. On Wednesday, the Bank of Canada (BoC) will announce policy decisions.

USD/JPY turns south in the European morning and trades below 147.00. In the early Asian session, the Japanese economic calendar will feature Merchandise Trade Balance data for August.

Following a quiet start to the week, Gold gathered bullish momentum in the second half of the day on Monday and rose nearly 1%. XAU/USD continues to push higher and trades at a new record-high above $3,680 in the European session on Tuesday.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.