Optimism price could fall as nearly $90 million worth of OP tokens is due flood markets

- Optimism volatility has dropped, with traders playing safe as shown by dwindling trading volumes.

- Nearly $90 million worth of OP tokens is due to flood markets in a cliff unlock.

- Token unlocks are bearish catalysts, with passive investors often caught in exit liquidity.

Optimism (OP) price volatility has shrunk in the ours leading to the network’s cliff unlock. It joins the likes of dYdX (DYDX) and Sui (SUI), which have similar events on their calendars. As token unlocks are often considered bearish catalysts, investors should brace for a reaction after the event.

Also Read: OP, YGG, AGIX: Worth $106 million in liquidity, these are the three cliff token unlocks to watch next week

Nearly $90 million worth of OP to hit markets on Friday

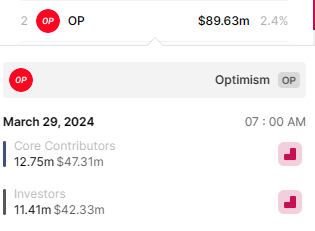

The Optimism network is part of this week’s $106 million in unlocks, with its own nearing $90 million. On March 29, the network will offload 24.16 million OP tokens worth $89.39 million at current rates. The tokens will be allocated to core contributors and investors, which is likely to impact price as they push for quick profit before the supply hits markets.

OP Unlocks

Notably, this will be the biggest token unlocks event next week and will happen on Ethereum Layer 2 (L2) network. Unlock events could offer sidelined investors an opportunity to enter positions in assets, taking advantage of the short-term volatility.

Optimism price outlook

After a climb of around 15% since news of the unlock hit the markets, Optimism price is slowing down ahead of the event as traders de-risk. OP price could consolidate along the 50% Fibonacci placeholder ay $3.75, as it remains stuck between the 50-day and 100-day Simple Moving Averages (SMAs).

For the next directional bias, Optimism price must break above or below either of the moving averages. In the meantime, the market is leaning in favor of the downside, with the Relative Strength Index (RSI) below 50 and both the Awesome Oscillator (AO) and the Moving Average Convergence Divergence (MACD) in negative territory.

Amid a strengthening bearish sentiment, the Optimism price could slip below the 100-day SMA at $3.59 to revisit the $3.00 psychological level before a recovery. In a dire case, OP price could drop all the way to the $2.62 before the L2 token can be ripe for selling.

OP/USDT 1-day chart

On the other hand, if the bulls can haul the Optimism price above the resistance due to the 50-day SMA at $3.84, it would reinvigorate the market, propelling OP price to the $4.50 threshold, or in a highly bullish case extend to the $4.86 peak. Such a move would denote a climb of about 3-% above current levels.